Choose Smarter Spend Management Today!

You’re probably tired of chasing receipts, fixing spreadsheet errors, or guessing where the budget went. Spending starts to slip when approvals are unclear, purchases happen outside policy, or no one knows who signed off. Without control, you end up putting out fires instead of driving growth.

According to McKinsey, nearly 42% of finance tasks can already be fully automated, with another 19% mostly automated using today’s tools. That presents a huge opportunity, yet many teams still rely on manual processes that slow them down and obscure spend visibility.

This blog breaks down what spend management actually means, why it’s often sidelined, and how getting it right can help you unlock cash flow visibility, enforce control, and scale with confidence.

Key Takeaways:

Spend management centralises all company spend data, eliminating silos and improving visibility across departments, budgets, and vendors.

Automated tracking flags duplicate payments, unused tools, and off-contract purchases so you can cut waste and renegotiate smarter deals.

Built-in approvals, invoice matching, and payment workflows reduce errors and speed up processing while keeping spend within policy.

Historical spend analysis surfaces buying patterns, enabling vendor consolidation and better pricing through volume-based negotiations.

Real-time budget alerts, role-based permissions, and audit trails prevent unauthorised spend and support clean, compliant financial records.

What is Spend Management?

Spend management is the discipline of tracking, controlling, and optimising every company expense, from vendor payments and SaaS tools to employee purchases, to protect the bottom line. It goes beyond basic expense reporting.

With real-time oversight and automated workflows, you reduce errors, improve control, and stay ahead of budget overruns. It includes procurement, invoicing, supplier relationships, and compliance.

By centralising data and automating approvals, spend management gives finance teams visibility into company-wide expenses and prevents waste. It helps you catch duplicate services, negotiate better terms, and avoid delayed or missed payments.

Why is Spend Management Important for your Business?

A structured spend process prevents waste, tightens compliance, and keeps cash flow predictable. Here’s what a solid spend management system helps you achieve:

Cut Costs Fast: Spot redundant tools, unused subscriptions, and duplicate invoices early. Cancel or renegotiate before budget leaks escalate.

Improve Visibility: Track spend by team, vendor, category, or period. Dashboards help catch overspending before it happens.

Speed Up Processes: Automated approvals, invoice matching, and expense submissions reduce manual work and errors.

Tighten Control and Compliance: Policy violations and audit risks are flagged with structured workflows and logs.

Strengthen Supplier Relationships: Data-backed negotiations lead to better pricing, terms, and vendor reliability.

Improve Cash Flow and Planning: Real-time expense data helps avoid late fees, forecast accurately, and manage working capital.

Boost Accountability: Assign spend ownership to teams or individuals and track follow-through. People spend more mindfully when it’s visible.

These benefits don’t just happen automatically. They come from a well-defined spend management process that brings consistency, visibility, and control to every purchase and payment. Let’s break down how that process works.

Also Read: What is Accounts Payable? Benefits and Examples

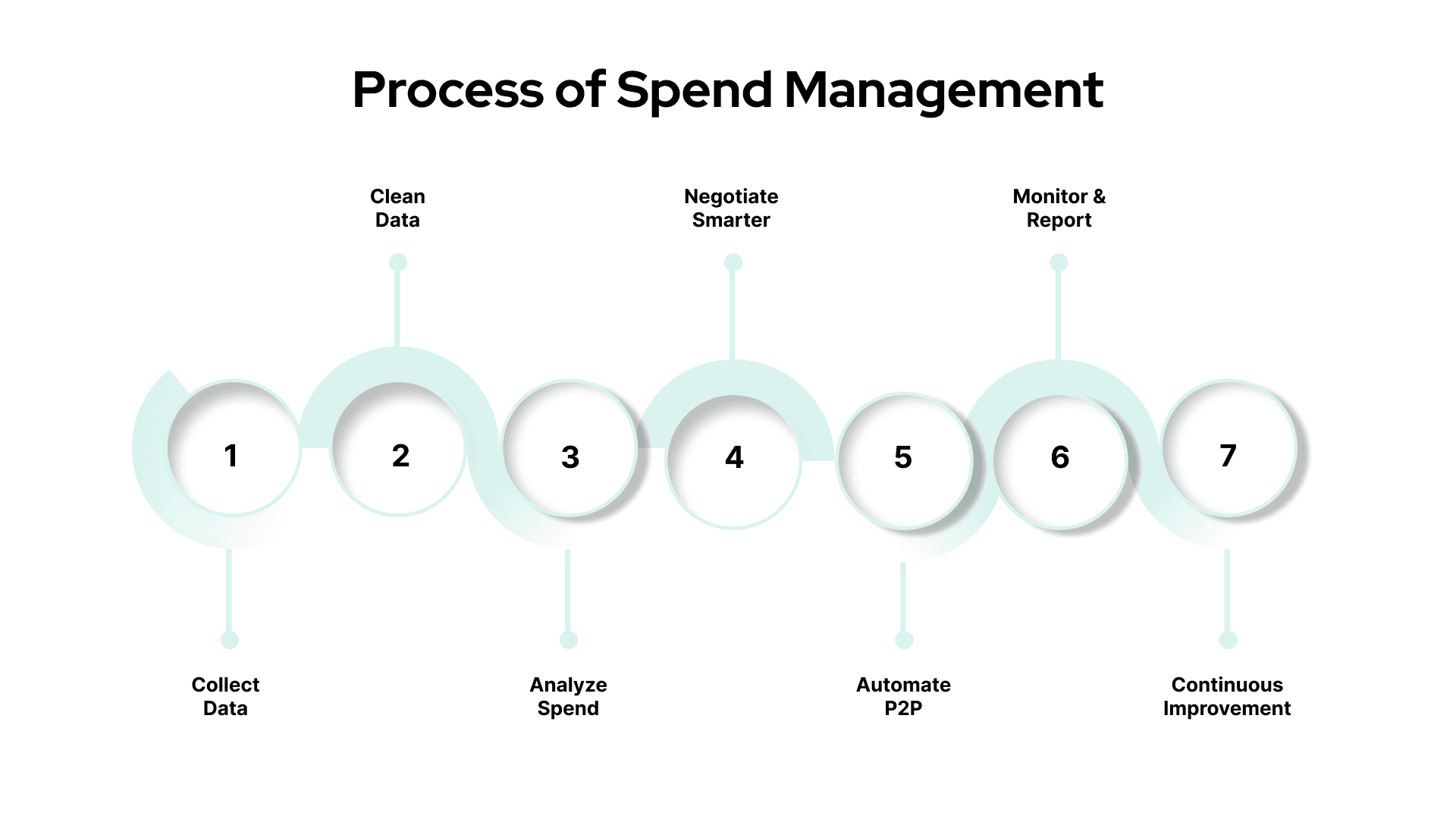

What is the Process of Spend Management?

Spend management is more than just tracking expenses. It's a continuous loop that connects planning, procurement, payment, and performance. The most effective companies treat it as a strategic process that aligns finance, operations, and procurement in one system of control.

Here’s how the cycle works:

Collect and Centralise Spend Data

Pull in data from purchase orders, invoices, corporate card transactions, reimbursements, and software tools. Connect your ERP, AP, and procurement systems to create a single, unified source of truth.

Clean and Organise the Data

Remove duplicates, fix vendor naming inconsistencies, and standardise data formats. Categorise spend (for example, marketing, travel, software) and map vendors correctly to gain reliable visibility.

Analyse Spending Patterns

Break down spend by department, category, region, or supplier. Spot contract leakage, duplicate purchases, or areas of unmanaged spend. Identify cost-saving opportunities and compliance gaps.

Source and Negotiate with Insight

Use spend insights to consolidate suppliers, compare rates, and renegotiate contracts. Data-backed sourcing strengthens negotiation power and drives long-term savings.

Automate Purchase-to-Pay (P2P)

Implement approval workflows, automate purchase orders, match invoices to POs, and track payments. Automation cuts down manual work, reduces delays, and prevents off-policy purchases.

Kodo is a smart spend management platform that streamlines everything from purchase requests to vendor payments. With automated workflows and real-time tracking, it helps finance teams stay in control without manual effort.

Monitor, Report, and Adjust

Track KPIs like savings achieved, policy adherence, and supplier performance. Share monthly reports with key stakeholders to guide budget planning and improve accountability.

Improve the Cycle

Take feedback from finance, procurement, and business teams. Adjust workflows, update vendors, refine tools, and roll out improvements while keeping the cycle lean and aligned with business growth.

Even with the right process in place, spend management doesn’t always run smoothly. Execution can fall apart when data stays siloed, teams rely on manual work, or no one owns accountability. Let’s break down the most common risks that derail spend control.

Key Challenges and Risks of Spend Management

Spend management fails when data remains scattered, systems remain manual, analytics remain weak, and teams resist change, all of which blend into financial inefficiency and risk.

Incomplete and Siloed Data: Many teams struggle to unify spend data across ERP systems, procurement tools, AP software, subscriptions, and P-cards. That fragmented view hides waste and savings opportunities.

Manual Processes Invite Mistakes: Spreadsheets and paper-based workflows lead to data entry errors, lost documentation, and delayed reimbursements. Manual work slows teams and clutters audits.

Poor Data Quality and Classification: Mismatched categories or duplicate vendors distort analytics. Without clean, standardised data, it’s hard to produce reliable insights or track spending trends.

Weak Analytics and Skills Gaps: Not every finance team has the analysts or tools to extract meaningful KPIs. Even when systems are in place, the lack of bandwidth or expertise holds back performance.

Low Adoption and Change Resistance: Teams often resist new processes or tools. When spend controls feel restrictive, departments and vendors may push back, slowing rollouts or ignoring policies entirely.

Decentralised Spending and Maverick Purchases: When teams make purchases outside defined channels, spend becomes hard to track or control. Without centralised oversight, duplicate orders or unapproved vendors slip through.

Unmanaged Tail Spend: Small, frequent purchases across departments add up quickly. Without tracking, tail spend becomes a blind spot with an outsized financial impact.

Supplier Onboarding and Risk Exposure: Onboarding vendors into P2P systems takes time. When neglected, it opens the door to fraud, compliance gaps, or supplier failures that disrupt operations.

Integration and IT Friction: ERP customisations, data mapping errors, and disjointed finance tools cause system delays or breakdowns during P2P implementation.

Compliance Gaps and Audit Risk: Missing receipts, policy confusion, or manual logs make audits painful. Lack of structure increases the risk of fines or failed reviews.

Also Read: 15 Key Benefits of Procurement Software

Many of these challenges stem from fragmented processes and outdated tools. With a few disciplined practices in place, you can move from reactive to proactive and build a system that scales cleanly. Here’s what that looks like in action.

Best Practices for Effective Spend Management

Smart spending requires centralised data, automated controls, live oversight, periodic audits, and strategic supplier negotiation.

Unify and Cleanse Your Spend Data

Aggregate procurement, invoices, subscriptions, and card transactions into one system to eliminate silos. Then, clean and categorise the data with consistent tagging—by supplier, category, or business unit—to enable precise analysis and trustworthy dashboards.

Automate Workflows and Enforce Controls

Reduce manual effort by automating pre-spend approvals, PO-invoice matching, receipt scanning, and contract tracking. Use software to set policy-driven rules, so approvals, limits, and exceptions are handled in real time.

Track Spend Live and Flag Issues Early

Use dashboards and live budget thresholds to monitor spend across teams and departments. Trigger alerts for overspending, unusual transactions, or non-compliant activity before they snowball into real problems.

Audit Regularly and Promote Accountability

Run monthly or quarterly audits to catch maverick spending, duplicate payments, or policy violations. Assign roles clearly across finance, procurement, and department leads—and use shared dashboards to foster cross-team ownership.

Strengthen Supplier Strategy with Data

Use historical spend data to group suppliers, analyse category-level trends, and benchmark prices. This helps you renegotiate terms, consolidate vendors, and lock in savings through volume-based contracts.

Align Policy with Practice

Issue virtual or corporate cards tied to policy rules, with clear spending limits and real-time tracking. Back this with clear documentation, regular training, and policy refreshes that evolve with your business.

Even with the right practices in place, execution often breaks down without the right platform. Choosing the right spend management software ensures you can automate workflows, enforce controls, and scale your systems as your business grows.

How to Choose the Right Spend Management Automation Software?

Selecting the right spend management software is about more than ticking feature boxes. To truly empower your finance and procurement teams, focus on automation depth, seamless integrations, user experience, and long-term value. Here's what you should focus on:

Start with Business Needs: Identify if you need procurement, AP automation, expense tracking, or all three. Avoid choosing tools based only on brand recognition.

Evaluate Actual Automation Depth: Look beyond invoice scanning. Check if the tool supports auto-approvals, PO matching, real-time policy enforcement, and hands-off payments.

Check Real-Time Integrations: Confirm the software syncs live with ERP or accounting systems like NetSuite, QuickBooks, SAP, or Xero. Avoid tools that rely on static data exports.

Compare by User Experience: Review setup time, mobile access, dashboard clarity, and how roles (finance, department heads, approvers) interact with the platform.

Validate Vendor Fit by Company Size: Lightweight tools often suit startups; complex suites better serve enterprises. Choose based on workflow, not just features.

Review Reporting Capabilities: Look for real-time spend tracking, budget alerts, custom reports by category or vendor, and automated audit trails.

Assess Cost Transparency: Don’t just compare pricing tiers. Ask about cost per transaction, onboarding fees, support costs, and time to ROI.

Check Compliance and Controls: Confirm the platform supports audit trails, approval chains, vendor risk tracking, and tax requirements by region.

Look at Scalability: Choose a system that handles volume growth, cross-border spending, and new subsidiaries without performance loss.

Ask for Customer References or Case Studies: See how similar businesses use the tool and what outcomes they achieve.

If you’re evaluating spend management tools, it’s worth considering platforms that offer strong automation, easy integrations, and clear visibility across your spend. Kodo is one such solution that helps teams manage procurement and payments efficiently, reducing manual tasks while keeping control and compliance front and centre.

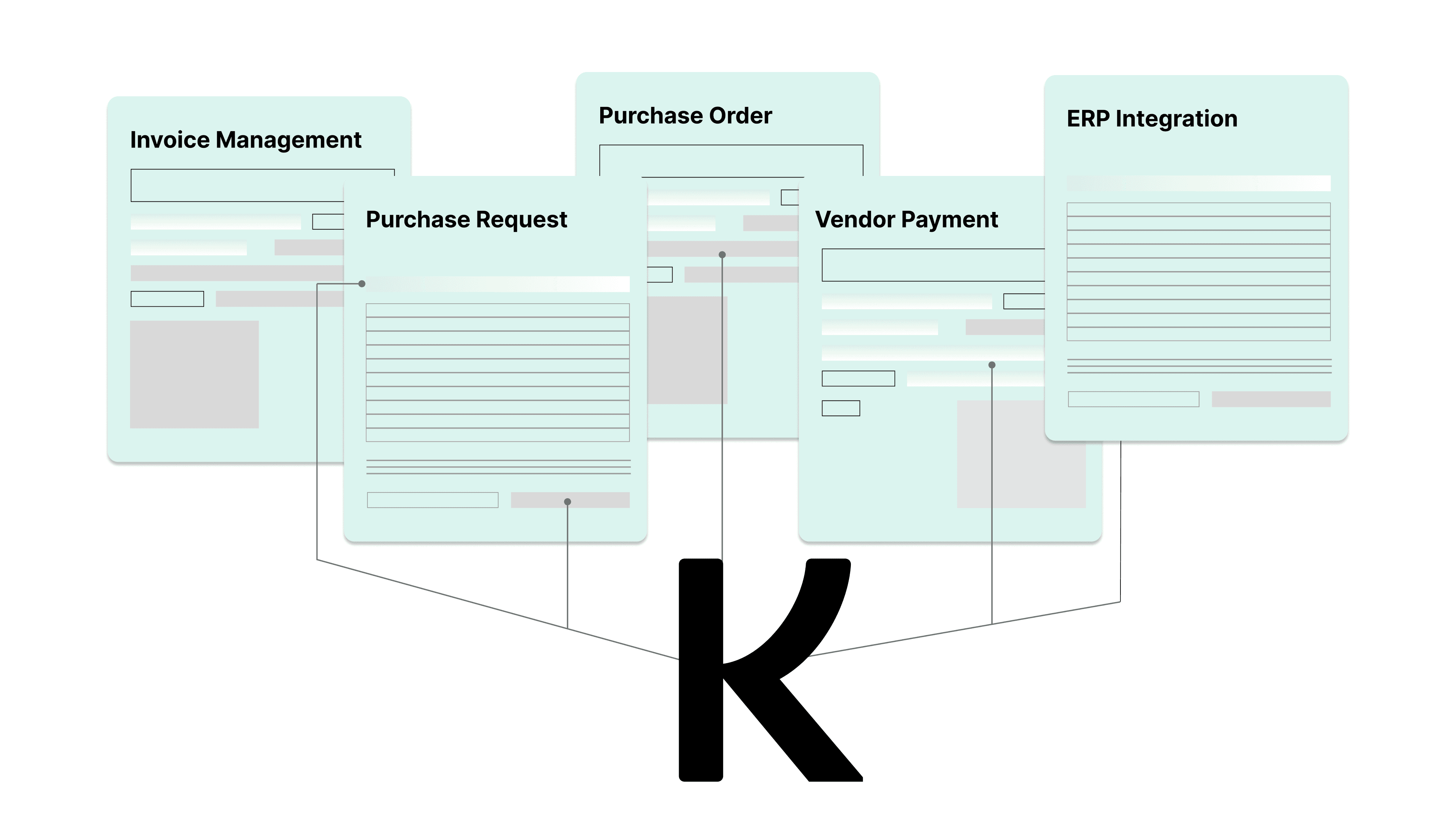

Use Kodo for All Your Spend Management Needs

Kodo helps teams manage spend without the usual back-and-forth or cleanup from scattered processes. Every step, from the first request to the final payment, stays visible, trackable, and under control, so finance isn’t left chasing missing data or fixing preventable mistakes.

Purchase Request: Kodo sets up structured forms that match how your teams work, by department, vendor, or budget. Approvals follow clear rules based on amount or category, so no request slips through the cracks.

Purchase Order: Turn approved requests into POs automatically. Everyone involved can see what’s been ordered and what’s pending without digging through email threads.

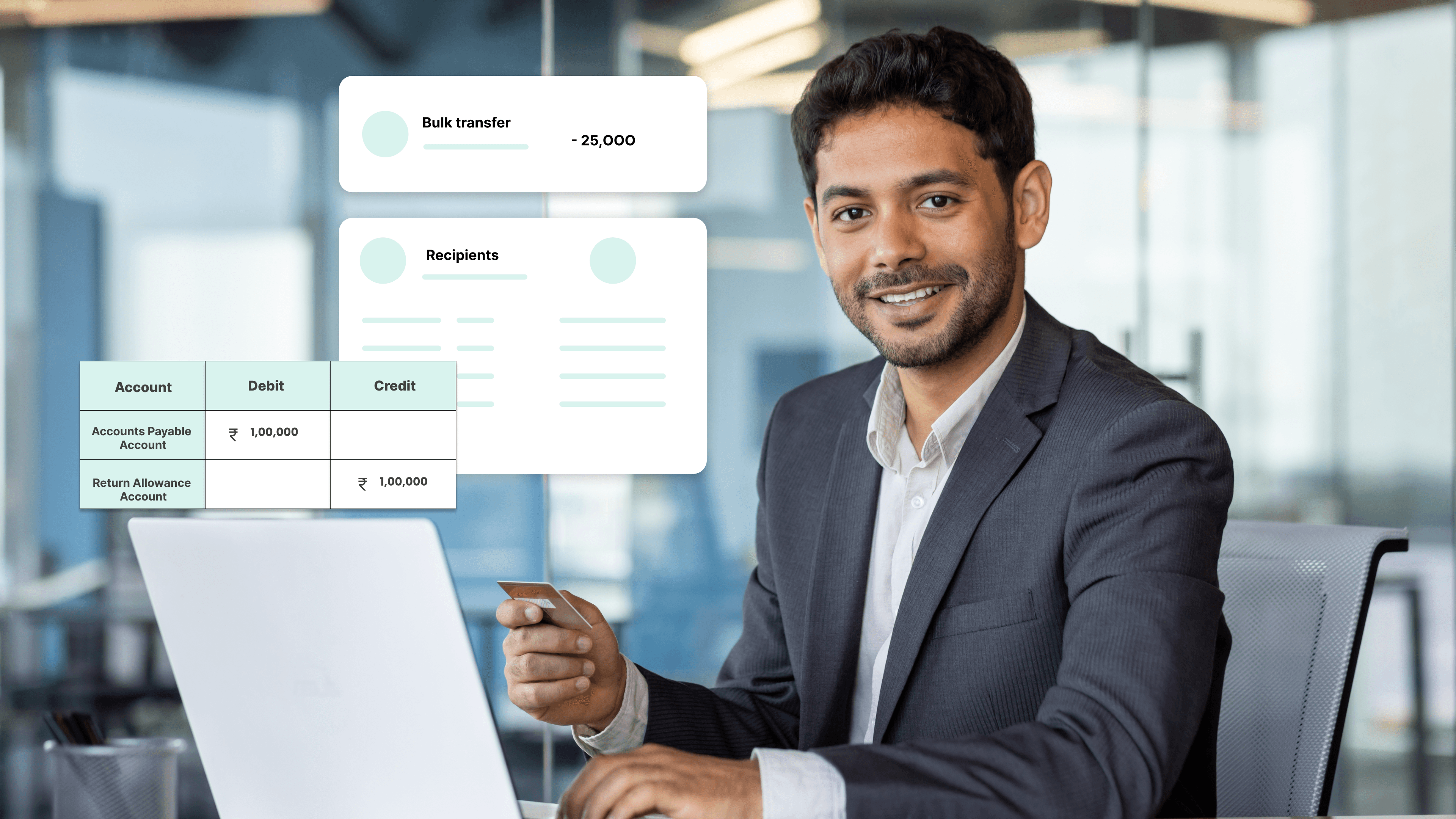

Vendor Payments: Using scheduled or one-time payments, Kodo’s platform pays vendors on time. Maker-checker approvals, audit logs, and payment tracking keep the process tight and transparent.

Invoice Management: Kodo uses two-way or three-way matching to process only the correct invoices. Finance can catch mismatches early and avoid double payments or last-minute fire drills.

ERP Integration: Kodo connects with Tally, Zoho, SAP, Oracle, and more, so you don’t need to re-enter data or worry about updates falling through. POs, invoices, and goods receipts stay in sync.

Finance and ops teams spend less time fixing errors and more time moving work forward with Kodo. You get structure without slowdown and the confidence that spending is under control at every step.

Conclusion

When you track how every rupee moves, you catch leaks before they hurt. Spend management isn’t just about cutting costs. It’s about seeing where money goes, who approves it, and why it was spent in the first place. If you wait too long to fix the gaps, small mistakes can snowball into bigger problems. Bringing structure to pay gives your team fewer surprises and more control.

Over 2,000 businesses rely on Kodo to bring structure and visibility to managing spending across teams. Instead of juggling spreadsheets, emails, and disconnected tools, you can manage purchase requests, approvals, invoices, and vendor payments in one place.

Kodo helps you set clear workflows, reduce delays, and avoid repeated follow-ups between finance and other departments. With built-in controls like real-time invoice tracking, tailored approval rules, and vendor payout tools, your team spends less time fixing errors and focusing more on what matters. Book a demo with Kodo today.

FAQs

How is spend management different from traditional budgeting?

Traditional budgeting focuses on planned expenses, while spend management tracks how money is actually spent across departments, vendors, and categories. It highlights hidden leaks, duplicates, and off-contract purchases that budgets may overlook.Can spend management improve supplier relationships?

Yes. When companies track spending patterns and compliance more closely, they’re able to negotiate better terms, identify preferred vendors, and consolidate purchases, leading to more predictable orders and stronger supplier trust.What kind of data is often missing from spend analysis reports?

Indirect expenses like software subscriptions, team reimbursements, and small departmental purchases often fall through the cracks. Without integrated systems, these costs are hard to classify and track, skewing true spend visibility.How does spend management impact ESG (Environmental, Social, and Governance) goals?

It helps organisations identify vendors that meet ESG standards and reduce spending on non-compliant or high-risk suppliers. It also supports sustainability efforts by tracking product origin, packaging waste, and ethical sourcing.Is there a point when spend management becomes too granular to be useful?

Yes. Over-segmentation can overwhelm teams and slow decision-making. The goal isn’t to monitor every rupee, but to spot trends, improve accountability, and guide strategic sourcing, not micromanage every transaction.