Choose Smarter Spend Management Today!

Accounts payable may not make headlines, but it’s the backbone of every successful business. It manages vendor payments, optimizes cash flow, and ensures smooth operations. And it’s gaining more attention than ever.

India’s accounts payable market is projected to grow from USD 95 million in 2024 to USD 215 million by 2035, reflecting how critical AP is becoming for business efficiency, accuracy, and compliance.

Today, AP is evolving with automation and digital tools, reducing delays, minimizing errors, and strengthening supplier relationships.

In this blog, we’ll explain accounts payable, why it matters, and its real-world impact through relatable examples.

What is Accounts Payable?

Accounts payable (AP) refers to the money that a business owes to its suppliers or vendors for goods and services received but not yet paid for. It is recorded as a liability on the balance sheet and plays a crucial role in managing cash flow, vendor relationships, and financial accuracy.

In addition to that, you also need to clear the concept that AP is different from accounts receivable. Accounts payable represent money a business owes to others, while accounts receivable represent money others owe to the business. In short, AP tracks outgoing payments, and AR tracks incoming payments.

Here is a quick outlook of Accounts Payable vs. Accounts Receivable:

Now, let’s take a closer look at some examples of accounts payable processes to see how businesses actually handle them.

Examples of Accounts Payable

From office rent to raw materials, AP shows up in all the behind-the-scenes costs that keep a company running smoothly. Here are some detailed examples to make it clearer:

Example 1: Purchasing Raw Materials

A textile manufacturing company in Surat orders ₹2,00,000 worth of high-quality cotton yarn from a supplier. After the shipment arrives, the supplier sends an invoice. The AP team checks the GST details, verifies the purchase order, and schedules the payment. The ₹2,00,000 is recorded as an outstanding liability under Accounts Payable on the company’s balance sheet. Once the payment is processed, the liability is cleared.

Example 2: Paying Office Rent

A digital marketing startup in Bengaluru pays ₹75,000 in rent each month. The AP team checks the landlord's tax invoice, verifies TDS deductions, and schedules the rent payment. The rent is recorded as a liability until paid, and the AP team ensures that TDS is deducted and remitted to the government. Timely payments and compliance with tax regulations are essential to avoid penalties.

Example 3: Utility Bills for a Manufacturing Unit

A manufacturing unit in Pune receives a ₹1,10,000 electricity bill for plant operations. The AP team verifies the meter readings, records the payable under utility expenses, and plans the payment based on cash flow. As a recurring expense, utility bills need careful attention to ensure no disruption of services or late fees.

As you can see, accounts payable spans across industries and expense types. Now that we’ve explored some examples, it’s time to break down the steps of the accounts payable process and understand how each stage works behind the scenes.

Role of AP in Financial Statements

Accounts Payable (AP) plays a crucial role in how your company’s financial health is assessed. From cash flow to liabilities, AP impacts several key financial reports that investors and stakeholders rely on. Here is its role in financial statements:

1. Balance Sheet Impact

AP shows up as a current liability on the balance sheet, representing the short-term obligations your company owes to suppliers. A rising AP balance can indicate expanding operations, but a value that is too high without matching cash flow might raise concerns about liquidity.

2. Cash Flow Statement Link

Accounts payable are directly tied to operating cash flow. An increase in AP boosts cash flow temporarily because payments are delayed. This provides insight into your company’s ability to manage outflows wisely without harming supplier relationships.

3. Income Statement Indirect Role

While AP doesn’t appear on the income statement directly, it affects it indirectly. Efficient AP processes reduce late fees and missed discounts, ultimately impacting your net profit. Poor AP management can lead to higher operational costs and strained vendor ties.

4. Working Capital Management

AP is a core component of working capital. It influences the difference between current assets and current liabilities. Proper AP control ensures the business can meet short-term obligations while using cash effectively elsewhere.

Understanding how AP interacts with financial statements gives you a sharper view of your company’s financial stability. Now, let’s look at how to record accounts payable accurately to keep those statements in check.

How to Record Accounts Payable

Recording accounts payable may seem routine, but doing it efficiently can save you time, money, and stress. Here’s how to make the recording process smooth, accurate, and audit-ready:

Verify Before You Record: Always double-check invoice details like amount, due date, and vendor name before entering anything. This first step catches errors early and avoids future payment disputes or mismatches. It also helps maintain trust with your suppliers by ensuring accurate records.

Use a Centralized System: Log every invoice into a centralized accounting or invoice management system. Avoid scattered spreadsheets or manual tracking. A unified system ensures consistency, reduces duplication, and provides full visibility across your team.

Categorize Correctly: Assign the right expense category or account code to each invoice. Whether it's office supplies or professional services, proper categorization helps you track spending patterns and ensures your financial reports stay clean and organized.

Set Reminders and Due Dates: Always set reminders for payment deadlines as soon as you record the invoice. Timely recording isn’t enough; tracking due dates prevents missed payments, saves you from late fees, and supports better cash flow planning.

Attach Supporting Documents: Always link relevant documents, like purchase orders or receipts, to the invoice entry. This habit streamlines audits, reduces approval delays, and backs up your records in case of vendor disputes.

Efficient recording is the first step toward mastering AP. Now that your entries are clean and organized, let’s move on to understanding the Accounts Payable Process as a whole.

Accounts Payable Process

Managing accounts payable shouldn’t feel like a complex process to handle. A streamlined workflow not only prevents costly errors but also boosts vendor relationships and cash flow visibility. Here’s how the AP process works:

Step 1: Receive Invoice

This is the first touchpoint in the AP cycle where a vendor sends an invoice for products delivered or services rendered. Businesses must receive, organise, and log these invoices correctly.

Step 2: Review Invoice

After receiving them, teams must verify invoices for accuracy and check supplier details, dates, tax information, amounts, and payment terms. This step is crucial to catch errors like incorrect rates, duplicate entries, or missing GST details before payment is scheduled.

Step 3: Match with Purchase Order

This is where the invoice is matched with the purchase order (PO) and goods received note (GRN). Known as three-way matching, this step confirms that the business is being billed for exactly what was ordered and received. Teams should resolve any mismatches before approval.

Step 4: Obtain Approval

Once the invoice is validated, it must go through internal approval. Depending on the invoice value or vendor category, this could involve multiple levels, team leads, department heads, or finance managers.

Step 5: Process Payment

After approval, the payment must be made using the right channel (bank transfer, UPI, etc.) and within the specified time. Manual payments increase the risk of duplication, missed due dates, incorrect TDS deductions, and strained vendor relationships due to delays.

Step 6: Record in Accounts Payable Ledger

Once payment is completed, all details, invoice number, payment ID, vendor info, and amount must be logged into the AP ledger and synced with your accounting software. Accurate records are essential for reporting, audits, and financial planning.

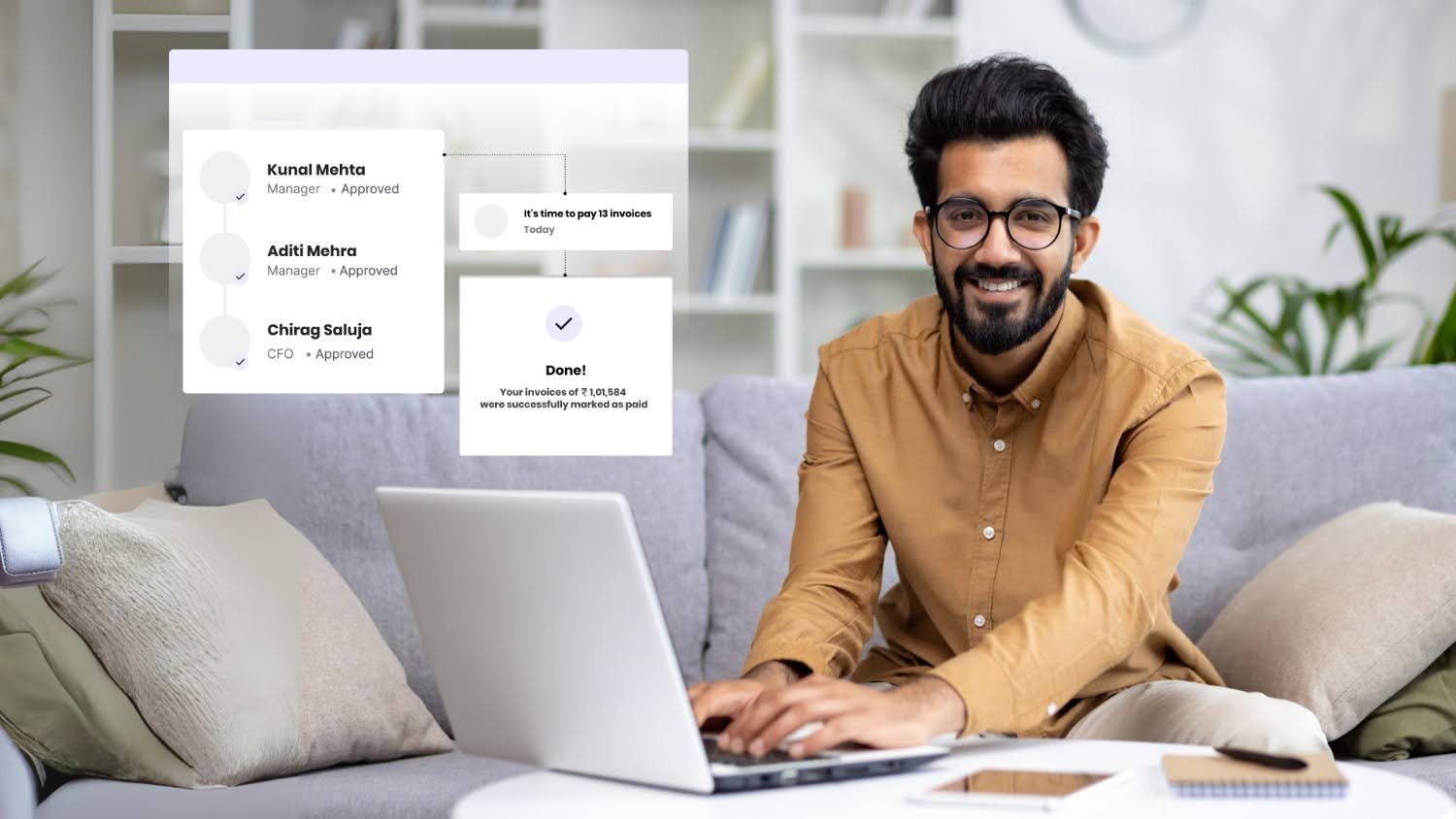

At Kodo, we simplify your accounts payable process with our smart invoice management solution. From capturing invoices to approvals and automated payments, everything happens in one seamless flow. Say goodbye to manual errors and late payments!

Next, we will see the benefits of automating accounts payable!

Benefits of Accounts Payable Automation

Handling invoices manually? It’s time-consuming, error-prone, and lets too many important things slip through the cracks. Here is how accounts payable automation changes the game:

1. Saves Time and Reduces Manual Work

Automation eliminates repetitive, manual tasks like invoice entry, approval follow-ups, and data matching. Your team no longer has to chase down emails or sift through paperwork. Everything happens in a centralised dashboard, scanned, verified, and routed automatically. So your AP team can focus on high-value work instead of tedious admin tasks.

2. Enhances Accuracy and Reduces Errors

Manual entry often leads to missed digits, duplicate payments, or incorrect tax deductions. Automated systems flag inconsistencies in real-time, whether it’s a mismatched PO or an invalid GST number. This reduces costly errors, prevents fraud, and ensures that only verified, accurate invoices make it to the payment stage.

3. Improves Vendor Relationships

Late payments and communication gaps can damage vendor trust. Automation ensures invoices are processed promptly and payments are scheduled on time. Vendors appreciate transparency and predictability, both of which are built into automated systems with real-time tracking, instant payment notifications, and faster dispute resolution.

4. Strengthens Compliance and Audit Readiness

GST regulations, TDS deductions, and invoice recordkeeping are non-negotiable. Automation tools maintain detailed audit trails, organise all documentation, and generate reports with just a few clicks. This makes it easy to stay compliant and breeze through audits without scrambling for paperwork or risking penalties.

5. Improves Cash Flow Visibility and Control

With automation, finance teams get a live snapshot of upcoming liabilities and current payables. Dashboards show what’s due, what’s overdue, and what’s scheduled, helping you make smarter cash flow decisions. You can prioritise payments, forecast needs, and avoid last-minute surprises in your bank account.

Automate Accounts Payable With Kodo

Kodo is a smart spend management platform built for modern Indian businesses. Trusted by over 2,000 companies, including Urban Platter, Dharma Productions, and Mokobara, we streamline your finance operations with ease.

With Kodo, your finance teams can automate invoice capture, approval workflows, and payments, all in one seamless platform. It’s fast, reliable, and designed to enhance your AP process.

Our services include:

Centralised Payments: Manage all your vendor payments from one platform with multiple bank payment options.

Instant Invoice Capture: Snap, Scan, Done! Upload your invoice, let OCR do the work, and submit in minutes!

Smart approvals: Stay ahead with our Invoice Scrutinizer. It flags due dates, vendor risks, and key details for faster, smarter approvals!

Reconcile with Precision: No more matching headaches! Automated two-way and three-way matching to save time and eliminate errors for effortless reconciliation.

Discover how Kodo simplifies finances and drives efficiency for businesses like yours!

Conclusion

A well-managed accounts payable process protects cash flow, builds supplier trust, and keeps your business running smoothly. When invoices are paid accurately and on time, vendor relationships strengthen, negotiations improve, and you gain the financial flexibility to make smart strategic moves. Efficient AP management also keeps you compliant, audit-ready, and aligned with regulatory norms, especially in a GST-heavy environment like India’s.

Here at Kodo, we transform AP from a manual headache into a seamless, automated workflow. We help you with smart invoice capture, automated approvals, real-time dashboards, and easy integrations with your existing accounting tools.

Book a call with Kodo to streamline your AP today!