Choose Smarter Spend Management Today!

Manual invoice processing is quickly becoming outdated as businesses turn to smarter, faster solutions. India’s invoice processing software market is set for rapid growth, fueled by the rise of AI and automation.

But this shift isn’t just about technology; it’s about saving time, minimizing errors, and improving financial accuracy.

As companies adopt these advancements, they’re streamlining their operations, raising efficiency, and ensuring compliance. In this market, understanding how invoice processing works and leveraging automation has become essential to staying ahead and delivering a seamless client experience.

In this blog, we’ll break down the basics of invoice processing and show why automation could be your finance team’s greatest strategic asset!

What is Invoice Processing?

Invoice processing is the step-by-step workflow for handling vendor invoices, from the moment they’re received to the point they’re paid. It ensures that every bill is tracked, verified, approved, and recorded accurately to keep finances in check and vendor relationships running smoothly.

Key Aspects of Invoice Processing:

Managing vendor invoices from receipt to payment: Includes scanning, verifying, and routing invoices for approvals before initiating payment.

Tracking vendor billing details: Keeps a record of due dates, amounts, PO numbers, and payment history to avoid late fees or double payments.

Error checking and approvals: Verifies invoice accuracy against purchase orders and delivery receipts.

Payment scheduling: Aligns invoice payments with the company’s cash flow and payment cycles.

Documentation and compliance: Maintains records for audits, GST filings, and internal reviews.

When done right, invoice processing reduces errors, improves transparency, and strengthens vendor trust.

Up next, let’s explore the different types of invoice processing and how each one fits into your workflow.

Types of Invoice Processing

There is no one-size-fits-all method for invoice processing. Depending on the size of the business and the volume of transactions, companies choose from different approaches that best suit their needs. Here are some different types of it:

1. Manual Invoice Processing

This is the traditional method where finance teams handle physical or emailed invoices manually, entering data into spreadsheets, chasing approvals, and tracking payments. It’s time-consuming and error-prone, especially for businesses handling hundreds of invoices a month.

For example, a small manufacturing firm might still rely on Excel sheets to log vendor bills and manually issue cheques after manager approvals.

2. Automated Invoice Processing

This method uses software to scan, read, route, and process invoices digitally. It significantly reduces human effort, speeds up approvals, and cuts down errors caused by manual entry.

For instance, a mid-sized IT services company using cloud-based AP automation software can auto-approve recurring vendor payments and directly sync records with its ERP system.

3. Outsourced Invoice Processing

Here, businesses outsource their invoice handling tasks to third-party service providers. This is a cost-effective solution when internal resources are limited, but it requires trust and strong service-level agreements.

A logistics firm with scattered vendor networks across India might outsource its AP function to a financial BPO that handles data entry, verification, and payment reconciliation.

4. Hybrid Invoice Processing

A mix of manual and automated systems is often used during transitions or in companies not fully ready for complete automation. This setup gives flexibility but also needs careful monitoring to avoid gaps.

For example, a retail chain may process high-volume, recurring supplier invoices through software but handle one-time, service-based vendor bills manually due to their complex terms.

Understanding these types helps you choose the right method that balances cost, efficiency, and control. Now that we know the different modes of processing, let’s walk through the key steps involved in getting an invoice from inbox to paid.

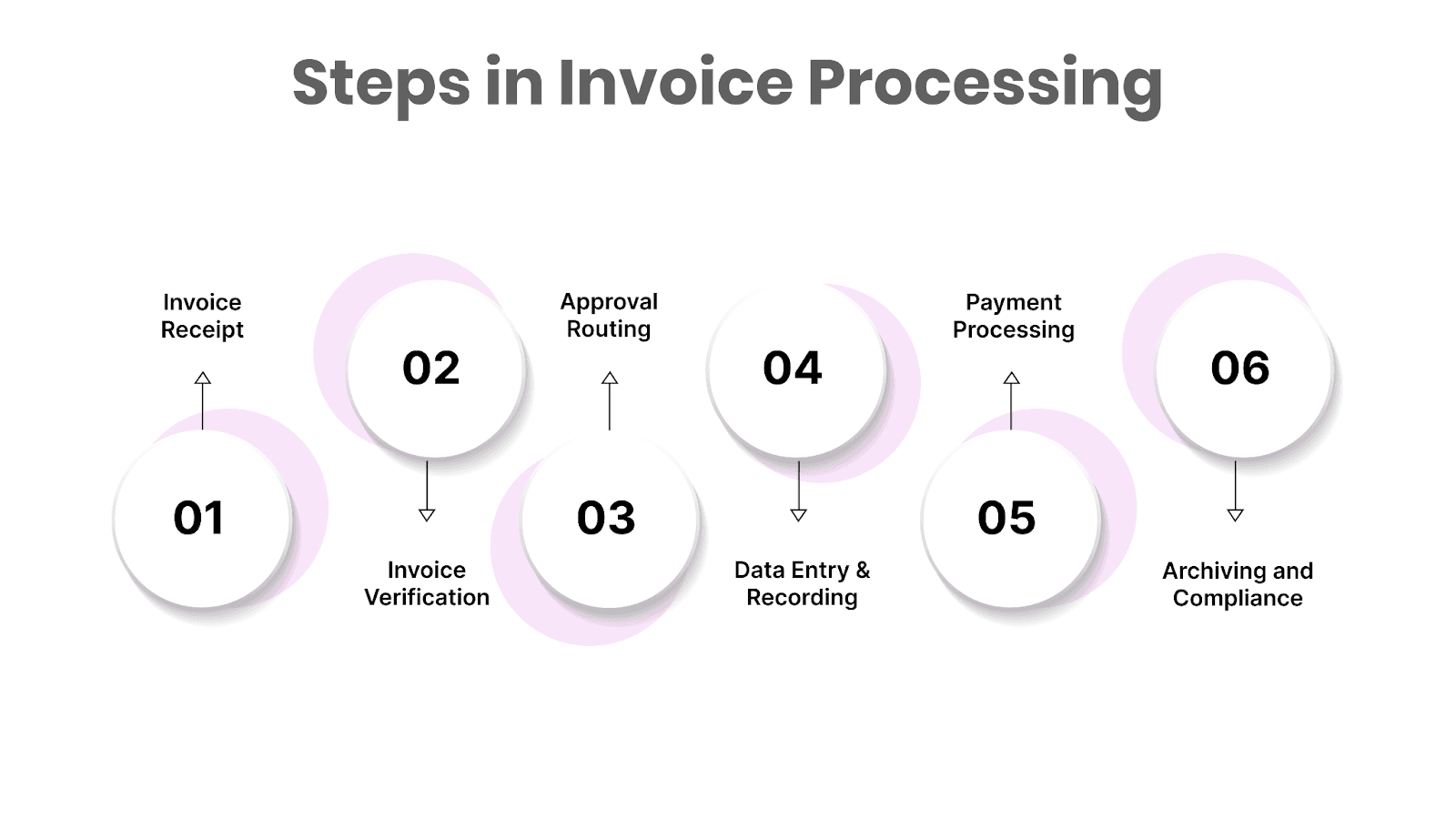

Key Steps in Invoice Processing

Processing an invoice might seem simple, but there’s a well-defined sequence behind every payment. Each step ensures accuracy, avoids fraud, and keeps vendor relationships strong. Here are the steps:

Step 1: Invoice Receipt

This is where the process begins. Invoices arrive via email, courier, or automated system. The finance team (or the software) logs the incoming invoice and verifies that it's addressed correctly and contains essential details like the PO number, amount, and vendor name.

Step 2: Invoice Verification

The invoice is matched against supporting documents, such as purchase orders, contracts, and delivery receipts. This three-way match confirms that what was ordered has been received and billed correctly. Any mismatch here can cause payment delays or raise red flags.

Step 3: Approval Routing

Once verified, the invoice is sent for internal approval. Depending on the organisation's structure, it might go through one or multiple stakeholders. Timely approvals are key to avoiding missed due dates and maintaining healthy vendor relationships.

Step 4: Data Entry and Recording

Invoice details are entered into the accounting or ERP system. In automated setups, this step is done using OCR (Optical Character Recognition) that extracts and inputs data with minimal human intervention. Accurate recording is crucial for audit trails and future referencing.

Step 5: Payment Processing

After approval and data entry, the invoice moves to the payment stage. The finance team schedules the payment based on vendor terms, early payment discounts, due dates, and cash flow status, which are considered before releasing funds.

Step 6: Archiving and Compliance

Finally, the invoice and its payment details are stored securely for compliance, tax filing, and audits. Proper documentation ensures the business is ready for any financial scrutiny and can easily track historical data.

These steps will help you improve cash flow control and build long-term vendor trust. Now, let’s look at some of the benefits of automating invoice processing!

Benefits of Automated Invoice Processing

Automation doesn’t just speed things up; it transforms how finance teams work. With fewer errors, faster approvals, and complete visibility, automated invoice processing is a major improvement for modern businesses. Here are some benefits of automated invoice processing:

Faster Invoice Approvals: Automated workflows route invoices to the right approvers instantly. No more waiting on emails or chasing managers. This speed reduces processing times from days to just hours, helping companies avoid late fees and take advantage of early payment discounts.

Reduced Manual Errors: Data entry mistakes, missing fields, and mismatched purchase orders are common in manual processing. Automation solves this by pulling and matching data accurately from invoices, reducing rework and saving finance teams countless hours.

Cost Savings: Every manual invoice can cost a business ₹150 to ₹300 when you add up paper, printing, and human effort. Automated systems cut these costs dramatically by digitising the process, which means more budget can go toward growth, not admin.

Real-Time Visibility and Tracking: Automation platforms offer dashboards where you can track every invoice's status in real-time. This helps with forecasting, vendor management, and audit readiness, all while making your team feel more in control of finances.

Improved Compliance and Audit Trails: Invoices are stored securely, with detailed logs of every action, who approved it, when, and how. This level of traceability ensures you're always ready for audits and regulatory checks without scrambling for paperwork.

With these benefits, it’s clear why you should turn to automation to streamline your invoice handling.

However, just to be prepared, let’s learn about some possible challenges of invoice processing and solutions for them.

Challenges in Invoice Processing

Even the most organised finance teams run into issues when handling invoices. From delayed approvals to vendor disputes, the road from receipt to payment isn’t always smooth. Here are some of them and how to handle them properly:

1. Delayed Approvals

One of the most common bottlenecks in invoice processing is waiting for approvals. When invoices sit in inboxes or on desks, they cause payment delays and strain vendor relationships.

Solution: Implementing automated approval workflows, like those offered by Kodo, can route invoices instantly to the right stakeholders and send reminders to keep things moving without manual follow-ups.

2. Data Entry Errors

Manual data entry can lead to misprints, mismatched amounts, and incorrect vendor codes. These errors can trigger payment disputes or even compliance issues.

Solution: OCR-based tools in platforms like Kodo extract data directly from invoices and match them with POs or receipts, significantly reducing the risk of human mistakes.

3. Lack of Visibility

When invoice status updates rely on email threads or spreadsheets, tracking becomes chaotic. Finance teams lose sight of what’s pending, approved, or paid.

Solution: Kodo’s dashboard provides a clear, real-time view of every invoice, who has it, where it stands, and what actions are pending, bringing clarity to the chaos.

4. Non-Standardised Invoice Formats

Vendors often send invoices in different formats, making it hard to process them consistently. Some might miss crucial details, causing rework or delays.

Solution: An automated platform can standardise these formats by extracting necessary fields and flagging any missing data, so nothing falls through the cracks.

5. Compliance and Audit Risks

Invoices not stored properly or missing approvals can cause serious trouble during audits or tax filings.

Solution: Kodo creates a complete audit trail for each invoice, including timestamps, approver IDs, and version history, ensuring full traceability and compliance.

Addressing these challenges upfront improves efficiency and builds a stronger foundation for scalable financial operations. Lastly, let’s talk about the best practices that can make invoice processing seamless from day one.

Best Practices for Invoice Processing

A well-oiled invoice process is built on consistent and smart practices. From standardisation to smart tech adoption, these best practices can help your finance team stay ahead of delays, errors, and compliance risks. Here are some practices to follow:

Standardise Invoice Formats and Requirements: Clearly communicate to all vendors what an acceptable invoice should include, like PO numbers, due dates, tax details, and line-item breakdowns. This minimises back-and-forth and ensures faster, smoother processing without missing crucial financial or legal information.

Implement a Centralised Invoice System: Using a single platform to manage all invoices reduces confusion, eliminates duplicate records, and ensures everyone on the finance team works from the same playbook.

Automate Approval Workflows: Manually chasing approvals slows down the process and introduces inconsistencies. Automated workflows route invoices to the right people based on predefined rules, send reminders, and eliminate bottlenecks, ensuring a streamlined path from receipt to payment.

Set Clear Payment Schedules: Establish and communicate fixed payment cycles, like bi-weekly or end-of-month processing. This helps vendors align expectations and allows your finance team to plan disbursements more effectively, keeping cash flow under control and reducing ad-hoc chaos.

Maintain Accurate Vendor Records: Outdated or incomplete vendor details can lead to payment failures or tax mismatches. Make it a habit to periodically update vendor profiles, including GSTIN, bank details, and contact information, to ensure error-free invoicing and compliance.

Conduct Regular Internal Audits: Set up quarterly reviews of your invoice process to catch recurring issues early. These audits help identify inefficiencies, flag non-compliant invoices, and ensure everything is aligned with company policy and regulatory norms.

Train Your Team Continuously: Even with the best systems in place, human awareness matters. Equip your finance staff with the right knowledge on tools, workflows, and compliance updates so they can spot red flags and operate confidently.

Sticking to these best practices not only makes invoice processing efficient but also prepares your organisation for scale. With a strong foundation in place, you're ready to handle more volume, more vendors, and tighter regulations!

Automated Invoice Processing Solutions with Kodo

At Kodo, we’re reshaping the way you manage your spend. With our cutting-edge procure-to-pay and payment solutions, we eliminate inefficiencies, reduce costs, and free up time for what matters most: growth! 2000+ companies trust our platform, including Urban Platter, Inshorts, Mokobara, and more.

We revolutionize invoice management by automating the entire accounts payable process, from invoice capture to payment, enhancing accuracy, efficiency, and control for finance teams.

How Kodo enhances automated invoice processing:

Instant Invoice Capture: Kodo's OCR technology quickly scans and uploads invoices, eliminating manual data entry and accelerating the processing time.

Smart Approval Workflows: Kodo's customisable workflows automate multi-level approvals, ensuring that invoices are reviewed and authorised by the appropriate personnel without delays.

Automated Matching: The platform performs two-way and three-way matching of invoices with purchase orders and receipts, reducing errors and ensuring consistency across documents.

Efficient Task Delegation: Kodo allows for seamless delegation of approval tasks, maintaining workflow continuity even when team members are unavailable.

Integrated Financial Management: Beyond invoice processing, Kodo offers a comprehensive suite for managing procure-to-pay cycles, corporate cards, and reimbursements, providing a unified platform for financial operations.

By using Kodo's automated solutions, businesses can streamline their invoice processing, reduce operational costs, and improve financial accuracy.

Conclusion

Efficient invoice processing is a critical part of running a smart, scalable business. When handled right, it saves time, cuts costs, and strengthens vendor relationships. Adopting automated solutions brings consistency, transparency, and speed, while proven practices help businesses grow without increasing operational chaos.

At Kodo, we don’t just simplify invoice processing, we transform it. From smart approvals to real-time tracking, our platform automates every step so your finance team can focus on what truly matters. Whether you're handling 10 invoices or 10,000, Kodo scales with you, accurately, securely, and effortlessly.