Choose Smarter Spend Management Today!

Behind every successful business lies an efficient system that manages cash flow and payments without hiccups. Yet, many organisations in India still struggle with slow, manual payment processes that tie up resources and create costly delays. Not to mention being prone to human error and bottlenecks. Such inefficiencies drain time and risk damaging relationships with vendors.

The good news? These challenges can be eliminated with a robust payment automation system. By automating your payments, you free your team from repetitive tasks, accelerate invoice processing, and gain full control and transparency over your cash outflows.

In this comprehensive blog, we’ll unpack what payment automation really means to its types, tangible benefits, and practical strategies to implement it seamlessly in your organisation.

Let’s start by understanding the core concept of payment automation and how these systems operate.

What is Payment Automation?

Payment automation refers to the use of technology to streamline and automate the process of making and receiving payments. Instead of relying on manual methods like paper checks or manual data entry, your business can utilise software solutions to automate the entire payment cycle and handle tasks such as invoice processing, approval workflows, and payment execution. This approach reduces human intervention, minimises errors, and accelerates transaction speeds, leading to enhanced operational efficiency.

Types of Payments That Can Be Automated

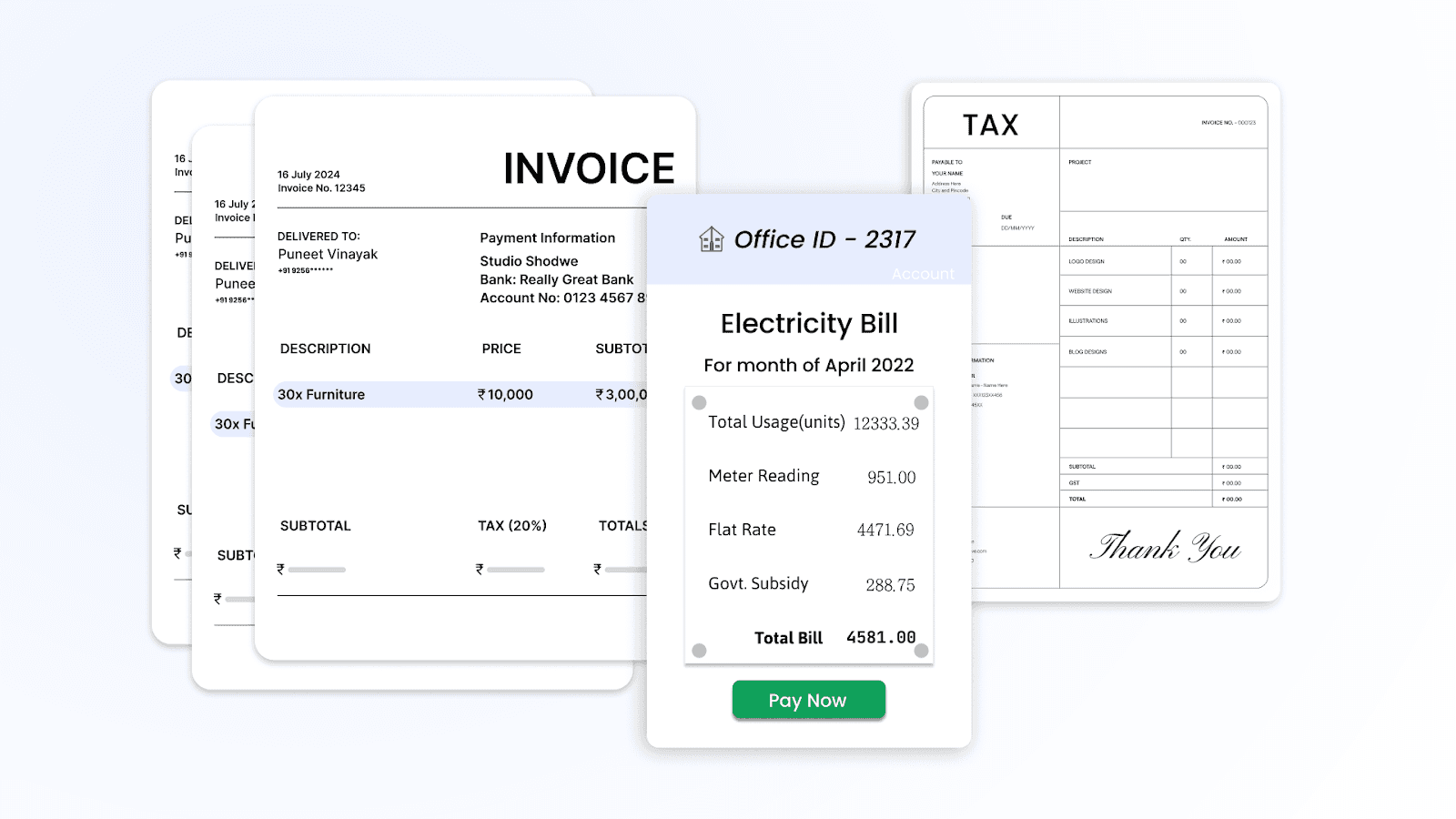

Almost every business payment can be automated to save time, reduce errors, and boost control. Here are some key payment types that your businesses can commonly automate:

Business-to-Business (B2B) Payments: Automate supplier, contractor, and vendor payments for faster, accurate, and traceable transactions.

Tax Payments: Schedule GST, TDS, and other tax payments automatically to avoid penalties and maintain compliance.

Payroll Payments: Ensure timely salary transfers to employees without manual intervention, reducing errors and delays.

Utility and Recurring Bills: Automate monthly payments for electricity, internet, and other services to avoid disruptions.

Subscription and Software Licenses: Manage timely payments for SaaS, software licenses, and subscriptions without manual tracking.

This leads naturally to the question, why is it so important to automate business payments? Let’s discuss this in more detail next.

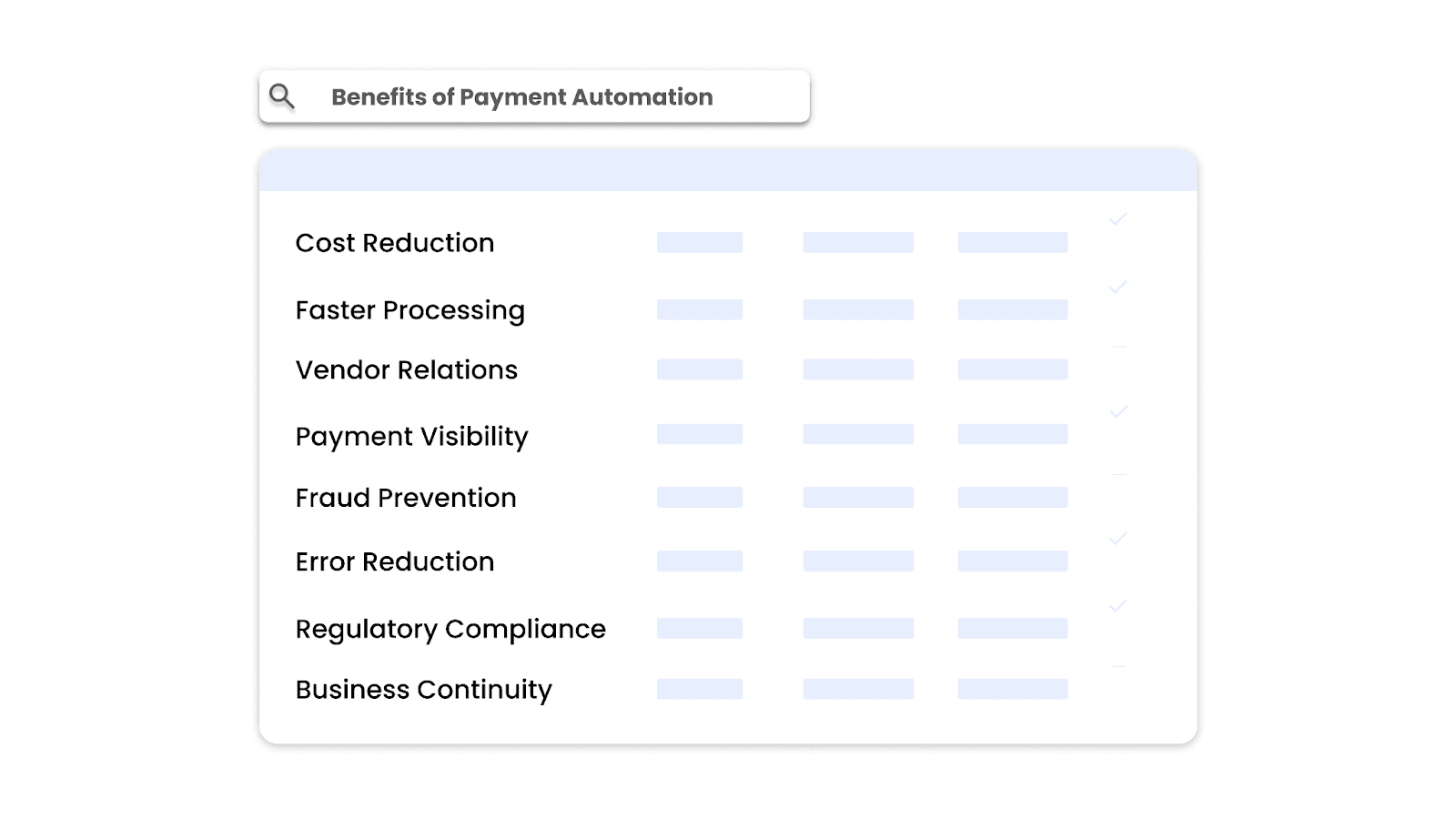

Benefits of Payment Automation

Manual payment processes, with their delays and errors, often hold your business back from real growth and agility. Automation isn’t just a tool for convenience; it’s a strategic move that redefines how you can manage your cash flow, vendor relationships, and operational capacity.

Here are eight compelling reasons to consider automating your payment systems:

Significant Cost Reduction

Payment automation cut down labour costs by reducing the need for manual data entry, paper handling, and physical approvals. You can also save on overhead expenses related to printing, postage, and banking fees. Moreover, electronic payment methods have lower processing fees than traditional methods.

Faster Invoice Processing Speed and Improved Cash Flow

Automated payment systems capture invoices instantly and route them to the right approvers without delay, accelerating the entire payment cycle. This enables smoother cash flow management, allowing you to optimise liquidity and use funds strategically for growth initiatives or operational needs.

Improved Vendor Relationships

Payment automation eliminate human delays and ensure your suppliers receive payments exactly when expected. This reliability strengthens vendor confidence, making them more willing to prioritise your orders, offer additional discounts, or negotiate favourable terms.

Enhanced Payment Visibility and Automatic Reconciliation

Payment automation systems provide a centralised dashboard where you can get a 360-degree view of the status of invoices, approvals, and payments in real-time. Automatic reconciliation matches payments against invoices without manual intervention, reducing errors, saving time, and simplifying financial reporting.

Fraud Prevention and Enhanced Security

According to AFP’s Payments Fraud and Control Survey, 79% of organisations were victims of payment fraud activity in 2024. Automated payment systems incorporate multi-layered security features such as role-based access, multi-factor authentication, and fraud detection to safeguard financial transactions.

Reduction of Manual Errors and Duplicate Payments

Automation standardises workflows, eliminating human intervention and reducing mistakes. Interestingly, over 63% of organisations using automation reported fewer errors than before. This way, you save money, reduce reconciliation time, and improve financial accuracy.

Better Compliance with Regulatory Requirements

Payment automation systems can apply tax calculations accurately and generate necessary reports, reducing risks of non-compliance penalties and fines. This adherence mitigates legal risks and builds stakeholder trust by demonstrating robust financial governance.

Improved Efficiency and Business Continuity

By automating payment processes, your business can reduce dependence on manual operations, freeing up your finance teams to focus on strategic tasks rather than routine work. Automated systems foster business continuity, minimising operational risks.

Understanding these benefits highlights why payment automation systems are essential for modern businesses.

To understand how automation systems facilitate these benefits, let's first delve into what a payment automation system is.

What are Payment Automation Systems?

A payment automation system is a software solution designed to manage and automate the entire payment process. These systems integrate with your existing financial tools, such as accounting, procurement, and Enterprise Resource Planning (ERP) systems, to provide a seamless flow of information and transactions. They handle functions like invoice capture, approval workflows, payment execution, reconciliation, and reporting – all on one platform.

The goal of such systems is to enable faster, accurate, and secure payments with real-time visibility and control over your financial operations. By automating these payment-related tasks, your business can achieve greater control over your finances, reduce the risk of fraud, and improve vendor relationships through timely payments.

Now, let’s explore the step-by-step workings of a payment automation system.

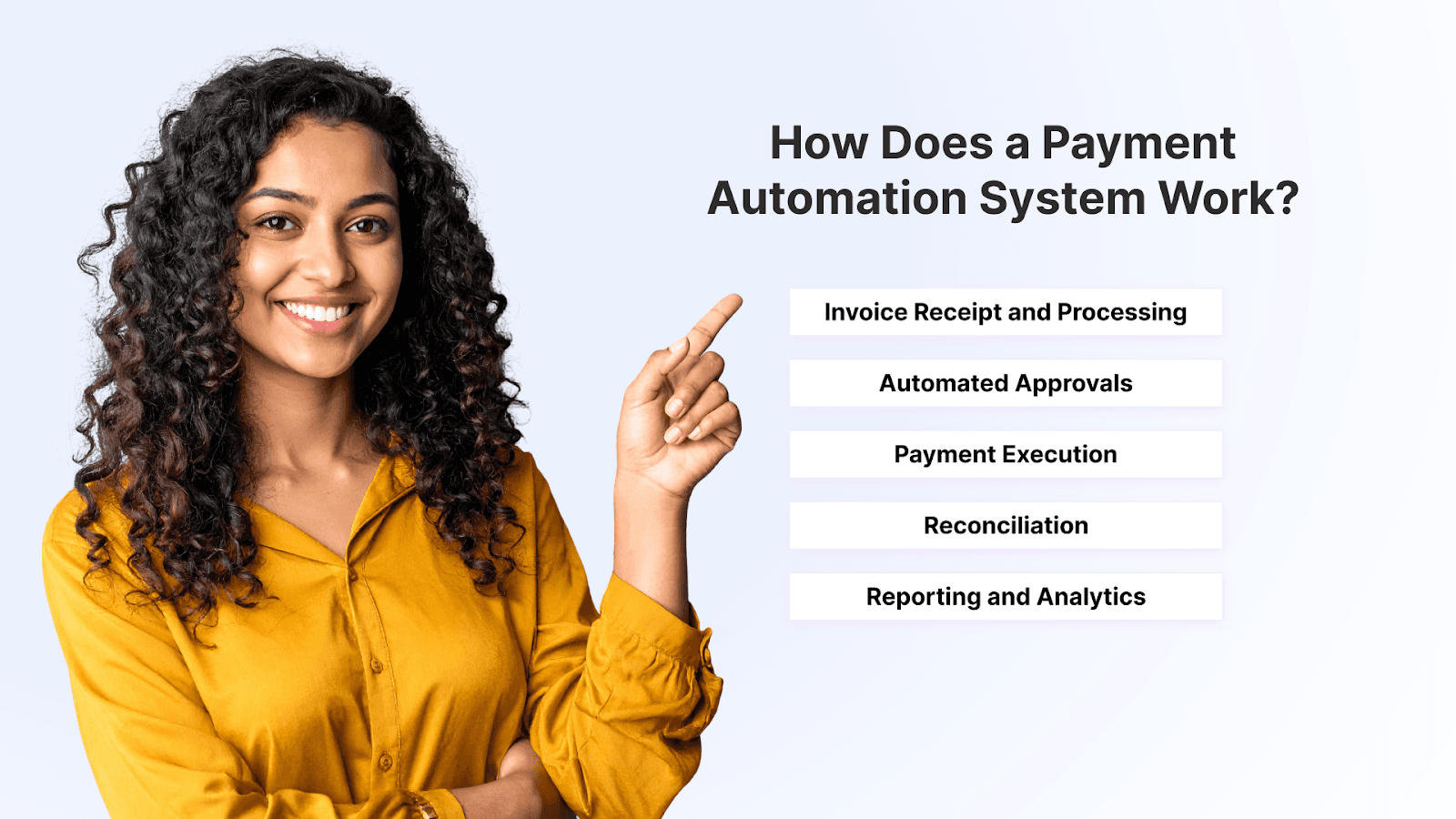

How Does a Payment Automation System Work?

Implementing a payment automation system is akin to installing a high-efficiency engine into your business's financial operations. It transforms manual, error-prone processes into streamlined, accurate workflows that save time and money. But how exactly does this transformation occur?

Let's delve into the intricate steps that power payment automation systems.

Invoice Receipt and Processing

The journey begins when invoices arrive digitally via email, vendor portals, or scanned documents. Advanced systems employ Optical Character Recognition (OCR) technology or digital data capture to extract key data such as vendor details, invoice numbers, due dates, line items, and amounts. This automated data capture eliminates the need for manual data entry, reducing human errors and accelerating the processing time.

For instance, Kodo utilises AI-driven OCR to instantly capture and digitise invoices, making them ready for the next steps in the workflow.

Automated Approvals

Once invoices are digitised, they are routed through predefined approval workflows. These workflows are customisable, allowing your business to set rules based on factors such as department, amount thresholds, or vendor categories. Approvers receive notifications and can approve or reject invoices with a few clicks, often through integrated platforms or mobile applications. Approval reminders and escalation features ensure no delays, reducing bottlenecks and enhancing accountability.

Moreover, automation provides a clear audit trail, facilitating transparency and compliance with internal controls.

Payment Execution

After approval, the system initiates payment execution. Depending on your organisation's settings, payments can be made through various integrated payment channels such as bank transfers, corporate cards, wire transfers, credit cards, or digital wallets. The system can schedule payments to align with vendor terms, ensuring timely transactions and potentially capitalising on early payment discounts.

For example, Kodo's platform offers multiple bank payment options and customisable approval workflows, enabling businesses to execute payments swiftly and securely.

Reconciliation

Post-payment, the system automatically reconciles transactions by matching them against invoices and purchase orders. This process involves comparing payment records with bank statements to save time and ensure consistency and accuracy.

Any discrepancies are flagged for review, allowing finance teams to address issues promptly. It also provides real-time visibility into your organisation's financial status, aiding in better decision-making, financial planning, and month-end closing.

Reporting and Analytics

Advanced payment automation systems generate comprehensive reports that provide insights into payment histories, outstanding invoices, cash flow, and vendor performance. These analytics help your business identify trends, optimise payment strategies, forecast expenses, and make better financial decisions.

Furthermore, these insights support strategic planning and contribute to the overall financial health of your business.

Having understood how payments are automated, let’s explore effective strategies to successfully integrate payment automation systems into your operations.

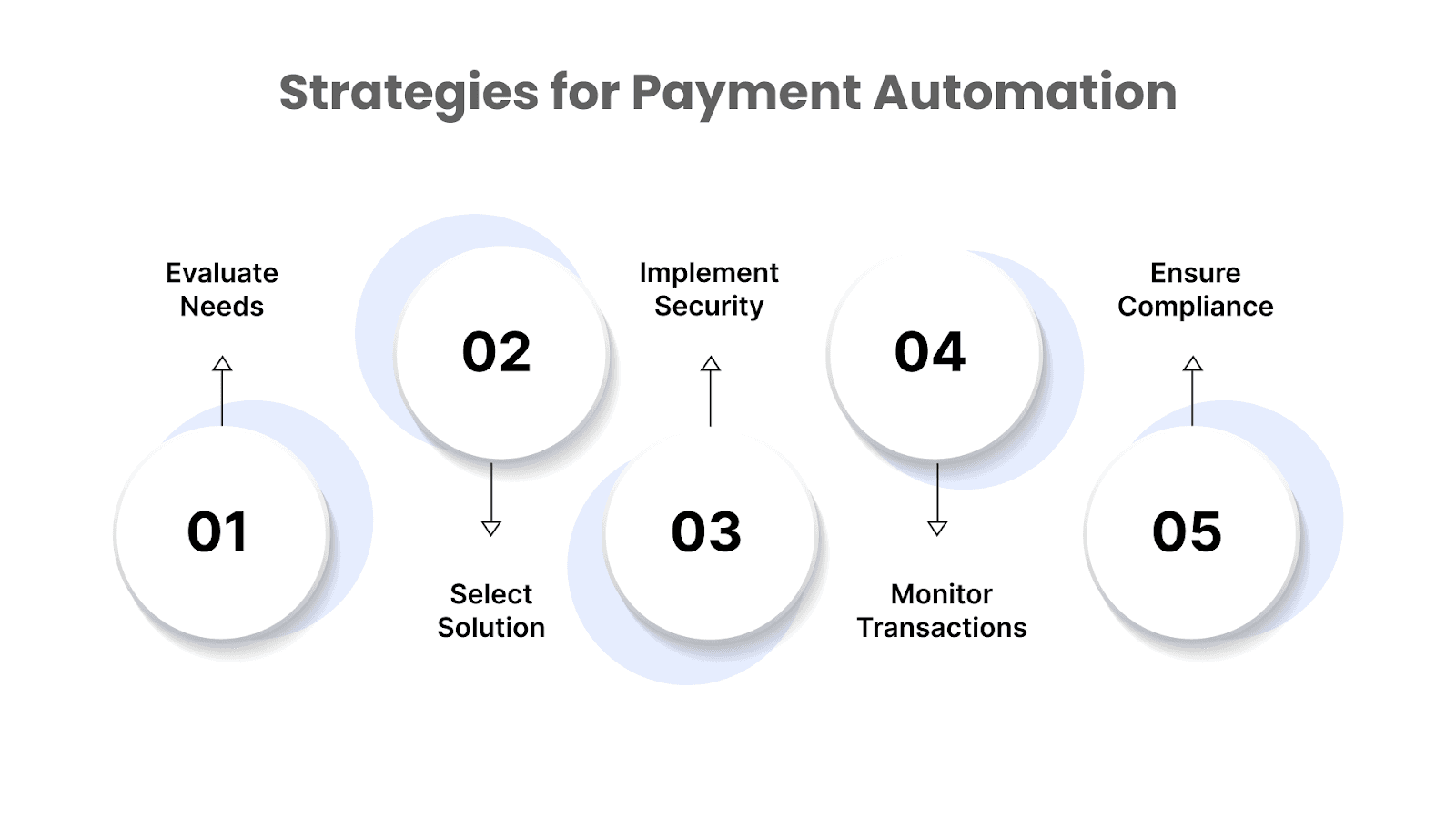

Strategies for Implementing Payment Automation

Adopting payment automation is a game-changer, but successfully integrating it into your business requires more than just installing new software. It involves thoughtful planning, careful selection, and a clear understanding of how automation fits within your existing processes.

Let’s explore some practical strategies that your business can use to implement payment automation effectively.

Evaluate Business Needs and Plan Integration: Assess your existing payment workflows to identify bottlenecks and areas prone to errors and delays. Understanding these pain points will help you select an automation solution that addresses your specific needs. This sets a solid foundation for a successful automation journey.

Choose the Right Automated Payment Solution: Keeping in mind your business needs, select a solution that is compatible with your existing financial systems and ERPs. It should offer customisable workflows, multi-currency support, automated reconciliation, security features, vendor management tools, and real-time tracking. It must also be flexible with different payment methods, scalable, compliant, and user-friendly.

Implement Security Measures Before Transition: Prior to transitioning to an automated system, ensure all sensitive financial data is encrypted and set up multi-factor authentication, spend limits, role-based access controls, and approval hierarchies to protect your payments.

Monitor Transactions Continuously: Once the automation system is live, utilise dashboards and maintain detailed audit trails for regular monitoring and to gain real-time insights. Also, set up notifications for anomalies and vendor communications. This helps to ensure smoother financial operations.

Ensure Compliance with Financial Regulations: Keep your automated system updated with changing GST rules, RBI guidelines, and audit requirements. Also, stay updated with changes in financial regulations and ensure that your automation system is adaptable to these changes.

Now that you’re equipped with the strategies to navigate the complexities of financial operations let’s discuss how our solutions can help you.

How Kodo Can Help You Automate Your Payments Seamlessly

Kodo offers India’s leading all-in-one spend management platform designed to automate your payments with ease and confidence. Whether you want to speed up invoice approvals, manage vendor payments, or track expenses via corporate cards, we’ve got you covered.

Here’s how we streamline your payment processes:

Automated Vendor Payments: Simplify vendor transactions with multiple bank payment options and customisable approval workflows.

Invoice Management: Capture invoices instantly, give approvals smartly, and unlock effortless reconciliation to save time and eliminate errors.

Corporate Cards; Empower your team to spend with minimum effort and maximum control with real-time spend tracking, customisable spend controls, and streamlined reporting.

Expense Reimbursements: Fast, hassle-free reimbursements that keep your employees happy and your processes smooth.

We integrate smoothly with your existing ERP and provide real-time visibility into every transaction. Trusted by over 2,000 fast-growing companies in India, we turn financial chaos into clarity.

Conclusion

Payment automation is no longer a luxury but a necessity for businesses aiming to improve efficiency, reduce costs, and build stronger vendor partnerships. By adopting a payment automation system, you save valuable time, enhance payment security, and gain real-time insights to make better financial decisions.

If you want to experience seamless, error-free, and secure payment processes, consider automating your payments with Kodo. Our comprehensive all-in-one spend management platform will empower your business to operate smarter and scale faster without adding complexity.

Explore our solutions to automate your payment process efficiently and drive business growth. Get started with Kodo today.