Choose Smarter Spend Management Today!

A recent Salesforce report revealed that employees waste nearly a third of their workday on tasks that don't actually move the needle, simply to appear busy. The same survey also found that employees using automation tools save roughly 3.6 hours per week. That’s about 23 full working days a year.

Tasks like accounts payable management can consume a good chunk of your finance team's bandwidth. It doesn't make fiscal sense to spend hours manually entering invoices and tracking payments, whereas an automated system can handle this in minutes.

This guide offers practical and actionable strategies to transform your AP function from a time sink into a strategic asset.

What Is Accounts Payable Management?

Accounts payable management is the systematic process of tracking and paying money that a company owes to suppliers and vendors.

It includes receiving invoices, verifying their accuracy, getting proper approvals, scheduling payments, and recording these transactions in your financial system. Effective AP management ensures you pay the right amounts at the right times while maintaining accurate financial records.

Core Components of Accounts Payable

Invoice Management: Receiving, validating, and entering supplier invoices into your accounting system

Approval Workflows: Routing invoices to authorised personnel for review and approval before payment

Payment Execution: Scheduling and disbursing funds to vendors through appropriate payment methods

Recordkeeping: Maintaining accurate documentation of all transactions for accounting and audit purposes

Account Reconciliation: Regularly reconciling accounts payable records with bank statements and financial reports to ensure accuracy and prevent discrepancies.

Dispute Management: Addressing any discrepancies or issues with invoices promptly to avoid payment delays.

Vendor Management: Maintaining accurate records of vendor details and agreements to streamline payment processes.

Risk Management: Identifying potential risks within the accounts payable process, such as fraud or compliance issues, and implementing strategies to mitigate them.

These components form the backbone of your AP operations and must work together seamlessly for optimal efficiency. Now, let’s quickly review the goals of AP management.

Goals of Accounts Payable Management

The goals of AP management vary from company to company, depending on size and needs. However, the fundamental goals, regardless of your business’s scale, should focus on the following aspects:

Cost Reduction: Minimise processing expenses through automation and standardisation

Payment Optimisation: Time payments to capture discounts without compromising cash flow

Error Prevention: Implement controls to catch mistakes before they impact financial reporting

Vendor Relationships: Maintain reliable payment schedules to build supplier trust and leverage

Data Visibility: Provide real-time insights into obligations and spending patterns for better decision-making

Proper alignment of these goals with your financial strategy can lead to benefits like lower processing costs, improved cash flow forecasting accuracy, and stronger supplier relationships. These improvements create measurable operational efficiency and contribute directly to your company's financial stability and growth potential.

In the next section, we will highlight the most common pitfalls that can undermine even well-intentioned AP teams.

Challenges in Accounts Payable Management

Even established finance departments regularly fall into these traps that drain resources and create unnecessary risks. Learning to recognise and avoid these mistakes will significantly improve your AP performance.

Relying on Manual Data Entry

Having staff type invoice details by hand introduces errors and wastes time. Each mistake requires additional hours to track down and correct, while your team could be focusing on higher-value analysis instead.

Overlooking Employee Involvement

Risk management should be a company-wide effort. Failing to involve employees or stakeholders at all levels can limit effectiveness and cause critical blind spots.

Missing Approval Hierarchies

Without clear rules about who can approve what amounts, you risk unauthorised purchases or delayed payments. Properly structured approval workflows ensure the right people review transactions without creating bottlenecks.

Paying Invoices Too Early or Late

Rushing to pay before due dates ties up cash unnecessarily, while consistently late payments damage vendor relationships. Strategic payment timing optimises your cash position while maintaining supplier goodwill.

Overlooking Duplicate Payments

When invoices are processed through multiple channels or lack proper tracking, you may pay the same bill twice. Robust duplicate detection saves money directly and prevents the administrative headache of recovering overpayments.

Underestimating Low-Probability, High-Impact Risks

Low-probability risks with high impact are often ignored but can cause significant damage if they occur. Be sure to plan for these unexpected risks.

Skipping Three-way Matching

Failing to verify that purchase orders, receiving reports, and invoices align opens the door to fraud and errors. This fundamental control ensures you only pay for goods and services actually ordered and received.

Ignoring Risk Monitoring

Risks evolve, and failure to continuously monitor and reassess them can lead to unaddressed vulnerabilities. Regularly review and update your risk assessments.

Identifying the challenges is only the first step; you also need to build a strong AP management strategy to address them. Let’s take a closer look at why having a well-structured AP management strategy is so critical for your business.

Importance of Effective AP Management Strategy

An effective AP management strategy is essential for any organization looking to streamline its financial processes and maintain smooth operations. Below are the key reasons why a well-structured AP strategy is critical for your business:

Improved Cash Flow Management: A solid AP strategy helps ensure that payments are made on time while optimizing cash flow. By strategically timing payments and capturing early payment discounts, businesses can better manage their liquidity.

Stronger Vendor Relationships: Timely and accurate payments build trust with vendors, leading to better business terms, discounts, and long-term partnerships. A structured AP process ensures consistent communication and transparency with suppliers.

Reduced Risk of Fraud and Errors: By implementing controls like approval workflows and segregation of duties, an effective AP strategy reduces the likelihood of fraud or payment errors. This protects your organization from financial losses and regulatory scrutiny.

Enhanced Financial Control: A clear AP strategy provides more control over your finances by streamlining approval processes, minimizing errors, and ensuring that only authorized payments are made. This leads to more accurate financial reporting and budgeting.

Increased Operational Efficiency: Automating AP processes and setting clear procedures speeds up the invoice processing cycle, reducing manual labor and freeing up valuable time for your team to focus on higher-value tasks.

Better Compliance and Auditing: An effective AP strategy ensures that your organization complies with internal policies and external regulations. It also makes audits smoother by maintaining transparent and organized records, reducing the risk of non-compliance penalties.

Now, let’s explore some proven strategies that will streamline your AP operations and help you build a more robust financial structure.

Top 10 AP Management Strategies

To stay ahead in a competitive business environment, you need more than just a functional accounts payable system; you need a strategy that drives efficiency, reduces errors, and enhances cash flow management.

Here's how to take control of your AP process and optimise your operations:

Streamline Your P2P Process

The Procure-to-Pay (P2P) process is the journey from purchasing goods or services to paying the supplier. Think of it as the link between buying and paying. If this process isn’t smooth, it can cause delays, errors, and missed payments.

By taking the guesswork out of your P2P process, you create a clear path for everything to flow without hiccups.

A well-managed P2P process makes your accounts payable system more reliable, keeps your vendors happy, and ensures you never miss a payment.

Kodo helps eliminate bottlenecks by providing flexible workflows tailored to your organisation's specific needs. With an efficient system in place, you can quickly submit, monitor, and approve invoices, ensuring a smooth and uninterrupted process.

Standardise Invoice Processing

Establish a standard procedure to ensure invoices are processed efficiently. When everyone follows the same steps, mistakes are reduced, and payments are made on time. This consistency allows your team to handle any issue that may arise quickly and ensures that you’re always in control of your expenses.

Establish Strong Vendor Relationships

Good relationships with your vendors can go a long way in making the AP process smoother. When vendors trust you to pay on time, they are more likely to offer flexible terms and discounts.

Maintaining open lines of communication ensures that any issues can be resolved quickly, and they’ll appreciate your reliability, which might come in handy during negotiation.

Additionally, strive to build relationships with suppliers from day one to set the foundation for smooth AP operations. Clearly communicate your payment terms, invoice requirements, and submission process during vendor onboarding. This early clarity prevents future confusion and payment delays.

Regular Cash Flow Monitoring

Keeping an eye on your cash flow allows you to plan your payments effectively and avoid cash shortages. Regular monitoring helps you understand when payments are due and how much you can afford to pay at any given time.

With this awareness, you’ll always be prepared and can avoid delays that could hurt your relationships with vendors.

Implement Approval Hierarchies

A clear approval process helps maintain control over your accounts payable. Setting up an approval hierarchy ensures that the appropriate people review invoices before payment goes through.

This reduces the risk of errors or fraudulent payments slipping through the cracks and ensures that every payment is properly authorised.

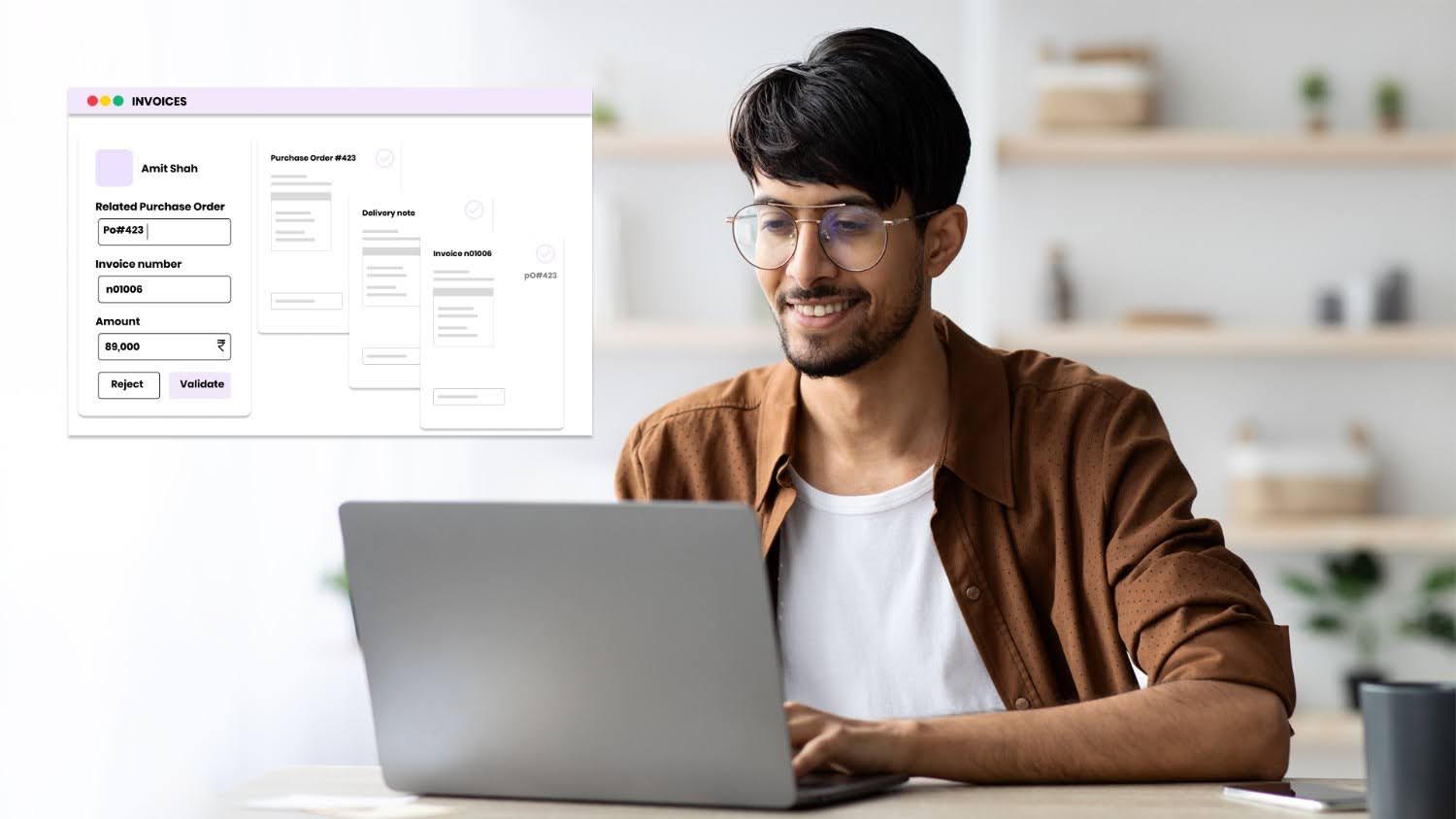

Kodo’s AP management solution simplifies your approval process with OCR-driven automated invoice capture.

It ensures accuracy with 3-way matching, validating invoices against purchase orders and receipts. Our platform also automates reconciliation, saving you time and reducing the risk of human error.

Pay Invoices in Large Batches

Processing invoices in batches saves significant time and reduces processing costs. Instead of handling payments individually as they arrive, set specific days each week or month to process multiple payments at once. This approach cuts down on transaction fees and administrative work.

Batch payments also improve your cash flow forecasting. With predictable payment schedules, you gain better visibility into when money leaves your accounts. Vendors appreciate knowing exactly when to expect payments, which strengthens your business relationships.

Create a Supplier Portal

A self-service supplier portal puts information directly in your vendors' hands. They can

Check payment status

Update their information

Submit invoices without calling your AP team.

The portal creates a digital record of all communications and transactions with each vendor. This documentation would be useful during potential disputes or audits, providing a clear timeline of all interactions. No more searching through email chains or paper files for information.

Moreover, this accessibility improves satisfaction and positions your company as easy to work with, potentially leading to better terms and priority service.

Integrate AP with Financial Systems

When accounts payable is integrated with your broader financial system, you gain real-time visibility into your cash flow and financial standing.

This integration allows for seamless tracking of invoices, payments, and outstanding amounts. It also reduces the need for duplicate data entry, which can save time and minimise errors.

Automate AP Management

Automation is one of the most effective ways to improve your accounts payable process. By automating tasks like invoice approvals, payment scheduling, and record-keeping, you can reduce the time spent on routine tasks and minimise human errors.

Automation not only saves time but also improves accuracy, so you can focus on more important business functions without worrying about missing payments or making mistakes.

Centralise and Standardise Your AP Function

Scattered AP operations across multiple locations or departments create inconsistency and waste. Centralising your accounts payable function brings all invoice processing under one system with uniform procedures. This consolidation eliminates duplicate efforts and reduces processing variations.

Staff working in a centralised AP environment develop deeper expertise. They handle higher invoice volumes and encounter more scenarios, becoming more efficient with each transaction.

Standardised procedures ensure every invoice follows the same path regardless of which vendor sent it or which department ordered it. When everyone follows the same rules, your entire AP process becomes more transparent and manageable.

More on the instrumental role of automation in AP management in the following section:

How Automation Can Help Simplify AP Management

When applied to accounts payable, automation simplifies your process, reduces manual input, and provides real-time insights into your financial situation, allowing you to focus on driving growth instead of handling routine tasks.

Here’s how automation can elevate your accounts payable management:

Faster Invoice Processing

Automation speeds up the entire invoice processing cycle. With fewer manual steps involved, invoices are processed quickly, reducing the time it takes to approve and pay them. This ensures you never miss a payment deadline and keeps your vendors happy.

Improved Accuracy with Less Manual Input

Manual data entry is one of the leading causes of errors in accounts payable. Automation eliminates this issue by automatically pulling data from invoices and entering it into your system. This ensures accuracy and reduces the chances of mistakes, such as entering the wrong amounts or missing discounts.

Enhanced Vendor Communication and Payment Tracking

Automated systems keep track of payment statuses and send automatic reminders to vendors. This makes it easier to manage communication and avoid delays. With everything tracked in one place, you can quickly see which payments have been made, which are due, and which need attention.

Better Compliance and Documentation

Automation ensures that every transaction is accurately documented and stored in a central system. This makes it easier to stay compliant with internal policies and external regulations. You’ll always have an accurate record of your accounts payable history, which simplifies audits and reporting.

More Time for Strategic Business Functions

When routine AP tasks are automated, your finance team has more time to focus on strategic decisions that drive the business forward. They can work on budgeting, forecasting, or analysing financial trends, rather than spending their time on administrative tasks.

Simplify Accounts Payable Management With Kodo

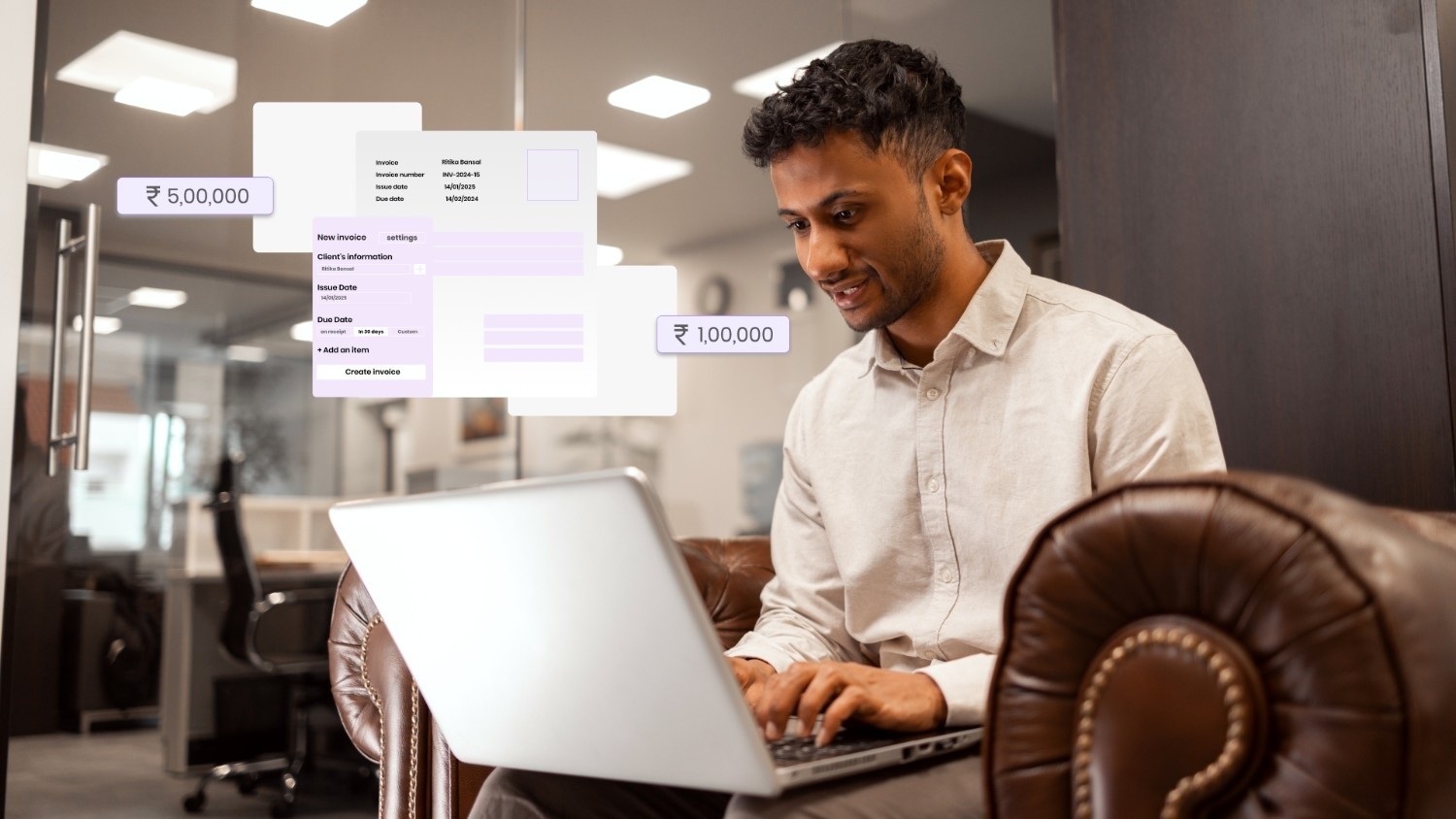

Kodo is a spend management platform that offers a dedicated AP management solution that automates every step. Our software uses OCR technology and automated approval workflows to streamline invoice processing and reduce manual errors, ensuring greater efficiency and accuracy. Kodo’s capabilities include:

Automated Invoice Capture: Kodo automatically scans and captures invoice data using Optical Character Recognition (OCR), checks it against purchase orders and receipts with 3-way matching, and reconciles the data for accuracy.

Multiple Bank Payment Options: Simplify your vendor payments with centralized bank transfers, tailored to your business needs.

Smart Integration for Reconciliation: Sync seamlessly with accounting tools like Zoho and Tally to automate reconciliations, reduce errors, and keep your financial records up to date.

Approval Flows for Internal Control: Implement customizable approval workflows to ensure only verified payments are processed, saving time and preventing errors.

Conclusion

What separates okay-ish AP management from a smooth, friction-free AP pipeline is clear objectives and the right tools to execute them efficiently. By implementing these proven approaches, you can save your employees the pain of hours of manual grunt work.

Use Kodo to track, approve, reconcile, and manage every single invoice with precision from a centralised platform. Plus, Kodo's collaborative environment allows you to achieve shared visibility and maintain transparency with both vendors and internal stakeholders.

Ready to eliminate the headache of manual AP management? Start automating today with Kodo.