Choose Smarter Spend Management Today!

No matter the size or stage of your business, expenses are an inevitable reality. Whether you're running a startup or managing a large corporation, spending is part of the journey. But the way you manage those expenses can be the key difference between thriving and merely surviving.

As organizations grow, their expenses often scale quickly. Without a solid system in place to track, approve, and reimburse these costs, organizations risk draining valuable time and resources.

This is where effective expense management comes into play, allowing your business to stay on top of spending while saving both time and money.

In this blog, we'll cover the fundamentals of expense management, why it's critical for business success, and guide you in choosing the best software to drive growth.

What is Expense Management?

Expense management is the systematic approach businesses use to plan, track, approve, and reimburse expenditures incurred by employees or departments during operations. It involves recording costs and ensuring that every expense aligns with your company's financial goals and policies.

The primary purpose of this system is to ensure that all expenses are

Properly accounted for

Adhere to the budget and company policies

Settled accurately

By managing expenses efficiently, your business can maintain better control over its finances and avoid unnecessary costs.

Types of Expense Management

When it comes to managing business expenses, companies have a variety of options at their disposal. Each method has its own set of advantages and challenges, and selecting the right one can significantly impact the efficiency and accuracy of your financial processes.

Let’s quickly explore the three primary types of expense management options:

1. Paper Tracking

This is the traditional method, where receipts are manually collected, and reports are submitted to the accounting department for reimbursement on paper. This method relies heavily on manual processes and physical documentation. While it is straightforward, it is time-consuming and prone to errors.

Advantages

Simplicity: Easy to implement without the need for technology.

Familiarity: Most employees are accustomed to handling paper receipts.

2. Spreadsheets

Spreadsheets, such as Microsoft Excel or Google Sheets, offer a more organized way to track expenses digitally. Employees manually input data, and formulas can be used to calculate totals and categorize expenses. Many businesses still use spreadsheets to track expenses.

While this is more efficient than paper tracking, it can still be cumbersome and lacks automation, leading to delays and errors.

Advantages

Cost-Effective: Spreadsheets are often free or low-cost software.

Customizable: Users can tailor spreadsheets to their specific needs.

Familiar Interface: Many employees are already proficient with spreadsheet software.

3. Expense Management Software

Expense management software offers a fully automated solution for tracking, reporting, and reimbursing employee expenses. These platforms often integrate with other financial systems and offer features like receipt scanning, policy enforcement, and real-time reporting.

Advantages

Automation: Reduces manual data entry and the associated errors.

Real-Time Tracking: Provides immediate visibility into expenses.

Policy Compliance: Ensures expenses adhere to company policies.

Integration: Seamlessly connects with accounting and ERP systems.

Scalability: Easily accommodates business growth.

Having discussed the different methods for expense management, it’s essential to compare the traditional methods with the automated ones to determine which one suits your needs.

Traditional vs. Automated Expense Management Methods

Understanding the differences between traditional and automated expense management methods is crucial for businesses aiming to enhance efficiency and control over their finances. The following table provides a comprehensive comparison:

Aspect | Traditional Expense Management | Automated Expense Management |

Data Entry | Manual input of expenses into spreadsheets or paper forms, leading to potential errors and time delays. | Automated capture of receipts and expenses through digital tools, reducing human error and saving time. |

Receipt Handling | Physical collection and storage of paper receipts, increasing the risk of loss and administrative burden. | Digital receipt capture via mobile apps, ensuring secure storage and easy retrieval. |

Approval Workflow | Sequential approval process involving manual forwarding of documents, which can be slow and prone to bottlenecks. | Real-time, digital approval workflows that streamline the process and enhance transparency. |

Reimbursement Process | Manual calculation and processing of reimbursements, leading to delays and potential discrepancies. | Instant reimbursement processing through integrated systems, ensuring timely and accurate payments. |

Reporting & Analytics | Limited reporting capabilities, often requiring manual compilation and analysis of data. | Advanced analytics and real-time reporting features that provide insights into spending patterns and trends. |

Fraud Detection | Higher risk of fraudulent claims due to a lack of automated checks and balances. | Enhanced fraud detection through automated alerts and anomaly detection algorithms. |

Employee Experience | Time-consuming expense processes can lead to employee dissatisfaction. | User-friendly interfaces and faster reimbursement cycles improve employee satisfaction. |

As you can see, the shift from traditional to automated methods offers distinct advantages. Now, let's break down how the expense management process unfolds, whether you're using manual or automated systems.

A Step-by-Step Guide to the Expense Management Process

Managing expenses isn't just about tracking receipts – it's about creating a seamless, transparent, and efficient workflow that empowers employees, supports managers, and ensures financial clarity for your business.

Let's explore how a well-structured expense management process unfolds, step by step.

Expense Incurred by Employee

The journey begins when your employee incurs a business-related expense. This could range from travel costs to client lunches or office supplies.

At this stage, it's crucial for employees to understand your company’s policies regarding allowable expenses and spending limits. Clear communication of these policies helps prevent misunderstandings and ensures that only legitimate expenses are submitted for reimbursement.

Receipts are Captured

Once an expense is incurred, the next step is capturing the receipt or proof of purchase. In the digital age, relying on physical receipts can be risky due to potential loss or damage. That’s why you should implement systems that allow employees to capture and store receipts digitally. This ensures that no receipts are lost and that accurate information is available for processing.

Expense Reports are Created

After capturing receipts, employees must compile them into expense reports. These reports should detail each expense, including the date, amount, purpose, and category, since they are the foundation for any further approvals or reimbursements.

Additionally, you can provide a standardized template for expense reports to help maintain consistency and accuracy.

Reports are Submitted, Processed, and Approved

Once the expense report is complete, it's submitted for approval. Typically, managers or supervisors review the reports to ensure compliance with company policies and budgets. This step also involves

Verifying receipts

Checking spending limits

Ensuring all necessary documentation is provided

If the expenses align with your company policies, they can be approved.

Reimbursement Completed

After approval, the final step is reimbursing your employee. Reimbursement methods can vary, including direct bank transfers, payroll adjustments, or issuing cheques. It's essential to ensure all reimbursements are processed promptly and accurately to maintain employee satisfaction.

This process helps streamline things, but there are still challenges, especially when businesses rely on manual methods. Let's dive into some of the key difficulties that come with managing expenses without automation.

Challenges with Manual Expense Management

Relying on traditional methods, such as paper receipts, spreadsheets, and manual approvals, can lead to numerous challenges that hinder efficiency, accuracy, and scalability.

Let's delve deeper into these challenges:

Time-Consuming Processes: Manual expense management is inherently slow. These time-intensive processes slow down operations and waste valuable employee time. They also divert attention from strategic tasks and delay reimbursements.

Prone to Human Errors: Manual data entry in paper-based systems and spreadsheets is prone to mistakes. Errors such as duplicate entries, incorrect categorization, or missed receipts can affect financial reporting and complicate audits and compliance.

Lack of Visibility and Data Insights: Manual systems hinder access to real-time spending insights. This makes it difficult for finance teams to get a clear picture of spending, make timely adjustments, or identify potential issues early on.

Lost Receipts: Physical receipts and paper-based reports can easily be misplaced or damaged before being audited. This can cause discrepancies and, in some cases, lead to denied reimbursements.

Fraud and Compliance Risks: Manual processes often lack built-in checks to enforce company policies. This can result in out-of-policy expenses slipping through the cracks, leading to compliance risks and potential financial discrepancies.

Now that you recognize these challenges, it’s time to explore how adopting an automated expense management software can benefit your business.

What is Business Expense Management Software?

Business expense management software is a digital tool designed to automate and streamline the process of tracking, approving, and reimbursing employee expenses. It allows your business to gain real-time visibility into spending, enforce company policies, and integrate seamlessly with existing financial systems.

Some of the key capabilities of an automated expense management software include:

Automated Receipt Capture: Employees can capture receipts using mobile apps, which are then processed using Optical Character Recognition (OCR) to extract relevant data, reducing manual entry errors.

Customizable Approval Workflows: Your business can set up its own approval hierarchies and workflows that align with your internal policies, ensuring all expenses are reviewed and approved by the appropriate personnel.

Real-Time Analytics: Managers can access real-time reports and dashboards, providing insights into spending patterns and helping to identify areas for cost savings.

Policy Enforcement: The software can automatically flag expenses that violate company policies, such as those that exceed budget limits or are submitted without proper documentation.

Integration with Financial Systems: They integrate with accounting and ERP systems, enabling seamless data transfer and reducing the need for manual reconciliation.

Next, let’s explore the numerous benefits that your business can reap by adopting such software solutions.

Benefits of an Expense Management Software

Expense management software provides an automated, all-in-one solution to optimize your company’s financial processes. By simplifying expense tracking and approvals, it ensures every penny is accurately accounted for, reduces inefficiencies, and enables smarter financial decisions that promote long-term growth.

Now, let’s explore how this powerful tool benefits business owners, employees, and accountants alike.

1. For Business Owners

Enhanced Financial Control: Expense management software provides real-time visibility into company expenditures. This transparency allows you to monitor spending patterns, identify cost-saving opportunities, and make informed financial decisions.

Streamlined Budgeting and Forecasting: With automated expense tracking, you can easily categorize expenses and compare them against budgets. This facilitates accurate forecasting and better financial planning, ensuring that your company stays on track to meet its financial goals.

Improved Compliance and Audit Readiness: By maintaining a comprehensive audit trail of all financial transactions, expense management software ensures compliance with regulatory requirements. This readiness simplifies the auditing process and reduces the risk of non-compliance penalties.

Scalability for Growing Businesses: As businesses expand, so do their financial operations. Expense management software scales with your company, accommodating increased transaction volumes and complexity without compromising efficiency.

2. For Employees

Simplified Expense Reporting: Employees can easily capture receipts and submit expense reports through user-friendly interfaces. This simplification reduces the time spent on administrative tasks, allowing employees to focus on their core responsibilities.

Faster Reimbursements: Automated workflows expedite the approval and reimbursement processes, ensuring your employees are compensated promptly. This efficiency enhances employee satisfaction and trust in your company's financial systems.

Clear Policy Enforcement: The software flags out-of-policy expenses in real-time, ensuring employees are aware of and follow company spending policies.

Mobile Accessibility: With mobile-compatible platforms, employees can manage expenses on the go, which is particularly useful for teams who frequently travel or work remotely.

For Accountants

Automated Data Entry: The software reduces manual data entry by automatically capturing and categorizing expenses. This minimizes errors and allows accountants to focus on more strategic tasks.

Efficient Reconciliation: Integration with accounting systems ensures seamless reconciliation of expenses, keeping financial records accurate and up to date.

Real-Time Reporting: Accountants can generate real-time financial reports, providing insights into spending trends and budget adherence. This helps in proactive financial management and decision-making.

Enhanced Fraud Detection: By monitoring expenses in real-time and setting up alerts for unusual activities, the software helps accountants detect and prevent fraudulent transactions early.

Next, we will explore how to select the best expense management system tailored to your organization's specific needs.

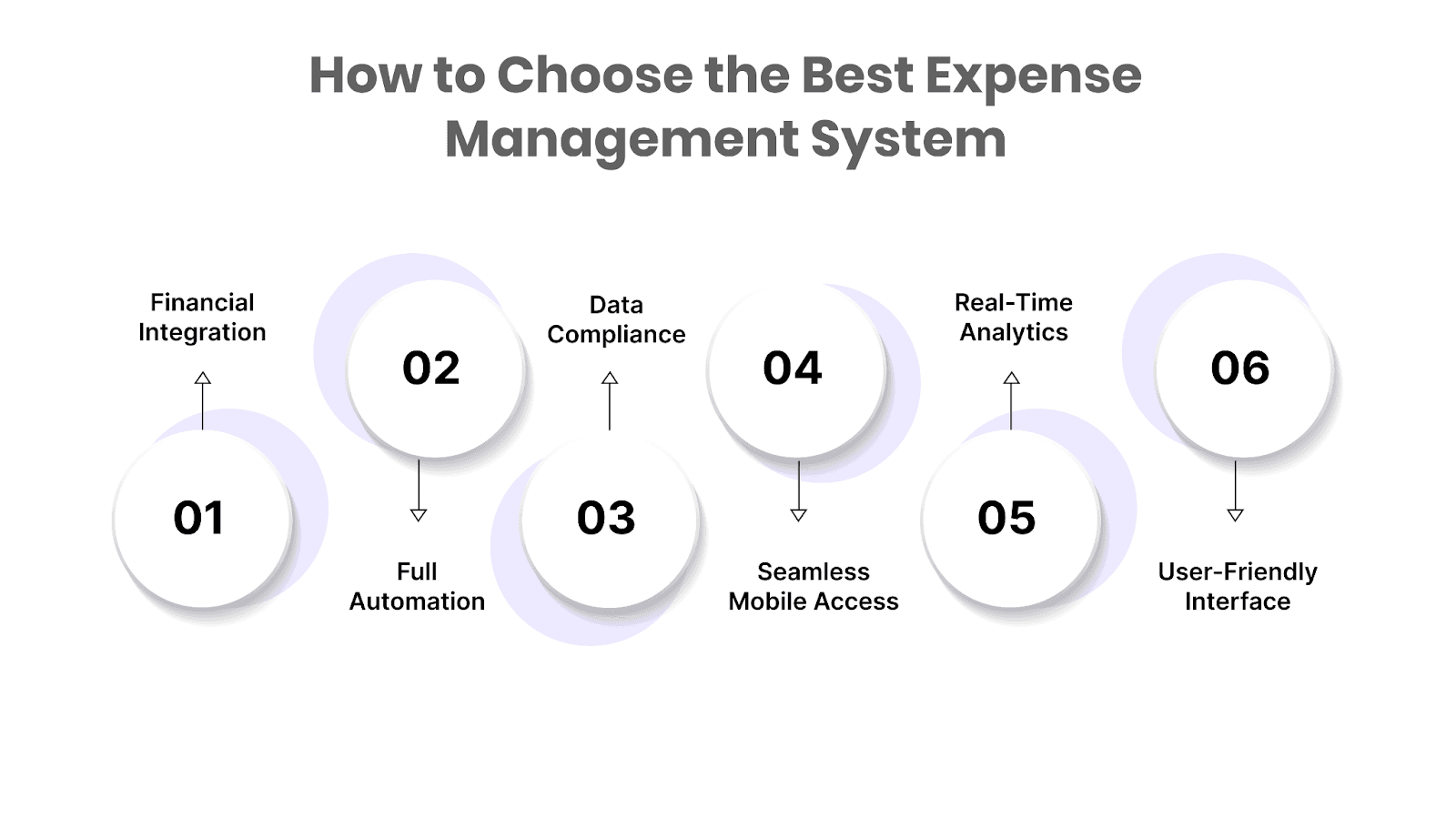

How to Choose the Best Expense Management System

Selecting the right expense management software is crucial for businesses aiming to streamline their financial operations. With numerous options available, it's essential to evaluate solutions that align with your company's specific needs and growth trajectory.

Here's a detailed guide to help you make an informed decision.

Integration with Existing Financial Systems

Seamless integration with your current financial infrastructure is paramount. Your ideal expense management software should effortlessly connect with your accounting platforms, ERP systems, and banking solutions. This ensures automatic data syncing, a unified financial overview, streamlined processes, and enhanced efficiency.

For instance, Kodo integrates effortlessly with your existing financial systems and helps onboard new users quickly.

End-to-End Automation Capabilities

Automation is at the heart of modern expense management. Your ideal expense management software should automatically extract key details from receipts through optical character recognition (OCR) scanning, minimizing manual data entry. It should also enforce your company's spending policies by flagging out-of-policy expenses before approval.

For instance, Kodo automates your expense reimbursement workflows to save time, reduce administrative overhead, and enhance accuracy.

Robust Data Security and Compliance

Handling sensitive financial data necessitates stringent security measures. Always ensure your expense management software protects data both in transit and at rest, supports role-based access controls, and ensures data privacy. It must also meet industry standards and local regulations, such as GDPR or India's data protection laws.

Kodo ensures secure collaboration with role-based access, limiting sensitive data to authorized personnel only. Additionally, Kodo is ISO/IEC 27001:2022 compliant, meaning your data is safeguarded with the highest industry security standards, ensuring privacy and reducing risk.

Also read: Kodo Achieves ISO/IEC 27001:2022 Certification

Seamless Mobile Access

Today, mobile accessibility is essential. Choose a software that allows employees to capture receipts and submit expenses on the go. It must also keep them informed about the status of their approvals through real-time notifications. This flexibility enables employees to manage expenses at any time and from anywhere, thereby improving compliance and satisfaction.

Real-Time Analytics

Insightful reporting is vital for informed decision-making. Your ideal expense management software should accurately represent your spending patterns through visual dashboards, enable granular analysis, and help predict future expenses based on historical data. Armed with such analytics, you can identify cost-saving opportunities and optimize spending.

User-Friendly Interface

A complex interface can hinder adoption and efficiency. Always opt for an expense management software that has an intuitive design to ensure your users navigate the platform with ease. It must also allow users to tailor the interface to their preferences and needs. Lastly, the software must offer comprehensive support through tutorials, FAQs, and customer service.

For instance, Kodo’s user-friendly interface can enhance productivity and encourage consistent use across your organization.

Conclusion

Efficient expense management and employee reimbursements don’t have to be complex and time-consuming. Thanks to automation, the process has been transformed, making it more efficient and less prone to errors. By streamlining your expense processes, you ensure that your business operates smoothly and efficiently, saving both time and money.

Kodo is an all-in-one spend management platform that simplifies the entire Procure-to-Pay cycle, including expense management, accounts payable automation, vendor payouts, and more. With Kodo, you can streamline processes with dynamic workflows, ensure real-time spend visibility, and maintain policy compliance effortlessly. It also integrates with your existing ERP systems, providing the scalability and flexibility your business needs as it grows.

By adopting Kodo, you can optimize your financial operations, reduce errors, and enhance compliance across your organization. Book a call with us!