Choose Smarter Spend Management Today!

Even well-run finance teams can find themselves buried in a pile of pending invoices, slow approvals, and unclear payment statuses. In fact, around 39% of invoices contain errors, resulting in additional back-and-forth, missed deadlines, and time-consuming corrections.

As businesses scale, what was once a manageable process often becomes harder to track and maintain.

If your current workflow involves chasing approvals or manually matching invoices, this guide explores what might be causing the friction and how modern systems can help simplify the process.

Whether you're still handling invoices manually or starting to explore automation, this blog walks through what better invoice management looks like, step by step.

What is Invoice Management?

Invoice management is the system businesses use to handle all aspects of their billing and payment activities. It includes the generation, approval, delivery, tracking, and storage of invoices, whether they’re outgoing (to clients) or incoming (from vendors).

At its core, invoice management ensures that payments are made accurately and on time. This helps businesses maintain cash flow, reduce administrative errors, and stay compliant with financial regulations.

For companies of any size, an efficient invoice management system is essential. Without one, it’s easy to lose track of payments, miss due dates, or spend hours manually resolving billing issues.

While some businesses still rely on spreadsheets and email, many are turning to automated tools to streamline these tasks and reduce human error.

The Invoice Management Process

The invoice management process covers all the steps involved in handling invoices, from creation to payment reconciliation. Whether you’re sending invoices to clients or processing bills from vendors, having a clear process in place ensures consistency, accuracy, and efficiency.

Here’s a step-by-step breakdown:

1. Invoice Creation

This is the starting point, where invoices are generated with the necessary details, such as client information, itemised services or products, pricing, applicable taxes, and payment terms. For businesses working with vendors, this might also include purchase order (PO) matching.

2. Internal Review and Approval

Before an invoice is sent out or processed for payment, it often goes through an internal approval workflow. Managers or finance teams verify that the amounts are correct, the services were rendered, and the terms match any prior agreements or contracts.

3. Sending or Receiving Invoices

Once approved, invoices are sent to customers or received from vendors. This can happen via email, client portals, or invoicing platforms. Timely delivery is key to initiating the payment cycle.

4. Tracking and Follow-ups

After sending, invoices need to be tracked to ensure they’re received and paid on time. Follow-up reminders may be sent automatically or manually, especially for overdue payments. For incoming invoices, businesses track due dates to avoid late fees or missed discounts.

5. Payment Processing

Once payment is made or received, it’s recorded and verified. Businesses might use various payment methods like bank transfers, credit cards, or digital wallets. Payment confirmation is often linked back to the invoice for easy reconciliation.

6. Reconciliation and Recordkeeping

The final step involves reconciling invoices with payments and updating accounting records. Invoices are stored securely for future reference, audits, and financial reporting. Proper recordkeeping ensures compliance with tax regulations and supports transparent financial management.

Also read: Understanding Procurement: Key Processes, Benefits, and Future Trends

Manual vs. Automated Invoice Management: Key Differences

Here's how an automated system shifts the entire equation: from reactive to real-time, error-prone to accurate, and effort-heavy to effortless.

Aspect | Manual Invoice Management | Automated Invoice Management |

Data Entry | Entered by hand, prone to typos and duplication | Pulled automatically from integrated systems |

Approval Workflows | Email-based, inconsistent, and easy to overlook | Rules-based workflows with real-time notifications |

Tracking & Visibility | Requires checking emails or spreadsheets manually | Centralised dashboard with status updates and reminders |

Payment Follow-ups | Done manually, often delayed or missed | Auto-reminders triggered before and after due dates |

Scalability | Time-consuming as volume grows | Easily handles increasing invoice volume |

Error Handling | Reactive and time-intensive | Proactive, with alerts and validation rules |

These differences highlight how automation doesn't just change the process; it actively addresses the key issues that hinder invoice management.

How Automation Solves the Biggest Invoice Management Challenges

Invoice management comes with a range of challenges, most of which stem from outdated, manual processes. The good news? Many of these issues can be resolved with just a few well-implemented automation features.

Here's how automation directly addresses them:

1. Time-Consuming Manual Work & Slow Approvals

Manual invoice entry, routing, and approval take up valuable time. With automated workflows, invoices are captured digitally, routed to the right approvers based on pre-set rules, and tracked through to completion. This significantly reduces approval times and eliminates the need for back-and-forth emails or physical signatures.

2. Errors, Inaccuracies, and Duplicates

Invoices entered by hand are prone to typos, missing information, or duplication. Automation tools can extract key data from invoices using OCR (optical character recognition), flag inconsistencies, match invoices to purchase orders, and alert users to duplicates before they reach payment.

3. Poor Visibility & Data Silos

When invoices are scattered across emails, spreadsheets, or departments, it’s hard to get a clear picture of what’s going on. Automation platforms offer real-time dashboards that track invoice statuses, approval stages, due dates, and spending trends, all in one place.

4. High Costs and Lack of Scalability

Manual processing requires more headcount and effort as volume increases. Automation scales effortlessly, handling thousands of invoices with the same speed and accuracy as it would a dozen. It also reduces costs by cutting labour time, avoiding late fees, and minimising costly errors.

5. Security & Compliance Risks

Storing physical invoices or loosely managed digital files opens you up to data loss or unauthorised access. Automation platforms provide encrypted, audit-ready storage with controlled access and version history, enabling you to stay compliant with financial regulations.

Why Finance Teams Are Moving to Invoice Automation

Beyond solving day-to-day inefficiencies, automation is helping finance teams modernise how they work, collaborate, and scale. It’s not just about doing things faster; it's about building smarter systems that reduce friction and free up your team for higher-impact work.

Save time and reduce manual effort: Automation eliminates repetitive tasks like data entry, routing, and filing. This shortens invoice cycles and helps teams do more with less effort.

Improve accuracy and minimise risk: OCR and AI tools extract invoice data and match it to purchase orders or receipts, reducing errors and preventing duplicate or incorrect payments.

Gain real-time visibility: Dashboards offer clear insights into invoice status, pending approvals, and cash flow, helping teams forecast spend and avoid bottlenecks.

Stay compliant and audit-ready: Every action is logged, who approved what, and when. Encryption and access controls help meet financial and data security regulations.

Scale without the growing pains: Automation handles higher invoice volumes without requiring more staff, supporting growth while keeping operations efficient.

Build stronger vendor relationships: Faster, more consistent payments improve vendor trust and reduce disputes, leading to better long-term partnerships.

Support remote work and sustainability: Digital-first systems allow teams to manage invoices from anywhere while reducing reliance on paper.

See faster ROI: Reduced processing costs, improved accuracy, and better control over cash flow often lead to measurable savings within months.

To get these benefits, the right tool makes all the difference. Here's what to look for in an invoice management solution.

Key Features to Look for in Invoice Management Software

Choosing the right invoice management software can make the difference between simply digitising your process and truly transforming it. While different tools cater to different needs, here are the essential features to look for in any effective invoice management system:

Automated Data Capture: Look for software that can automatically extract invoice data using OCR (Optical Character Recognition) or integrations with your email or procurement systems. This eliminates the need for manual data entry and reduces errors from the start.

Customisable Approval Workflows: A good tool should let you set up automated approval routes based on roles, invoice amounts, departments, or project codes. This ensures faster processing and clearer accountability.

PO Matching and Validation: Three-way matching (invoice, purchase order, and delivery receipt) is essential for accuracy and fraud prevention. Choose a tool that can automatically match and flag inconsistencies before payment is processed.

Real-Time Tracking and Dashboards: Visibility is key. Look for software that provides real-time status updates, pending approvals, and upcoming payment deadlines through a centralised dashboard. This helps teams stay aligned and avoid bottlenecks.

Integration with Existing Systems: Your invoice software should integrate seamlessly with your accounting, ERP, and procurement platforms, so you avoid data silos and duplicate work.

Kodo integrates effortlessly with your existing accounting, ERP, and procurement systems. Start automating without disrupting what’s already working with Kodo today.

With these core features in mind, the next step is choosing a tool that brings them together in a way that fits your workflow and scale.

Top 5 Automated Invoice Management Tools

To help you evaluate your options, here are five leading automated invoice management tools, each offering a slightly different approach depending on your company size, complexity, and integration needs.

1. Kodo

Kodo is a modern spend management and accounts payable automation platform designed to streamline everything from invoice intake to payment reconciliation. Whether you're processing vendor bills, managing approvals, or ensuring accurate payments, Kodo brings speed, structure, and intelligence to every step of the AP process.

Key Features:

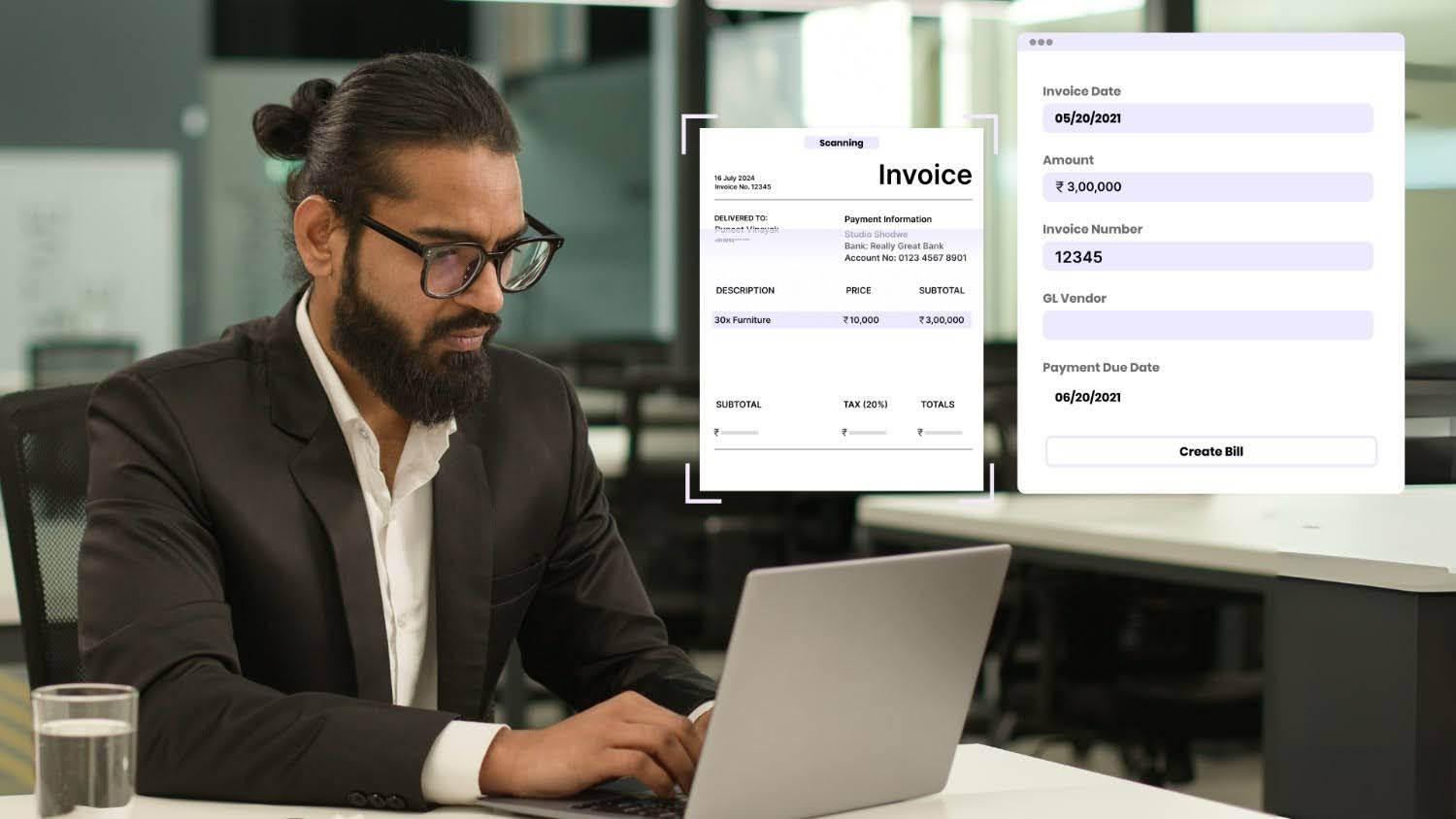

Instant Invoice Capture: Snap and upload invoices with OCR-powered data extraction; no manual entry.

Smart Approvals: Custom workflows, delegation options, and tools like Invoice Scrutinizer for faster, clearer approvals.

Automated Matching: Two-way and three-way matching to eliminate errors and speed up reconciliation.

Unified Spend Management: Manage purchase orders, vendor payments, corporate cards, and reimbursements in one platform.

Built-In Compliance: Digital records, audit trails, and real-time visibility to stay compliant and in control.

2. Tipalti

Tipalti is built for scaling businesses and global payouts. It automates the entire payables workflow, from onboarding suppliers and capturing invoices to approvals, global payments, and tax compliance. It’s a strong fit for companies handling high volumes of invoices across multiple entities and countries.

Key Features:

End-to-End AP Automation: From supplier onboarding to global payments and tax compliance.

Mass Payouts in Multiple Currencies: Pay vendors in 196 countries using various methods, all from one dashboard.

Built-In Tax & Compliance Checks: Connect with global e-invoicing networks for smooth invoice exchange and compliance with local regulations.

Integrated Payment Reconciliation: Automatically matches payments to invoices and updates your ERP.

3. Zoho Invoice

Ideal for small to mid-sized businesses, Zoho Invoice offers automated invoicing, time tracking, and expense management in an easy-to-use interface. It integrates well within the broader Zoho ecosystem and is known for affordability and simplicity.

Key Features:

Automated Recurring Invoices: Set up and forget, Zoho handles repeat billing.

Time & Expense Tracking: Convert billable hours and expenses into invoices with a click.

Integrated Payment Gateways: Accept payments via Stripe, Razorpay, PayPal, and more.

Client Portal: Customers can view invoices, make payments, and download statements anytime.

4. Airbase

Airbase combines spend management with powerful accounts payable automation. It supports invoice processing, approval routing, and direct payments, along with corporate cards and reimbursements. It’s best for mid-sized businesses looking to centralise spend controls.

Key Features:

Invoice to Payment in One Flow: Capture, approve, and pay invoices within the same system.

Multi-Level Approval Workflows: Customisable rules based on roles, amounts, and departments.

Real-Time Budget Controls: Track spend against budgets and set limits at the point of approval.

Audit-Ready Records: Full visibility and compliance with detailed approval trails and policy enforcement.

5. Stampli

Stampli is a dedicated AP automation platform that uses AI to speed up invoice approvals and enhance collaboration between finance and non-finance teams. It captures invoice data intelligently, streamlines communications, and integrates with major ERP systems like NetSuite, SAP, and QuickBooks.

Key Features:

AI Assistant “Billy”: Captures invoice data, flags issues, and learns over time.

Collaborative Approval Interface: Comment, tag, and resolve invoice questions in-platform.

ERP-First Integration Approach: Deep, native integrations with NetSuite, QuickBooks, SAP, and more.

Duplicate Detection & Fraud Alerts: Automated checks to catch repeat invoices or risky vendor behaviour.

Conclusion

Getting invoices paid on time shouldn’t require a full-time follow-up effort. And yet, that’s where many teams find themselves, locked in repetitive cycles that stall decisions, bury insights, and stretch resources thin.

The shift to automation isn’t about chasing a trend. It’s about reclaiming your team’s time and building systems that work with you, not around you.

If your team is still caught in the push-pull of approvals and manual tracking, maybe it's time to ask: What could you be doing if that effort were off your plate?

No more email trails, no more manual matching, and no more second-guessing about who approved what. Kodo makes invoice management feel like it should be structured, seamless, and scalable.