Choose Smarter Spend Management Today!

Introduction

Late payments, cash flow surprises, and frustrated vendors are too familiar when invoice terms aren’t spelt out or understood. Maybe a supplier assumed they'd be paid in 15 days while your team works on a 45-day cycle. Or someone agreed to early payment without knowing it affected the budget.

65% of small businesses report cash flow issues from late receivables, losing roughly 12% of revenue annually due to overdue invoices. The average Days Sales Outstanding (DSO) for small businesses is up to 60 days. Minor missteps like these lead to bigger headaches later.

If you’ve ever had to explain the same payment term five times or clean up after a missed deadline, you know how much smoother things run when everyone’s on the same page from the start.

This blog explores payment terms examples, standard invoice payment terms, their meanings, how they work, and where confusion usually starts. It aims to help teams set clear expectations upfront and avoid the back-and-forth that wastes time and strains relationships.

Key Takeaways

Clear payment terms prevent misunderstandings. Outlining terms like Net 30, COD, or PIA upfront avoids confusion over due dates, methods, and discounts, which can delay payment and harm vendor relationships.

Payment terms affect cash flow directly. If it's an early-payment discount or a penalty for late payment, the terms you choose influence how quickly you get paid, and how well you can budget.

Different clients need different terms. First-time buyers may require upfront payment, while trusted partners might be fine with instalments or Net 60. Tailoring terms to each situation reduces risk.

Small changes speed up payments. Shorter due dates, polite wording, prompt invoicing, and offering multiple payment methods can meaningfully reduce the time it takes to get paid.

Modern tools make invoicing smoother. Platforms like Kodo combine purchase requests, approvals, and payouts in one place, helping businesses track, manage, and complete payments without unnecessary back-and-forth.

What are the Payment Terms for an Invoice?

Payment terms specify when buyers must pay. They also explain how buyers may qualify for early payment discounts or face late charges. These terms define deadlines, payment methods, incentives, and penalties, which are critical for clear cash flow management.

How Does It Work?

Payment terms for an invoice specify the due date and conditions under which payment should be made, including any discounts or penalties. These terms help establish clear expectations between buyers and suppliers regarding payment deadlines and financial obligations.

The Invoice Date determines the starting point for payment calculations.

Accepted Payment Methods (e.g., bank transfer, cheque) are listed to avoid confusion.

Early-payment incentives (like 2/10 Net 30) motivate speedier payments by rewarding prompt settlement.

Late Fees or Interest may apply after the due date to discourage delays.

Example Illustration

Payment terms can include standard net durations like Net 30, upfront cash requirements, delivery-based payment conditions, instalment plans, accepted payment methods, early-payment discounts, and penalties for late payments.

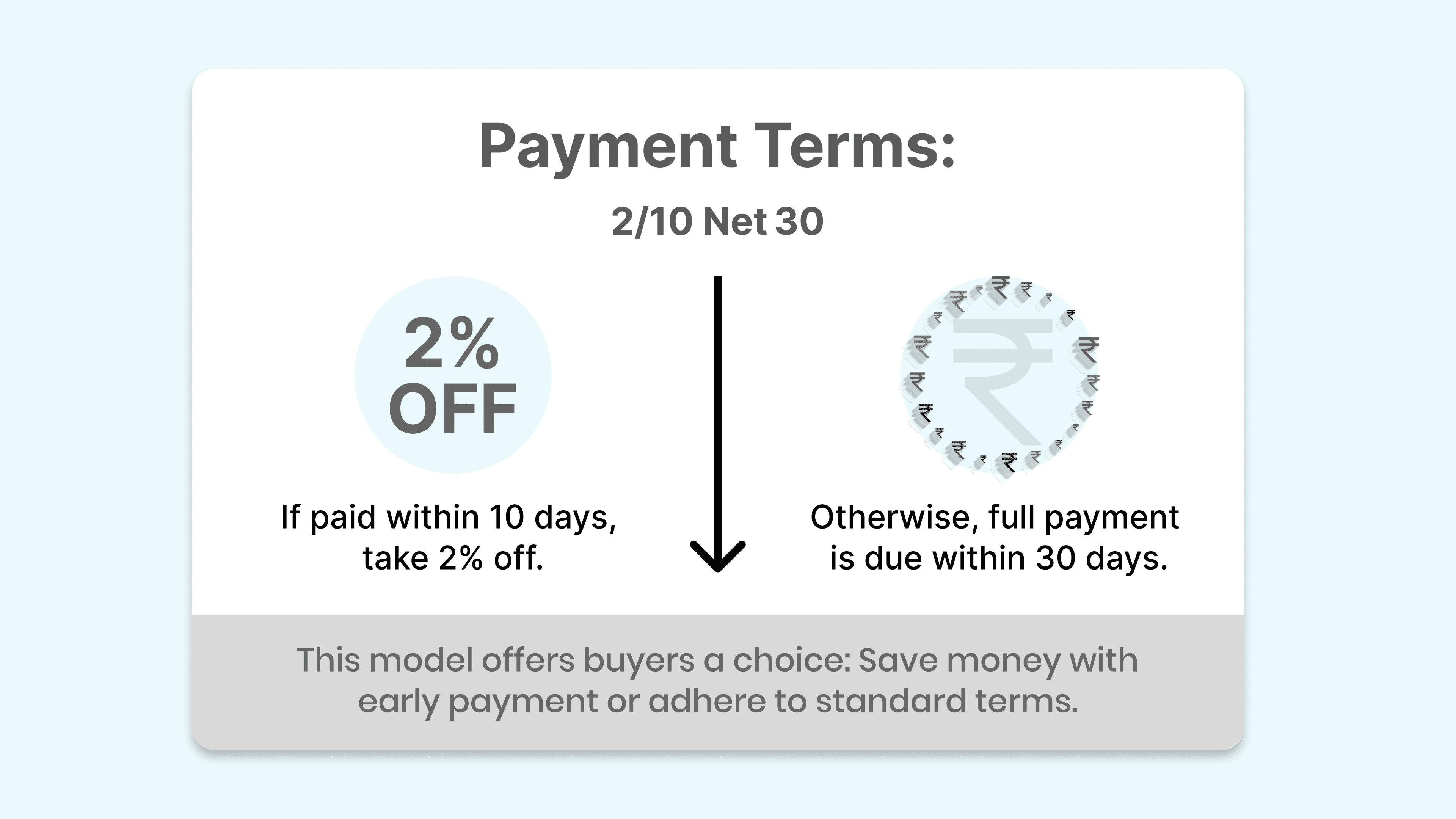

Payment Terms: 2/10 Net 30

If paid within 10 days, take 2% off. Otherwise, full payment is due within 30 days.

This model offers buyers a choice: Save money with early payment or adhere to standard terms.

A well-defined payment terms section helps prevent late payments, supports steady cash flow, and builds trust by removing misunderstandings. When chosen to suit your business’s financial rhythm and customer expectations, these terms balance prompt revenue and client convenience.

Knowing what they mean is just the beginning. The next step is understanding why they matter to you and the client.

Why Do You Need Payment Terms on Invoice?

Invoice payment terms establish agreed deadlines and methods for payment. They guide clients on when payment is expected, how they should pay, and what happens in early or late payment cases.

Maintain Predictable Cash Flow

Clear deadlines help you forecast incoming funds, making budgeting for payroll, supplier bills, and other expenses easier.

Encourage Prompt Settlements

Offering benefits like early-payment discounts or specifying penalties motivates clients to pay quickly, reducing the waiting time for your funds.

Set Expectations and Avoid Confusion

Documenting terms removes doubt. Clients know exactly how much they owe, when, and by which method, reducing misunderstandings and disputes.

Support Legal Recourse

Payment terms that are part of a contract or written agreement make it easier to claim late fees or take legal action if clients don’t pay on time.

Improve Business Relationships

Transparent payment policies reflect professionalism and build trust. Clients appreciate clarity, and that positive experience can lead to repeat business.

Protect Against Financial Loss

Including fees for overdue payments or cancellations allows you to recover costs if payments are delayed or cancelled at the last minute.

Manage Risk with New Clients

For first-time buyers or large orders, requiring advance payment, deposits, or payment on delivery helps protect you from non-payment risks.

Also Read: Vendor Relations: The Hidden Benefit of Faster Payments

Well-crafted payment terms protect your business, reduce uncertainty, and simplify financial planning. They guide you and your client through the payment process, helping you get paid on time and focus on growth, not chasing invoices.

Once the benefits are clear, the focus shifts to clearly, consistently, and without confusion about how to put them into action.

How to Use Invoice Payment Terms?

Use payment terms tailored to your finances and customers, ensuring transparency and detail by linking discounts or penalties to timing, automating reminders, and regularly reviewing your strategy.

Choose Terms that Match Your Cash Flow Needs and Client Profile

Decide whether to use short schedules like Net 15–30 or longer ones like Net 60. For new or high-risk buyers, opt for advance payment (CIA/PIA) or cash on delivery (COD). For returning, reliable clients, milestone billing or stage payments can spread out the cost.

Spell Them Out Plainly on Your Invoice

Write crystal-precise phrases, such as “Payment due within 30 days of invoice date” instead of just "Net 30.” Always include complete definitions of acronyms like CIA, COD, EOM, etc.

Include Key Details in One Spot

Your terms should list:

Due date or period (e.g., 30 days after invoice date)

Accepted methods (bank transfer, check, credit card, payment portal)

Any discounts (e.g., “2% if paid in 10 days”)

Late payment penalties (e.g., “1.5% monthly”)

Use Incentives and Consequences Wisely

Add early-payment discounts such as 1%/10 Net 30, which is suitable for buyer and seller because the cost, if not used, equates to about 18% annual interest. Mention penalties for late payment to discourage delays.

Match the Terms to Your Business Model

One-off Services: “Due on receipt” or Net 15 works well.

Large or Recurring Projects: Break payment into stages (milestones) or use recurring terms like CND.

Following Industry Norms: Choose what’s familiar to clients (for instance, Net 30 in construction, Net 15 for freelancers).

Communicate Terms Before Work Begins

Discuss your payment terms during contract negotiation or onboarding, not when you send the invoice. Obtain client agreement in writing or via signed contract.

Automate and Set Reminders

Use invoicing or accounts-receivable software to automatically calculate due dates, discounts, and fees. Set reminder emails for approaching or overdue invoices.

Track Performance and Review Regularly

Monitor the percentage of overdue invoices, the time spent chasing payments, and the cost of late fees. If problems arise, change your approach: shorten terms, adjust discounts or deposits.

Both parties benefit when your payment terms are practical, clear, and visible. You receive prompt payments and reduce disputes, while clients know precisely what is expected. Periodic reviews help fine-tune terms to stay aligned with your cash flow goals and client relationships over time.

Usage depends on the format and structure of the terms. Here’s a look at the different types across industries and billing styles.

What are the Types of Invoice Payment Terms?

Business invoicing uses a range of payment-term types that balance cash flow needs, risk levels, and customer relationships. Here’s a comprehensive breakdown:

Net Terms (Net X)

Full payment is due within a set number of days, usually 7, 10, 15, 30, 60, or 90, after the invoice date. For example, “Net 30” means full payment by day 30.

Early‑Payment Discounts (Cash Discounts)

A partial reduction, e.g., “2/10 Net 30” or “1%/10 Net 30,” rewards clients who pay early by offering a 2% or 1% discount if they pay within 10 days; otherwise, the full amount is due within 30 days. This speeds up collections while providing cost savings.

Due Upon Receipt/Immediate Payment

Clients must pay as soon as they receive the invoice or upon delivery of goods or services. This is typical in consulting, small-business work, and delivery scenarios.

Cash in Advance/Payment in Advance (CIA/PIA)

Payment is required before the work begins or shipment occurs. This method is frequently used with new clients or for custom orders with a high upfront cost.

Cash on Delivery (COD)

Cash is collected when goods are delivered. This is common in retail, e‑commerce, or goods that require inspection before payment.

Cash Before Shipment, CWO, CND

Payment methods that ask buyers to pay before shipment (“CBS”), at the time of order (“CWO”), or before the next delivery (“CND”) are useful for controlling logistics risk.

End‑of‑Month (EOM) & Month‑Following‑Invoice (MFI)

“EOM” means full payment by the end of the month of the invoice. Terms like “15 MFI” or “21 MFI” specify payment by a particular date in the month after billing.

Instalments & Stage Payments

Large projects may be divided into milestones, with payments due upon completion of each stage.

Line of Credit (LOC)/Trade Credit

Customers are extended credit, settling invoices in full within 30–90 days. This is often interest‑free, subject to prior agreement, and is popular among wholesalers and repeat clients.

Letter of Credit, Rolling Deposits, Split or Upfront Payments

LOCs provide bank-backed guarantees. Rolling deposits reserve credit balances. Upfront split payments, such as a 50% deposit on ordering, reduce financial exposure on long-term engagements.

Invoice Factoring & Interest on Late Payments

Some businesses sell their receivables to third parties (factoring) to access funds immediately. Others build in penalties or daily interest for late payments to enforce discipline.

Selecting appropriate payment terms requires assessing client reliability, project scale, and cash flow requirements; customized terms improve billing efficiency, mitigate risks, and allow focus on core business activities.

When clarity, speed, and control matter, Kodo gives finance and procurement teams the tools to move confidently. From early-stage startups to large enterprises, use Kodo to manage approvals, automate payouts, and track every rupee. From intake to payment, it’s built to cut delays and keep everyone in sync, no matter the size or stage of your business.

It helps to see these terms in action. Below are examples you’ve likely come across or should consider using.

What are the Examples of Common Payment Terms on an Invoice?

Invoice terms include standard due dates (Net X), discounts for early payment, upfront requirements, delivery-based payments, staged invoicing, and client financing options, all designed to match your workflow and cash requirements.

Net X (Net 7/10/15/30/60/90)

Payment is due within a specified number of days from the invoice date, commonly 30, but any duration can apply. Net 30 is the most prevalent, especially across B2B transactions.

2/10 Net 30 (or 1%/10 Net 30, 3/7 EOM, etc.)

It offers a percentage discount for early payment, e.g., 2% off if paid within 10 days; otherwise, the full amount is due by day 30.

Due Upon Receipt

Payment must be made immediately when the invoice arrives. This is common for freelancers, consultants, and small business services.

Cash on Delivery (COD)

Cash on Delivery (COD) means payment is collected when goods are delivered, common in retail, logistics, and delivery-based businesses.

Cash in Advance/Payment in Advance (CIA / PIA)

Cash in Advance (CIA/PIA) requires payment before work begins or shipment, frequently used with new clients or for custom orders with high upfront costs.

Cash Before Shipment (CBS), Cash With Order (CWO), Cash Next Delivery (CND)

These variations ensure some upfront payment before shipment, right at order placement, or before the next delivery.

End-of-Month (EOM) & Month Following Invoice (e.g., 15 MFI, 21 MFI)

EOM: Full payment by the month’s end in which the invoice is issued.

15 MFI / 21 MFI: Specific due dates in the month following the invoice date.

Split, Stage or Partial Payments

Large projects may be billed in stages, 50%, 25%, or 25%, or broken down into agreed instalment amounts.

Line of Credit/Trade Credit (Net)

Clients receive goods upfront and pay later, typically within 30–90 days. It's a standard zero‑interest loan backed by the supplier.

Letter of Credit, Rolling Deposit, Invoice Factoring

LOC: Bank-backed payment guarantee from the buyer’s side.

Rolling Deposit: Prepaid credit balance that depletes over time.

Invoice Factoring: Selling receivables to a third party for immediate partial cash.

Adding a mix of payment terms, standard Net, early-payment incentives, upfront deposits, and staged options gives your invoices flexibility and clarity. Tailoring terms to each client or project helps smooth payments, support cash flow, and keep invoicing efficient.

Beyond just timing, payment terms can also shape how money moves. That’s where payment methods come into play.

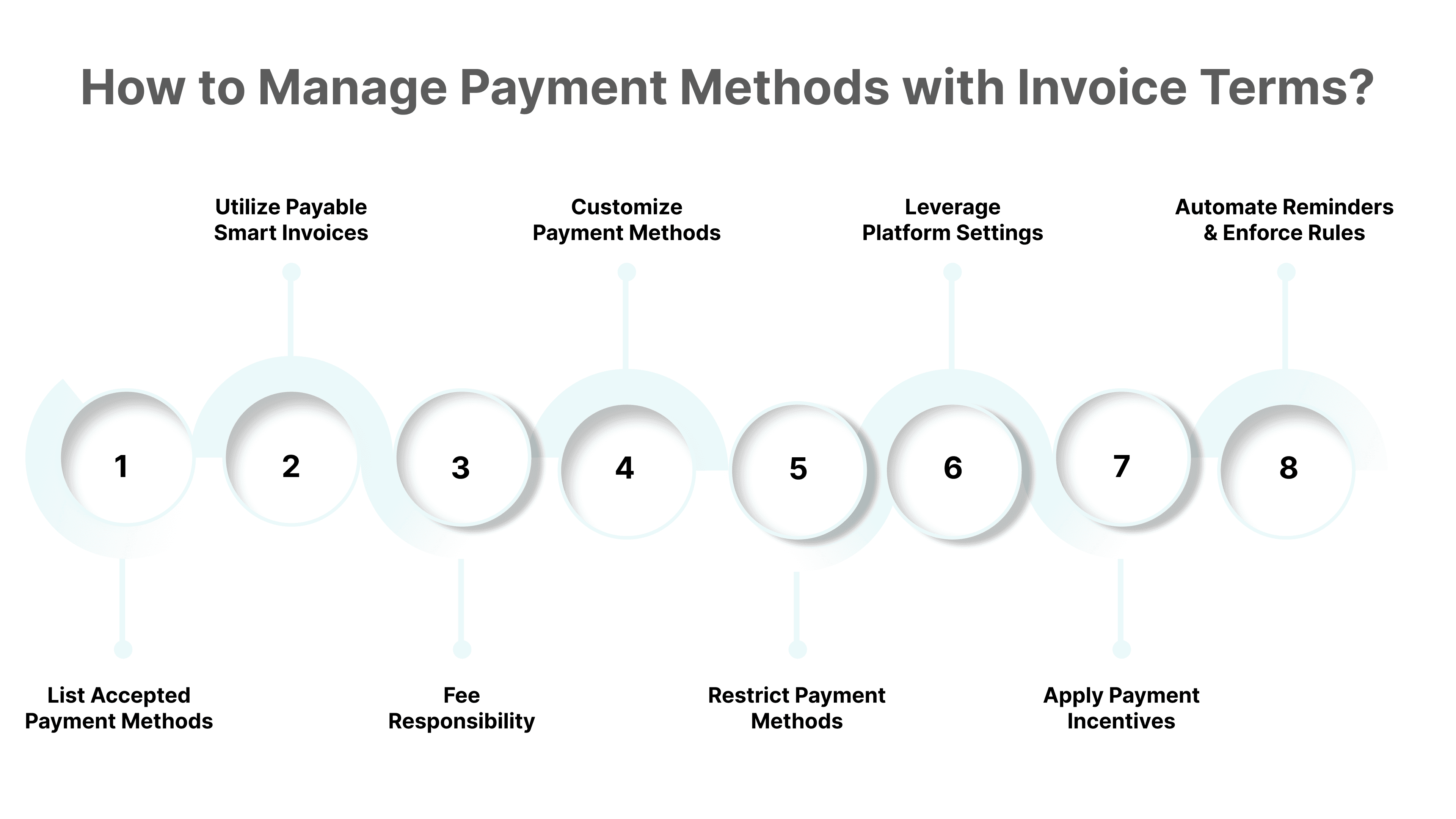

How Do You Control Payment Methods with Invoice Payment Terms?

Managing payment methods involves specifying accepted channels clearly, using digital invoices with embedded payment options, indicating who bears processing fees, and automating reminders to influence timely client payments.

Specify Accepted Payment Channels

Explicitly list methods, such as bank transfer, credit card, ACH, checks, and digital wallets, on your invoice. This removes guesswork and prevents delays.

Use Pay-enabled Smart Invoices

Invoicing tools support embedded payment links for debit/credit cards and ACH transfers. Smart invoices simplify payment, support recurring billing, and reduce manual follow-up.

Indicate Who Covers Payment Fees

If processing payments via credit card or ACH incurs fees, state whether you absorb the cost or pass it on to clients. Label it clearly, e.g., “Client responsible for 2.9% processing fees,” to avoid confusion.

Tailor Methods by Project or Client

Large or custom orders may need upfront payment (CIA/CWO), while recurring services work well with automated ACH. Align terms to project type and trust level.

Limit or Require Methods for Specific Clients

For instance, you could require new clients to put a credit card on file before offering Net 30 terms. You could also restrict methods: allow checks only for low-value invoices or block credit cards on large transactions.

Use Invoicing Platform Settings

Many platforms, such as Stripe Invoicing, let you select which payment methods are active per invoice. Depending on your region and preferences, you can enable ACH, cards, PayPal, Klarna, or Boleto.

Offer Discounts or Penalties Tied to Payment Method

Offer small incentives for preferred channels (e.g., a 0.5% discount for ACH, which costs less than credit cards). Or add higher charges for costly methods.

Automate Reminders and Enforce Rules

Set invoicing tools to send reminder emails for pending invoices and flag unauthorised payment types. This keeps payments on track and policy-compliant.

Carefully curated payment options make paying smoother and reduce friction. By restricting or mandating methods per invoice and using innovative tools, you gain better cash visibility and fewer payment delays. Thoughtful terms ease the process for clients and cut follow-up time for you.

Method and timing are only part of the equation. With a few minor tweaks, your terms can help you shorten the payment wait.

How Can You Improve Invoice Payment Terms to Get Paid Faster?

Accelerate payments by reducing payment periods, providing early-payment discounts, imposing late fees, issuing invoices promptly, accepting multiple payment options, using clear language, automating reminders, rewarding preferred payment methods, breaking large invoices into parts, and managing slow-paying clients strategically.

Shorten the Due Period

To reduce standard terms, choose Net 14 or Net 10 instead of Net 30. Studies show that Net 7 terms can reduce the average payment time from 28 to 13 days.

Offer Early-Payment Discounts

Simple discounts, such as 2 % for payment within 7–10 days, motivate faster remittances. A modest 1% is effective; investors view 1 %/10 Net 30 as ~18% annual return.

Add Late-payment Penalties

It includes interest charges (e.g., 1–1.5 % per month) for overdue invoices. The threat of additional costs nudges clients to pay on time.

Send Invoices Immediately

It delivers invoices right after completing work or each milestone. Clients pay sooner when the request they just performed is fresh in their minds.

Accept Multiple Payment Methods

It offers options, such as bank transfers, cards, ACH, and digital wallets, to remove friction. Clients are quicker to pay when they see their preferred method.

Use Precise, Friendly Wording

State terms plainly: “Payment due in 14 days (by July 9, 2025). Please and thank you.” A polite tone encourages action and promotes goodwill.

Automate Invoicing and Reminders

Automated systems can send invoices instantly, track due dates, and despatch reminder emails before and after the due date, saving time and catch-ups.

Offer Incentives Tied to Method or Terms

Provide an extra discount, say 0.5 %, for using low-fee payment methods (ACH) or committing to autopay. Alternatively, include an onboarding deposit or upfront payment requirement.

Break Large Invoices into Milestones

Divide big projects into smaller invoices per milestone. Clients find smaller, frequent payments easier to handle and are less resistant.

Eliminate Slow-paying Clients

Track payment habits and refuse terms or work with clients who are repeatedly late. Sometimes, switching to advance payment for risky clients strengthens your financial position.

Also Read: Understanding Procurement: Key Processes, Benefits

Smart payment terms, shorter schedules, small discounts, and reminders encourage quicker payments. Coupled with upfront billing and multiple payment options, these strategies reduce delays and support healthier cash flow. Evaluate client behaviour and adapt terms to maintain steady revenue and healthy financial footing.

Getting paid on time is easier when the right systems support your process. That’s where Kodo steps in.

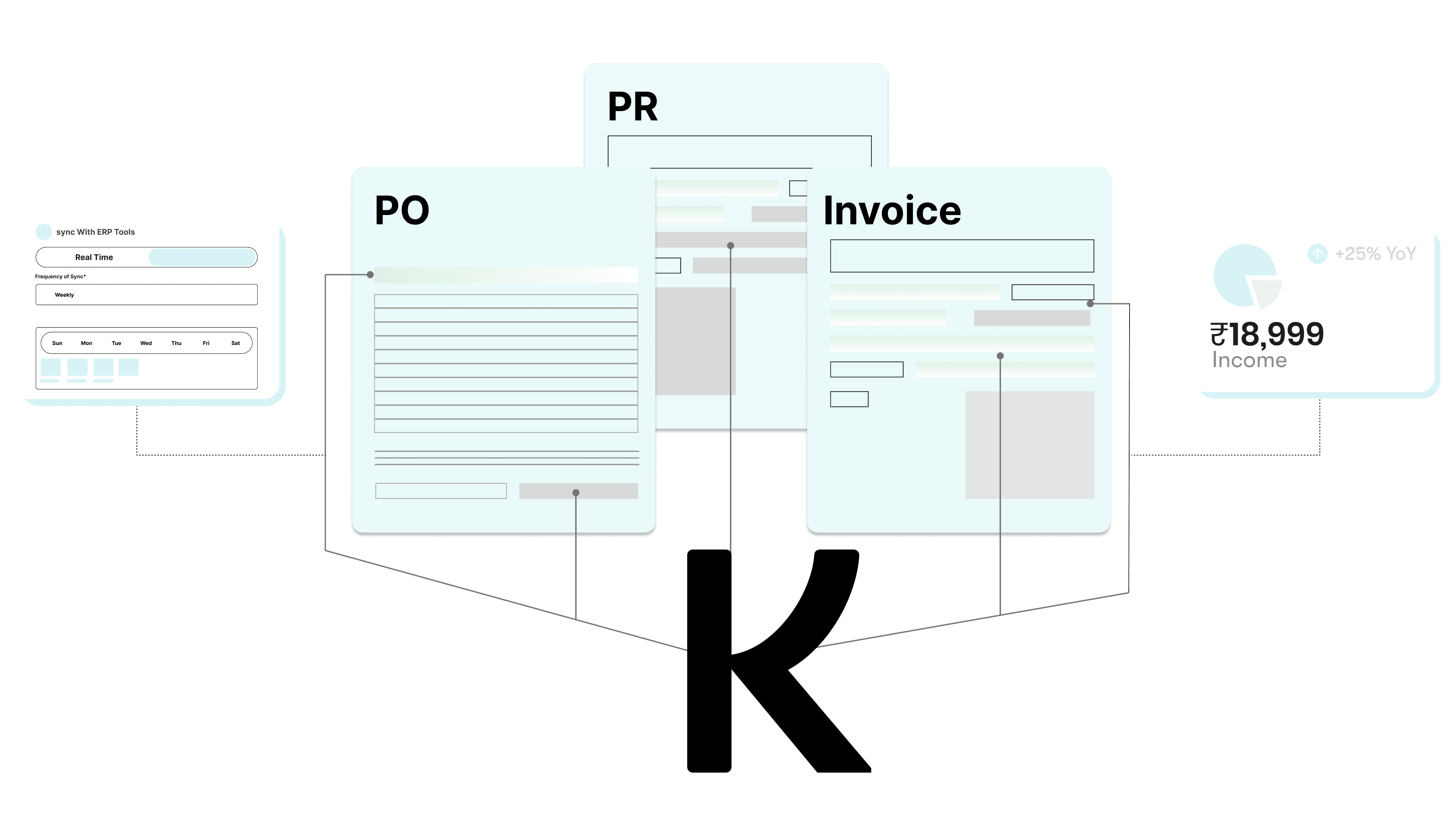

How Can Kodo Help You with Invoice Payment?

Kodo simplifies and clarifies invoice payments by combining requests, approvals, and payouts in one flow.

Purchase Request: Every invoice starts with an explicit request. Teams can submit detailed purchase needs early, with vendor quotes and supporting documents attached. This gives finance full context before any invoice shows up.

Purchase Order: Once approved, requests can be turned into POs in just one step. These POs stay linked to the original request and vendor quote, so everyone works off the same record without extra coordination.

Invoice Management: Invoices can be uploaded and matched against approved POs or quotes. Kodo flags any mismatch early, reducing last-minute corrections and long email threads.

Vendor Payments: Payouts can be scheduled or automated once invoices are approved and matched. Each payment is connected to its history, from request to PO to invoice, so nothing gets lost or questioned later.

Cross-Platform Integration: Kodo connects with finance tools to sync invoice data, approvals, and payment statuses. There is no need to copy-paste between systems or chase updates across teams.

Kodo helps finance and procurement teams handle invoice payments with fewer steps, fewer errors, and fewer delays.

Conclusion

Clear payment terms, and payment terms examples makes it easier to understand the terms for everyone. They reduce confusion, steady cash flow, and help avoid last-minute disputes that waste time and energy. You don’t need to memorise every possible variation, but it helps you know and consistently use the basics.

When terms are agreed on early and written clearly, they build trust and prevent unnecessary follow-ups down the road. If payment terms have been causing friction, it might be time to revisit how they’re shared, tracked, and discussed. A little clarity upfront can go a long way.

More than 2,000+ companies already use Kodo to simplify spending management, from raising purchase requests to paying vendors on time. By reducing back-and-forth, automating manual steps, and keeping everything connected, teams save hours every week.

This reduces errors and helps teams move faster without losing control. Clear records, fewer follow-ups, and less time lost in back-and-forth mean your business can scale without getting buried under process. Book a demo with Kodo today.

FAQs

What’s the difference between “Net 30” and “Due in 30 Days”. Are they interchangeable?

No. While both suggest payment within 30 days, "Net 30" typically starts counting from the invoice date, while "Due in 30 Days" may begin from the delivery or project completion date. This subtle difference can affect cash flow timing.

Can invoice payment terms legally include discounts or penalties?

Yes, but they must be clearly stated and mutually agreed upon. For example, "2/10 Net 30" offers a 2% discount if paid within 10 days. Late fees are enforceable only if they're reasonable and follow local commercial laws.What does “EOM” mean in payment terms, and how does it work?

"EOM" stands for "End of Month." A term like “Net 30 EOM” means payment is due 30 days after the end of the invoice month, not the invoice date itself. This gives the buyer a bit more time and can help with monthly accounting.Are payment terms like “Cash in Advance” or “CIA” negotiable?

Yes. While CIA is common for new clients or high-risk transactions, businesses often negotiate partial upfront payments or split milestones instead. Clear communication before signing a contract is key to adjusting such terms.How do payment terms affect tax reporting or accounting practices?

The timing of payment terms influences when revenue is recognised, especially under accrual accounting. For example, income from a "Net 60" invoice might be reported months before actual cash is received, impacting tax liability and cash flow planning.