Choose Smarter Spend Management Today!

Tired of chasing missing invoices, entering data manually, and dealing with payment delays?

These slow, error-prone tasks frustrate your AP team and vendors alike, especially when follow-ups happen before you’ve even located the document. Manual processes stall approvals, delay month-end close, and make audits more difficult than necessary.

Invoice automation helps you move away from all that. Instead of pushing papers and juggling spreadsheets, you can rely on a system that captures, matches, and routes invoices with minimal manual effort. It reduces the administrative burden and allows your team to focus on higher-value work.

This blog walks you through how to implement invoice automation, from defining rules and cleaning up workflows to selecting the right tools, so your AP team can close faster and operate with more control.

Key Takeaways:

Invoice automation reduces manual data entry and shortens processing time from weeks to days, while significantly improving accuracy.

End-to-end systems manage invoice capture, validation, approval, and payment, syncing with ERPs to maintain up-to-date financial records.

Automation lowers processing costs, prevents duplicate payments, and builds audit trails for easier compliance and fraud detection.

AI-driven OCR and validation rules flag mismatches for human review, freeing up staff to handle exceptions instead of routine tasks.

Faster approvals and automated reminders help capture early-payment discounts, while supplier portals reduce back-and-forth over payment status.

What is Invoice Automation?

Automated invoice processing uses software to manage the full invoice lifecycle, from receipt to payment, without heavy human effort. Systems rely on OCR and machine learning to extract invoice data, validate it, route it for approval, and match it against purchase orders or contracts.

Once approved, the system posts the invoice to your ERP or accounting platform, initiates payment, and logs the entire process for audit and compliance. This reduces manual entry, flags duplicates, speeds up approvals, and gives teams better visibility into cash flow and potential fraud risks.

With the process laid out, here’s what invoice automation can improve across your AP function.

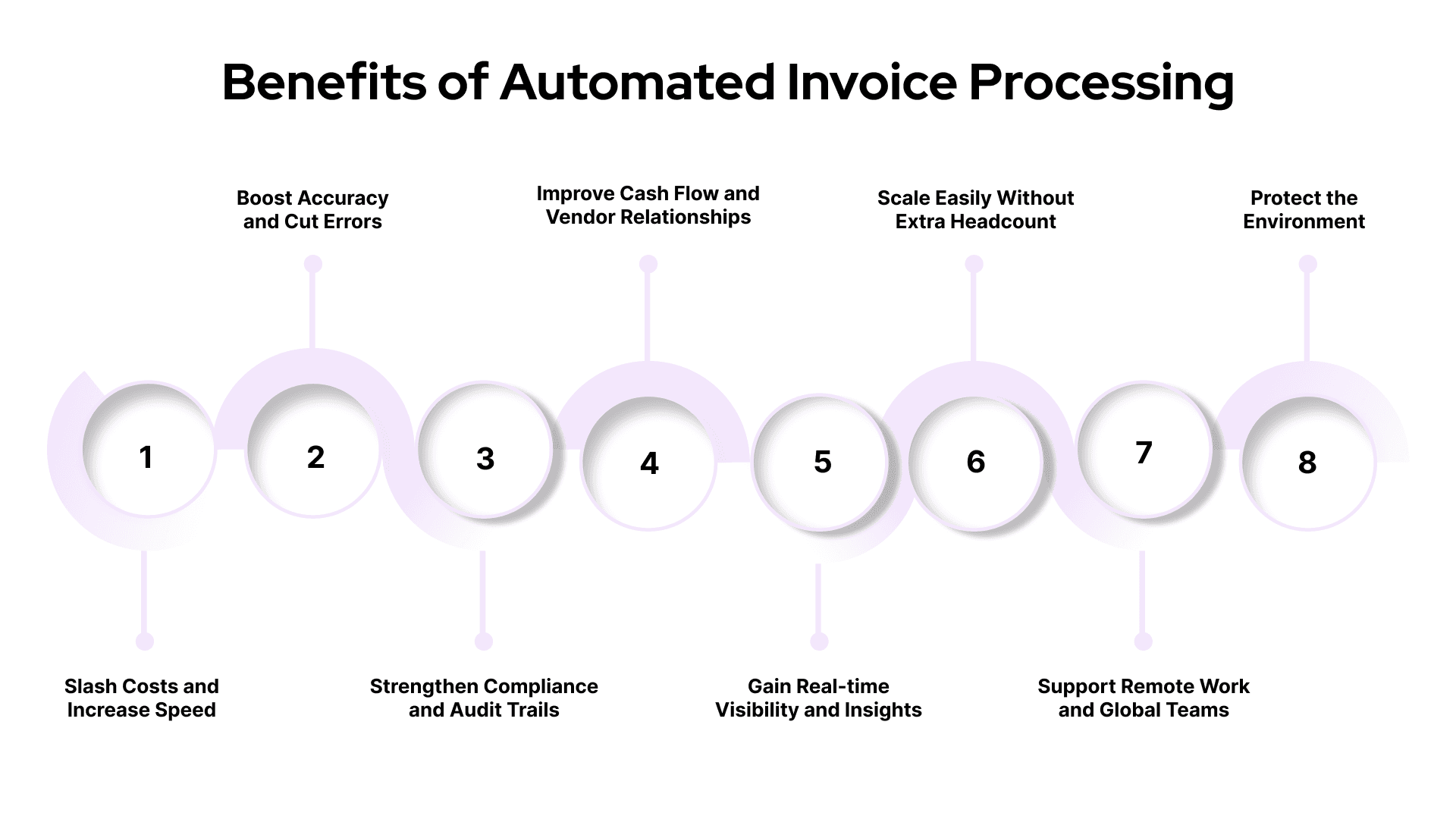

What are the Benefits of Automated Invoice Processing?

Automated invoice processing slashes costs and errors, speeds up cycles, improves cash flow, offers real-time analytics, scales without adding staff, enhances compliance, enables remote work, and supports green initiatives.

Slash Costs and Increase Speed: Automation cuts invoice handling costs. It reduces manual processing time from weeks to days or even hours.

Boost Accuracy and Cut Errors: OCR and AI eliminate manual data-entry errors, duplicate payments, and mismatches. Accuracy rises from ~80% to over 95%.

Strengthen Compliance and Audit Trails: Systems log every action, data extraction, approval, and edit, speeding up audits and reducing fraud risks.

Improve Cash Flow and Vendor Relationships: Automation triggers reminders, speeds up approvals, and avoids late fees. That enables early-payment discounts and smoother supplier relationships.

Gain Real-time Visibility and Insights: Dashboards show invoice status, ageing, and spending data in real-time, enabling finance teams to better forecast and spot trends earlier.

Scale Easily Without Extra Headcount: Platforms absorb spikes in invoice volumes, seasonal or growth-related, without hiring more staff.

Support Remote Work and Global Teams: Cloud-based solutions let users capture, review, and approve invoices from anywhere, reducing office-based bottlenecks.

Support Sustainability Goals: Paperless workflows reduce waste, storage needs, and your carbon footprint.

To extract maximum value, businesses must adapt to region-specific regulations, deploy advanced zero-touch OCR, and empower suppliers via self-service portals, three areas most content overlooks.

How Invoice Automation Works Behind the Scenes

Invoice automation collects, cleans, and reads invoices using OCR and AI. It validates them against business rules, routes exceptions for review, executes payments, syncs with ERPs, and provides transparent audit trails and analytics.

Invoice Capture

Invoices arrive via email, vendor portals, scanners, or uploads. The system collects everything in one repository. It applies preprocessing, removes noise, fixes skew, and adjusts contrast to produce clean PDFs or images for processing.

Data Extraction via OCR + AI

OCR reads characters; layout analysis identifies fields like vendor name, invoice number, dates, line items, and totals. AI/NLP maps values to these fields intelligently. It handles complex formats, handwriting, and multiple languages.

Validation Against Rules

The system checks extracted data against rules or system data. It matches invoices to purchase orders, receipts, or contracts. It also verifies totals, duplicates, tax rates, currencies, or GL mapping using past patterns.

Exception Handling and Human Review

The system flags inconsistencies, missing data, validation fails, and duplicates for review. Human approval kicks in only for exceptions, easing the manual workload.

Workflow Routing and Payment

Approved invoices move automatically through configured routing paths by vendor, department, or amount and trigger payment instructions (EFT, ACH, etc.). Notification and mobile review options accelerate the process.

System Integration

The platform syncs invoice metadata, GL codes, and payment events with ERP and accounting systems through APIs or connectors, updating back-end ledgers in real-time.

Audit Trail and Archive

Systems maintain detailed logs, including who scanned, extracted, approved, edited, and paid each invoice with timestamps. Invoices are stored in secure archives, accessible instantly for audit or reporting.

Reporting and Insights

Dashboards display metrics, processing times, exception rates, duplicate flags, pending workflow volumes, and missed discounts. Finance teams use these insights to refine operations.

If the process seems straightforward, the next step is getting started. Here’s how to set up automation that works for your team.

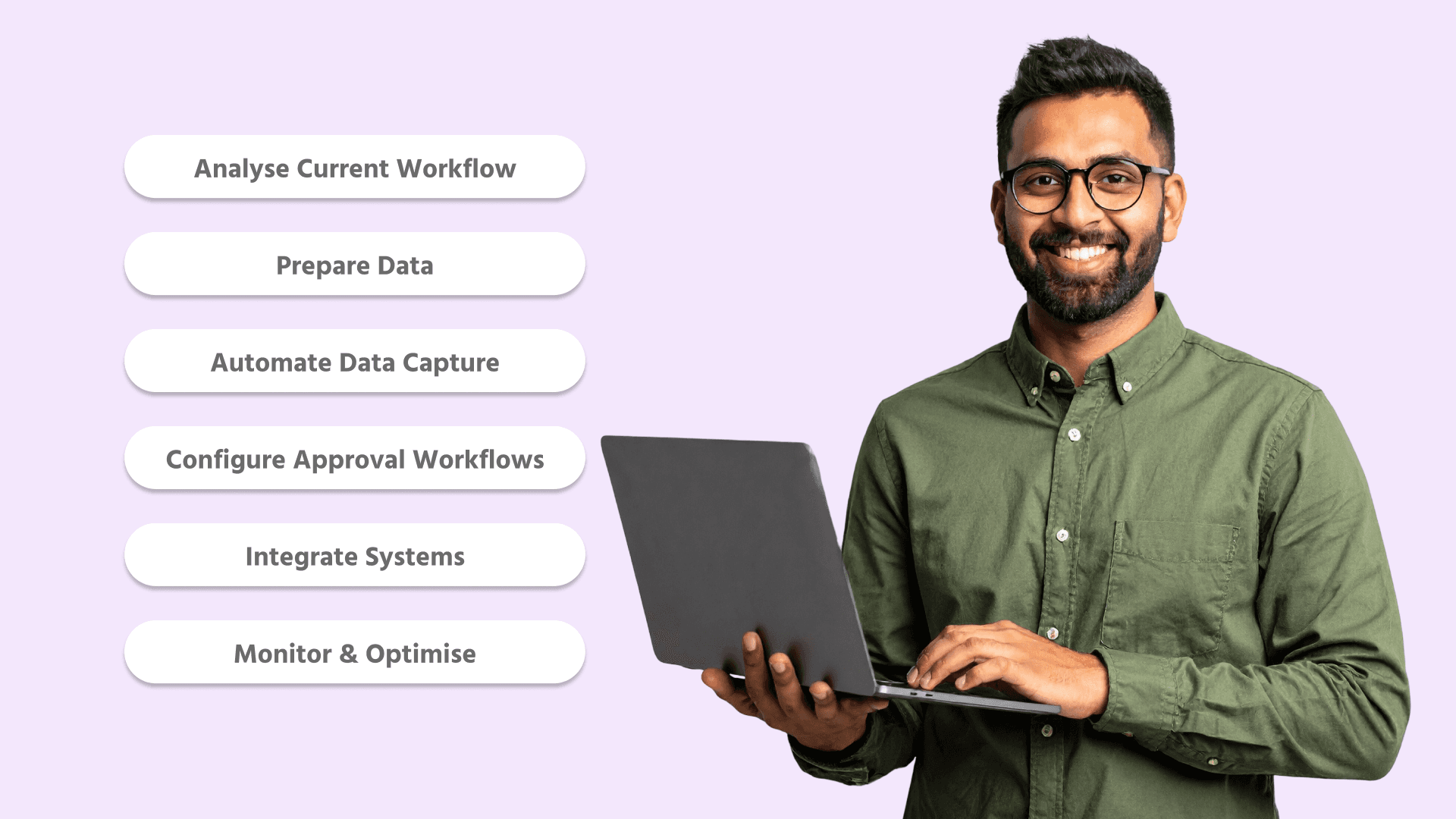

How to Implement Invoice Automation in Your Business

Automating the invoice process involves using digital tools to streamline tasks like invoice creation, data entry, approvals, and payments. By replacing manual processes with invoice automation, businesses can reduce errors, speed up processing times, ensure compliance, and gain better visibility into cash flow.

Step 1: Map and Diagnose Your Current Invoice Process

Before automating anything, understand how your existing process works. Track where invoices come from, who handles them, where errors occur, and how long each step takes.

Trace Every Step: Gather invoices from email, paper, EDI, and portals and scan inputs. Note who touches each invoice and how long it stays at each stage.

Spot Bottlenecks and Error Hotspots: Interview AP staff. Check where invoices get lost, rerouted, or error-prone, such as OCR failures, mismatches, or stalled approvals.

Document Volumes and Formats: Count invoices per channel (PDF, paper, EDI), peak seasons, and manual-entry costs. This data guides decisions and helps set goals.

Measure Key Metrics: Record average receipt-to-payment time, cost per invoice, exception rates, and late fees. Identify targets like cutting cycle time by X% or reducing exceptions by Y%.

Visualise the Workflow: Create a visual flowchart with decision points, handoffs, and manual reviews from receipt to archive. This reveals where automation brings the most benefit.

You automate wisely when you know what slows you down. Mapping workflows and capturing real data shows you exactly where automation brings the most ROI.

Step 2: Clean Your Data to Avoid Automation Errors

Automation fails without clean, reliable data. Consolidate all invoice sources and build a strong foundation before scaling tech.

Centralise Invoice Sources: Route invoices from email, scanning, portals, and EDI into one digital inbox. This step removes data silos and keeps everything in a unified queue.

Standardise Data Formatting: Normalise invoice fields, vendor names, dates, and currencies into consistent formats. Standardisation reduces mismatches during data capture and rule checks.

Remove Duplicates and Errors: Cleanse data by filtering out duplicates, fixing missing values, and correcting common errors before processing. That step cuts the exception volume downstream.

Verify Vendor Master Data: Match invoice data against vendor records, check addresses, tax IDs, and payment terms, and avoid posting to the wrong accounts.

Set up Governance and Procedures: Define data standards and cleansing routines. Assign ownership, audit cleansing steps regularly, and update lists with new vendors or tax rules.

Skipping data prep leads to high exception rates and failed automation. Cleaning early means fewer manual interventions later.

Step 3: Set Up Data Capture and Validation Rules

Once your data’s clean, configure automation to extract, analyse, and validate invoice content with minimal human input.

Clean Images and Extract Data: The system applies preprocessing, noise reduction, skew correction, and contrast adjustment before OCR reads invoice fields and line items. OCR then captures text from diverse formats (PDF, scan, photo).

Use AI for Field Mapping: AI and layout‑analysis templates learn vendor layouts and adapt over time. They identify invoice numbers, dates, amounts, taxes, vendor details, and currencies without manual template coding.

Apply Validation Rules: The system checks for duplicates, mismatched totals, missing fields, incorrect tax rates, format compliance, and vendor existence.

Route Exceptions and Enrich Data: Invoices that fail the validation flag for human review are categorised by type. The system enriches data via vendor master or pricing catalogues to fill gaps.

Set up AI‑Based Fraud Checks and Compliance: Advanced tools scan data patterns to detect fraud, like near-threshold amounts, vendor changes, or repeats, and apply regional tax rules (e‑invoicing, multi-currency, VAT).

A strong capture layer goes beyond OCR. It learns, validates, adapts, and flags problems early, keeping humans focused on real issues.

Also Read: 15 Key Benefits of Procurement Software

Step 4: Build Smart Approval Workflows

Automation only works if your approval paths are logical and flexible. Design workflows that fit your actual operations.

Define Approval Paths by Rules: Set routing based on invoice attributes, amount, vendor, or department. For example, some invoices over a threshold go to senior staff, while others follow a shorter route.

Set Backup Approvers and Triggers: Assign substitute reviewers to prevent delays. Use time-based triggers and reminders so invoices don’t linger.

Manage Exceptions and Rejections: Configure rules such as mismatches, like missing POs or incorrect totals, and route to a specific exception queue. Add human review and resubmission steps.

Enable Mobile and Email Approvals: Allow approvers to review and approve invoices via email links or mobile apps, minimising bottlenecks.

Log Every Action: Track who approved, rejected, or added comments with timestamps. This builds a complete audit trail.

Workflows should adapt to real-world behaviours. Add flexibility, escalation logic, and transparency to make compliance second nature.

Step 5: Integrate With Your Existing Systems

Automation falls apart when systems don’t talk. Build integrations with your ERP, procurement, payment gateways, and CRM.

Use APIs or Prebuilt Connectors: Choose tools that connect natively with your ERP (e.g., SAP, Oracle) or support open APIs. This removes the need for manual data uploads.

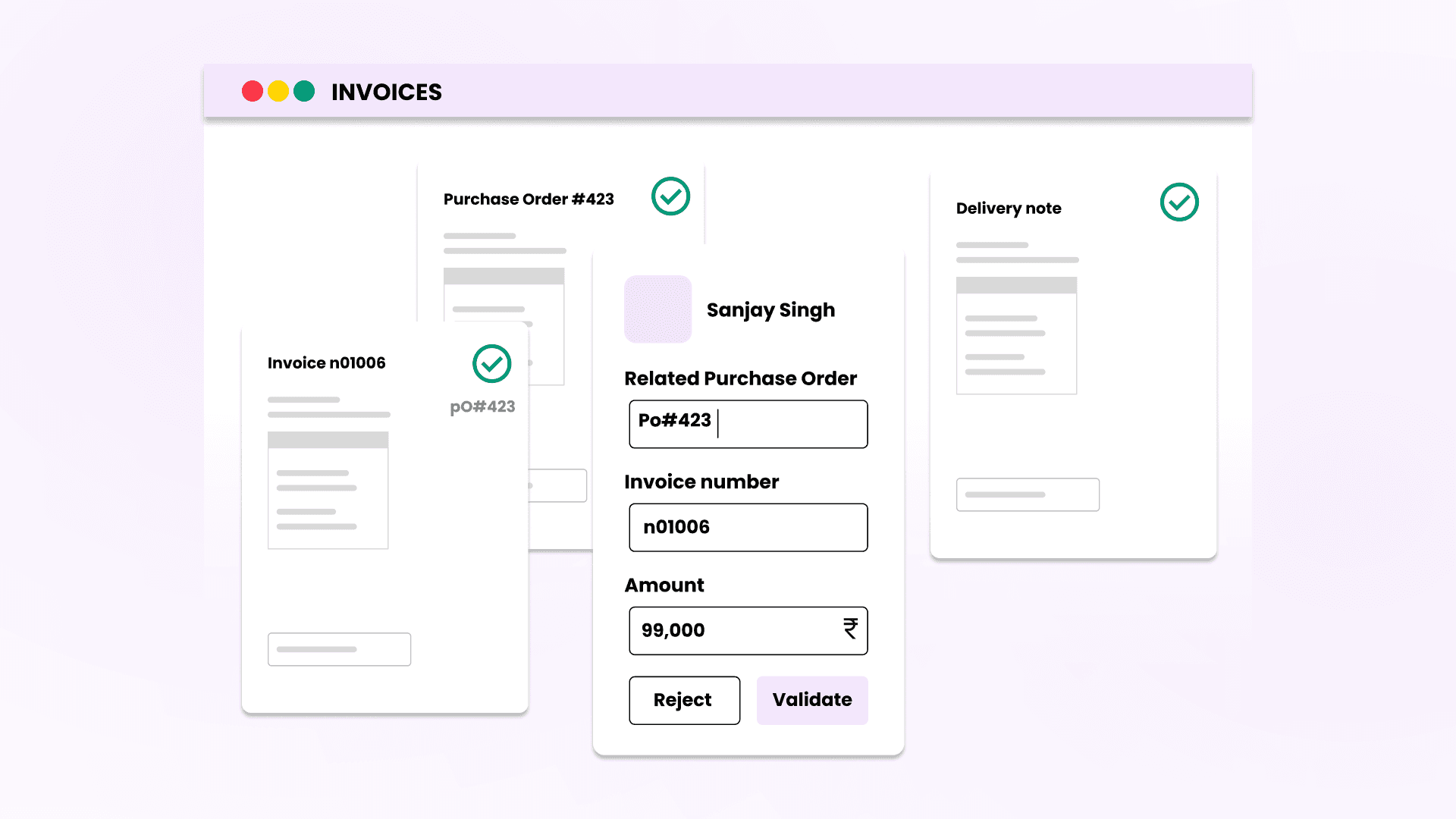

Automate PO Matching: Pull POs and contracts from your procurement system, match them automatically with invoice data, and flag any mismatches.

Sync GL and Payment Details: Push approvals, tax details, and payment instructions directly to your ERP or accounting system once validated.

Link to CRM and Banks: Connect to your CRM for customer data and payment systems for live payment status updates.

Test End-to-End Accuracy: Run pilot batches to test invoice ingestion, GL sync, and payment execution. Make sure everything reconciles correctly.

Integration isn’t just about speed; it’s about trust. When all systems sync, your data becomes reliable and actionable.

Also Read: Accounts Payable Automation

Step 6: Monitor, Measure, and Optimise

Automation is not “set and forget.” Monitor usage, spot gaps, and iterate based on real outcomes.

Track Core KPIs: Log metrics like average cost per invoice, processing time, exception rates, and on‑time payments. Compare results against industry averages.

Set Dashboards for Real-Time Insights: Display data on outstanding invoices, approval delays, error hotspots, and missed discounts. Dashboards clarify bottlenecks.

Benchmark and Define Targets: Compare your data to top performers (e.g., ₹123 cost per invoice, sub-5-day cycle) and set measurable targets.

Run Regular Audits and Reviews: Review exceptions to identify recurring issues, template mismatches, vendor data errors, or validation failures, and refine rules or data cleaning protocols.

Adjust and Scale Workflows: Tweak thresholds, introduce auto‑escalation for stalled approvals, and scale rules as volume or vendor mix evolves.

Capture ROI Gains: Calculate savings from lower cost per invoice, reduced late fees, early payment discounts, and freed labour hours. Use ROI metrics to justify further automation.

Getting invoice automation up and running is about more than plugging in software. It takes careful prep, clean data, and workflows that actually match how your team works. When done right, it speeds things up and makes your AP process more accurate and less stressful.

But even with the best tools, automation can hit roadblocks. Let’s look at the common challenges.

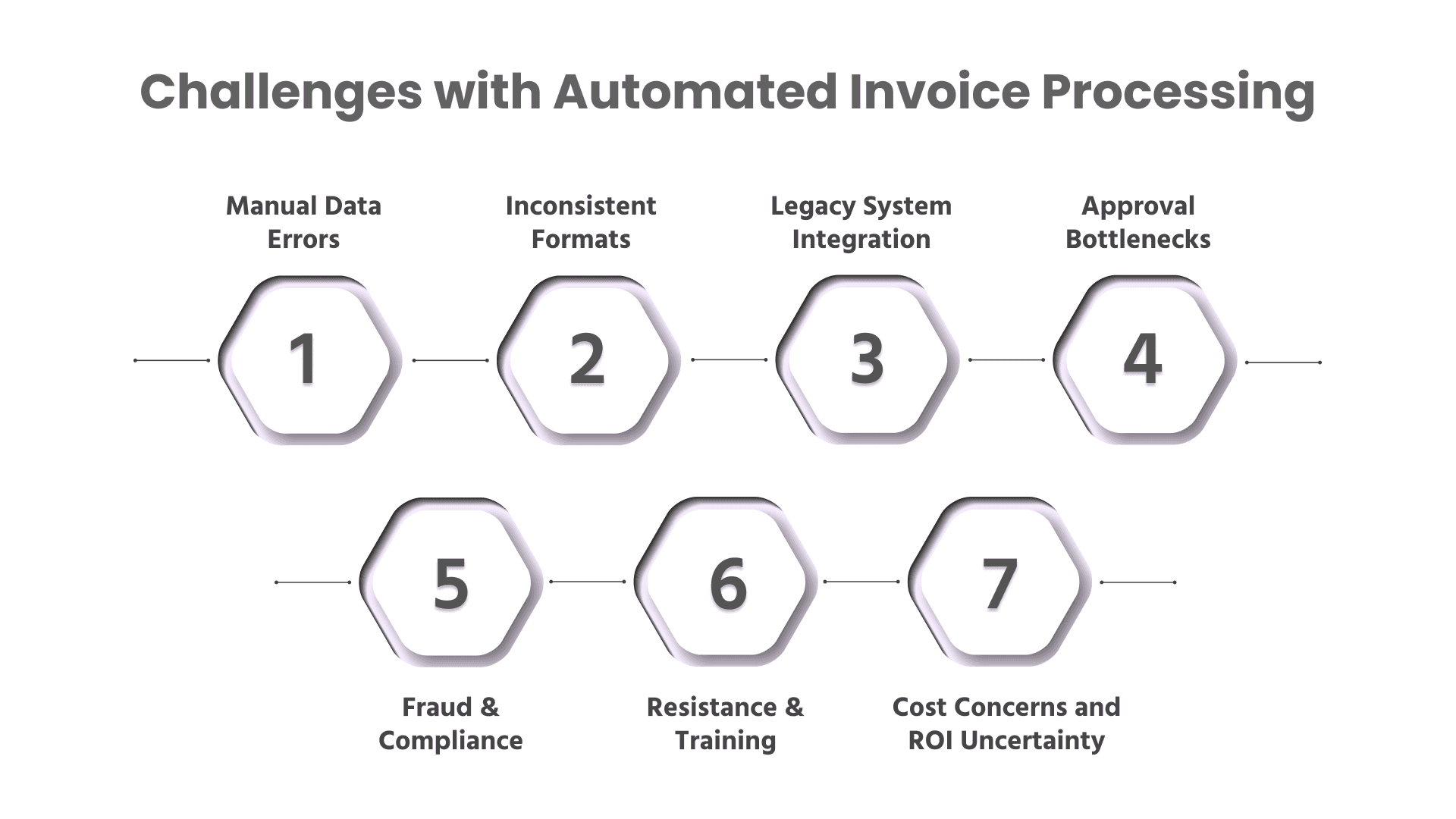

What are the Challenges with Automated Invoice Processing?

Automated invoice processing reduces errors, speeds up approvals, and improves compliance, but it’s not a plug-and-play solution. Success depends on clean data, smart capture, seamless integration, and user adoption. Here are the most common roadblocks teams face:

Manual Data Entry and Errors

Teams still spend hours entering invoice data, leading to typos, duplicates, and delays. While OCR can help, not all tools handle varied formats or handwritten inputs effectively. Look for systems that support intelligent capture with built-in validation.

Inconsistent Invoice Formats

Invoices arrive in PDFs, scanned papers, mobile photos, or EDI files, which makes standardised processing difficult. Tools that use AI to learn layouts dynamically, without relying on templates, handle this better than fixed rule-based systems.

Integration with Legacy Systems

Outdated ERPs and mismatched formats often break the flow between capture, approval, and payment. Choose tools with open APIs or native connectors, and test end-to-end to ensure accurate syncing and data posting.

Bottlenecks in Approval Workflows

Invoices can stall if there are no clear routing rules or backup approvers. Use flexible workflow logic, assign secondary reviewers, set time-based escalations, and allow approvals via mobile or email to avoid delays.

Fraud Risks and Compliance Concerns

Fake invoices, duplicates, and shifting tax regulations create risk. Strong platforms include audit trails, fraud detection logic, access controls, and support for local compliance needs such as e-invoicing or QR code validation.

Change Resistance and Training Gaps

Teams used to spreadsheets or manual reviews may hesitate to adopt new systems. Involving users early, offering targeted training, and showing the real-world benefits of automation help improve buy-in.

Unclear ROI or Cost Concerns

Initial costs can seem high, especially without a clear view of returns. Track metrics like cost per invoice, error reduction, fewer late fees, and captured early-payment discounts to build a clear ROI case.

Many of these challenges come down to the tool you choose. The right software fits into your existing systems, handles exceptions, supports users, and scales as your needs grow. Here is how to evaluate solutions that actually solve the problems you just read about.

Key Features to Look For in Automation Software

Pick software that fits your systems. A system that reads diverse formats intelligently, applies smart validation, routes approvals dynamically, enforces security, supports your team, scales with growth, and delivers real ROI.

Ensure System Compatibility: Choose software with prebuilt connectors for your ERP, accounting tools, procurement platforms, and payment systems. Open APIs make integration smoother, especially if your setup is nonstandard.

Look for Intelligent Data Capture: Go beyond basic OCR. Prioritise tools with AI and machine learning that can adapt to varying invoice layouts, including PDFs, scans, photos, and mobile captures, without requiring template coding.

Validate with Smart Matching Rules: Your software should automatically detect duplicates, flag mismatches, verify tax rates, and support two- or three-way matching. Flexible rules help route exceptions without clogging the process.

Prioritise Workflow Flexibility: Seek drag-and-drop workflow builders with dynamic routing, time-based triggers, backup approvers, and mobile or email approvals. Flexibility ensures invoices keep moving even when something changes.

Demand Strong Security and Compliance: Look for features like role-based access, encryption, audit trails, and alignment with standards such as SOC 2 and GDPR. Global tax logic and volume scaling are critical for growing or cross-border businesses.

Evaluate Ease of Use and Support: User-friendly design matters. Intuitive dashboards, searchable archives, and in-app guidance speed up adoption. Good vendor support, onboarding resources, and a responsive help desk make a big difference.

Weigh Cost Against ROI: Understand the pricing model, whether per invoice, user-based, or flat fee, and compare it to savings from reduced errors, faster processing, and captured early-payment discounts.

Many tools promise automation, but few deliver real control, visibility, and ease of use. Here’s how Kodo simplifies every stage of invoice processing.

How Can Kodo Help You With Automated Invoice Processing?

Kodo removes the manual invoice handling burden by setting up a structured, rule-based flow from invoice intake to approval and sync with your ERP. This allows faster processing, fewer errors, and clearer records without the back-and-forth.

Invoice Management: Kodo captures invoices from email, uploads, or WhatsApp and matches them to purchase orders and goods receipts. You can set rules for two-way or three-way matching so that only approved entries move forward.

Purchase Request: Every invoice relates to an approved request, giving you a clear audit trail. Kodo links the request, order, and invoice in one place, cutting down on time spent tracking missing paperwork.

Purchase Order: Kodo auto-generates the purchase order once a request is approved. When an invoice arrives, it checks against the PO and goods receipt before sending for payment; manual checks are unnecessary.

Vendor Payments: Kodo enables automated payouts, both scheduled and one-time, with built-in maker-checker approvals, detailed audit trails, and live payment tracking to streamline invoice processing.

Cross-Platform Integration: Kodo syncs invoices and related documents with ERP systems like Tally, Zoho, SAP, and Oracle. Approved data flows directly, reducing entry errors and updating your records across systems.

With Kodo, you stop reacting to invoice chaos and start managing the process on your terms. It ties every invoice to its source, reduces touchpoints, and helps your team move faster without cutting corners.

Wrapping Up

Automating invoice processing eliminates delays, errors, and endless back-and-forth. Instead of chasing paperwork, your team can focus on work that actually moves the business forward. With the right system in place, approvals flow faster, payments stay on track, and compliance becomes automatic.

Kodo makes that system work. From smart capture to seamless ERP sync, Kodo moves invoices from inbox to payment with minimal manual effort. Real-time tracking keeps vendors informed and your finance team in control, reducing errors, delays, and follow-ups.

Join 2,000+ businesses already streamlining their payables with Kodo. Book a demo today and see how simple invoice automation can be.

FAQs

Can invoice automation systems detect duplicate invoices across different vendors?

Yes, advanced systems use metadata, line-item matching, and vendor history to flag duplicates, even when invoice numbers differ slightly, helping avoid overpayments or fraud.What happens if an invoice lacks a matching purchase order (PO)?

The system can route such invoices for exception handling. Some platforms also allow setting custom rules for auto-flagging non-PO invoices or matching them against historical buying patterns.How do automated workflows handle early payment discounts?

Many systems automatically prioritise invoices eligible for early payment discounts, helping accounts payable teams capture savings by fast-tracking approvals and payments within discount windows.Can invoice automation tools integrate with tax compliance checks?

Yes, some tools validate tax information like GSTIN, VAT, or TIN automatically during invoice processing, reducing manual compliance errors, especially in cross-border transactions.How do users correct errors flagged by the automation system?

Most platforms have a user-friendly interface for manual review, allowing corrections to data fields (like mismatched totals or vendor details) and resubmission without restarting the entire process.