Choose Smarter Spend Management Today!

Introduction

Finance and procurement often feel like they’re working on parallel tracks, with the same destination but different priorities. Procurement is focused on finding the best suppliers, negotiating terms, and meeting timelines.

Nearly half of companies rely on email (70%) and spreadsheets (52%) for sourcing and procurement, a setup that frequently causes delays and inefficiencies in approvals. Finance is watching the bottom line, tracking budgets, and flagging risks. Both teams want what’s best for the business, but without clear communication, things slip. Better collaboration reduces delays, lowers costs, and improves vendor communication, easing frustration for all parties.

This blog looks at procurement finance, how to smoothen that relationship, not by overhauling how either team works but by tightening the link between them, with clearer processes, better tools, and regular conversations that matter.

Key Takeaways

Shared systems and data reduce confusion and delays. Connecting procurement and finance tools, like P2P and B2P platforms, eliminates manual reconciliation, improves transparency, and shortens the purchase-to-pay cycle.

Real-time collaboration improves spending decisions. When procurement and finance share forecasts, supplier data, and contract terms, they prevent budget overruns and identify savings that reach the bottom line.

Joint risk reviews catch issues early. Finance tracks financial exposure, while procurement watches supplier performance. Together, they reduce compliance gaps and avoid supplier disruptions.

Defined roles and frequent check-ins prevent bottlenecks. Clarifying responsibilities and holding regular review sessions help teams stay in sync, avoid duplicate work, and speed up approvals.

Integrated planning supports cash flow and supplier trust. Coordinated payment timing supports working capital goals while maintaining timely payouts, leading to stronger supplier relationships and fewer disputes.

What is Procurement Finance?

Procurement finance covers the monetary side of acquiring goods and services, from budgeting and sourcing to payment and cost tracking. It ties procurement activities closely to a company’s financial objectives, managing cash flow, supplier terms, and expenditure analysis.

By connecting purchase decisions with financial metrics and future planning, procurement finance helps businesses maximise value and maintain liquidity throughout the procurement process.

Why Does It Matter?

Procurement finance bridges procurement operations with financial strategy. It emphasises cash flow, supplier terms, automated routines, and data-driven choices to reduce costs, strengthen liquidity, and build stronger supplier partnerships.

Stronger Operating Cash Flow: Smarter payment terms and prompt invoice processes free up capital for strategic use.

Better Partnership with Suppliers: Trust grows when suppliers are paid on time or given faster access to funds, opening the door to improved pricing, innovation, and stability.

Higher Savings Beyond Unit Cost: Combining negotiated pricing, discounts, and payment flexibility yields savings directly to the bottom line.

Reduced Manual Overhead: Automation cuts errors decreases administrative work and accelerates approvals.

Also Read: Accounts Payable Automation

Companies gain tighter control over spending, cash flow, and supplier dynamics by weaving financial planning, supplier strategies, process automation, and analytical insight into procurement. This solidifies procurement’s role in supporting overall economic health and business growth.

Why is Finance and Procurement Collaboration Necessary?

When procurement and finance work together, they reduce cash outflows, track spending smartly, manage supplier and financial risk, secure savings, and react quickly in volatile markets.

Optimising Cash Flow & Working Capital

Collaboration supports smarter payment terms and early-payment strategies. Treasury teams, equipped with procurement insights on supplier needs and schedules, can structure payments to preserve liquidity while taking advantage of discounts. Shareable real-time data ensures finance teams forecast cash flow accurately and avoid surprises.

Real-Time, Aligned Spend Management

Procurement brings granular data, line‑item spending history, contracts, and category trends, while finance aligns this with budget cycles and reporting. Connected systems like budget‑to‑pay unify this data, cut off rogue spending, and let both teams track purchase requests against budgets in real-time.

Shared Risk Mitigation

Each function spots risks uniquely: finance focuses on liquidity and counterparty risk, and procurement focuses on supplier stability and delivery. Collaboration allows coordination of due diligence, audit trails, supplier risk scoring, and fraud prevention, reducing blindspots.

Stronger Supplier Relationships

When finance understands procurement’s view of supplier reliability and innovation, it supports the negotiation of fair terms, like supply‑chain finance options, that benefit both buyer and supplier. This builds trust and leads to better pricing and service.

Cost Visibility & Savings Realisation

Procurement identifies savings through sourcing, and finance ensures they flow into P&L. Integrated reporting captures supplier discounts, avoids contract expiry leakage, and measures cost reductions versus actual budgeted spend.

Single Source of Truth via Shared Systems

Fragmented tools breed mismatches and manual reconciliation. Connecting procurement platforms (P2P/B2P) with finance systems unifies master data, purchase orders, invoices, budgets, streamlining operations and reporting.

Agility During Disruptions

Economic shocks, pandemics, and geopolitical risks test supply chains. Coordinated efforts between procurement, treasury, and finance to help optimise payment flows, adapt supply strategies, and maintain supplier health.

Merging procurement and finance isn’t optional; it raises accuracy, agility, and financial strength. By pooling spending data, budgets, supplier insights, and cash plans, businesses gain clarity and control of economic resources. This results in measurable savings, healthier supplier relations, stronger liquidity, and better preparedness for risk.

Understanding the need is one part. The next is to explore how the two teams interact in day-to-day operations.

How Do Procurement and Finance Work Together?

By merging data, responsibilities, and tools, procurement and finance avoid overspending, control workflows, manage supplier risk, and maximise savings across the organisation.

Shared Systems & Fast Data Flow

Platforms like procure-to-pay (P2P) integrate procurement and accounts-payable to share requisitions, purchase orders, invoices, and payment records. Through dynamic discounting tools, finance assesses the value of accelerated payments, and procurement initiates discounted early-pay options, creating cost savings for both parties.

Joint Budgeting & Real-Time Spend Oversight

Procurement provides line-item spending data and contract details, while finance contributes budget forecasts and actuals. Systems such as budget-to-pay (B2P) enforce limits, block purchases once budgets are used, and flag projects for review.

Role Clarity & Shared Targets

Clarifying responsibilities, procurement on supplier contracts and finance on invoicing avoid gaps. Establishing shared performance indicators (e.g., realised savings, payment timing, discount capture) aligns both functions with business-wide financial goals.

Coordinated Risk and Supplier Strategy

Finance flags counterparty or liquidity risk. Procurement handles delivery and inventory risk. Joint risk scoring and supplier onboarding ensure financial stability and performance visibility.

Close coordination on terms (e.g., 90-day vs early-pay) balances cash preservation with supplier satisfaction.

Unified Reporting & Analytics

ERP systems and analytics dashboards (e.g., Power BI) blend procurement and financial data into a standard view. This reveals patterns, forecasts spending, tracks accruals, and supports audit and compliance reporting.

Joint Reviews & Steering

Formal cadence, such as cross-functional committees, captures early-stage procurement plans and gives finance visibility into supplier negotiations and spending commitments.

Better Supplier Relations

Operational hiccups like late payments erode supplier trust. Procurement advises which suppliers can tolerate extended terms while finance executes payments. Shared portals and clean data minimise invoicing errors and delays.

This cooperation strengthens trust and often unlocks better rates, service, or innovation. This integration safeguards budgets, boosts transparency, and strengthens financial resilience. When the connexion between both teams is well-structured, the payoff shows across multiple business areas.

What are the Benefits of Integrated Finance and Procurement Strategies?

Combining procurement and finance eliminates data gaps, tightens control over cash and costs, speeds up processing while reducing risks, and creates more precise forecasting, leading to healthier supplier relationships and fiscal oversight.

Deeper Spend Visibility

Linking procurement systems (like P2P and ERP) with finance creates a unified data flow. This eliminates errors from manual entry, reveals line‑item spending and contract details, and gives a clear snapshot of obligations and commitments.

Smarter Cash Management

Integrated workflows let teams optimise payment timing, balancing working capital needs with supplier discounts. Finance gains foresight into payables; procurement chooses suppliers offering favourable terms.

Improved Cost Capture

Collaboration means savings identified through bulk sourcing, early‑payment discounts, and contract renewals are captured in actual budgets. Shared systems prevent “tail‑end” spending from slipping through the cracks.

Risk Control

Teams work together on due diligence, audit trails, automated invoice matching, and supplier risk assessment, reducing fraud and compliance gaps.

Faster Cycle Times

Automation slashes the cycle from requisition to payment. No-touch purchase orders and EDI‑enabled supplier onboarding speed up processes and reduce invoice errors.

Better Budget Forecasting

Procurement insights, like commodity-price trends and supplier availability, feed into more accurate financial forecasts. This helps finance predict costs beyond simple historical data.

Stronger Supplier Relations

When invoices are accurate and paid on time, trust grows. Integrated portals and clear data help avoid disputes, boosting relationships and paving the way for improved terms, loyalty, and collaboration.

Also Read: Vendor Relations: The Hidden Benefit of Faster Payments

The close connexion of procurement and finance delivers more than operational efficiency. It reshapes financial control. Shared systems and joint workflows ensure savings translate into real-world results, cash is used strategically, and suppliers stay engaged.

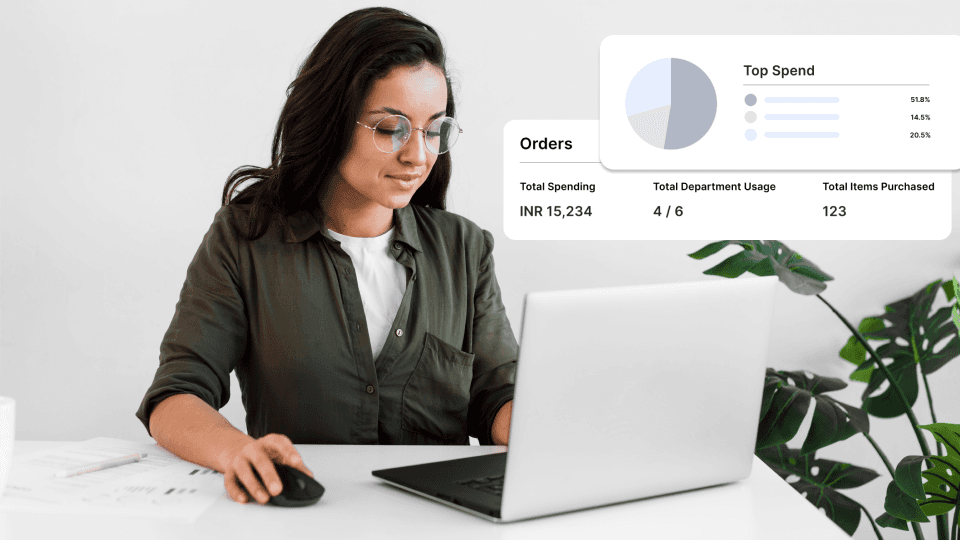

Kodo brings finance and procurement closer on one platform built to keep teams synced and spending visible. Kodo helps streamline approvals, track every rupee, and cut delays across intake-to-pay. It supports smarter decisions without the usual back-and-forth, from real-time workflows to automated vendor payments.

With the upside in view, the next step is figuring out how to build and strengthen that connexion in practical terms.

What are the Strategies to Improve Finance and Procurement Collaboration?

These strategies, clear responsibilities, frequent joint sessions, empathy, integrated platforms, shared risk management, unified terminology, pilot testing, and interpersonal development work to deepen cooperation between procurement and finance teams.

Define Roles and KPIs Clearly

Outline procurement and finance responsibilities via formal documentation or KPIs. For example, procurement handles contract negotiations and supplier sourcing, while finance oversees budget control and payment processing. Shared performance indicators include captured discounts, invoice cycle time, or realised budget savings.

Hold Regular Cross-Functional Sessions

Schedule recurring review meetings or establish small, cross-departmental task forces. These sessions present upcoming procurement plans, like contracts or major supplier negotiations, giving finance insight into expected spending and enabling synchronised cash flow planning.

Support Empathy and Role Awareness

Encourage team members to learn each other’s perspectives. Procurement teams benefit from understanding finance’s focus on cash preservation and controls, while finance gains from procurement’s supplier-first approach and timing trade-offs. This mutual insight builds respect and collaboration.

Adopt Shared Technology Platforms

Use integrated procure-to-pay (P2P) or unified budget-to-pay systems to automate requisitions, invoice matching, approvals, and payments. Automation removes manual work, reduces delay, and gives both teams real-time access to the same data.

Organise Joint Risk Reviews

Combine procurement’s supplier vetting with finance’s credit analysis and fraud controls. Use shared risk tools for scorecards, audit logs, and compliance checks. This approach catches supplier weaknesses or payment fraud early.

Standardise Terminology and Reporting

Finance and procurement often use “cost savings” differently. Agree on definitions for terms like savings, cost avoidance, working capital release, or early-pay benefits. Define reporting templates and formats that both teams use.

Start with Pilot Projects, Then Scale

Pilot a single category or supplier group to test new processes, data sharing, and regular dialogues. Evaluate results, such as discount capture or reduced payment days, then expand successful practises to other areas.

Invest in Training and Soft Skills

Offer cross-training sessions and “lunch-and-learn” events where each function shares its priorities and challenges. Build basic interpersonal skills like active listening and open feedback to support collaboration culture.

When procurement and finance teams operate together, from planning to payment, they reduce duplicate work, accelerate transactions, manage supplier risks, and improve budget outcomes. These steps improve efficiency, unlock measurable savings, strengthen supplier confidence, and enhance financial performance across the organisation.

To make any strategy work, it helps to be clear on what sets the two functions apart, both in goals and responsibilities.

What are the Differences Between Finance and Procurement?

Both finance and procurement handle spending from different angles: finance on funds and controls, procurement of goods, agreements, and market value. The comparison between finance and procurement are as follows:

Category | Finance | Procurement |

Primary Focus | Financial well‑being, budgeting, forecasting, liquidity, P&L, compliance, and audits | Sourcing goods/services, vendor selection, negotiation, inventory, and supply risk control |

Core Responsibilities | Manages financial records, monitors expenses, processes invoices, maintains fiscal health | Identifies suppliers, evaluates markets, negotiates pricing, manages delivery timelines, oversees suppliers |

Interaction with Suppliers | Indirect – via invoices and payments | Direct – onboarding, relationship management, contract renewals |

Goals and Metrics | Budget variance, profit margins, audit outcomes, working capital | Cost savings, supplier quality, supply reliability, contract compliance |

Tools and Systems | ERP finance modules, accounting software, financial models | P2P platforms, supplier databases, sourcing tools, contract management systems |

Reporting Style | Budgets vs. actuals, cash flow, audit/statutory metrics | Line‑item spend, supplier performance, contract adherence, purchasing trends |

Mindset & Timing | Monthly/quarterly focus, precision, historical accuracy | Shorter timelines, market-responsive, project-driven |

Shared Ground

Though distinct, these departments intersect in the quote-to-pay process. They must reconcile budgets with purchases and supplier payments. Collaboration becomes essential for preventing data gaps, costly delays, or vendor disputes.

Recognising these differences helps teams play to their strengths while working together where functions overlap. Shared tools, regular communication, and agreed-upon definitions, especially for savings metrics, close gaps and strengthen the procurement–finance partnership. This aligned effort supports accurate budgets, smooth supply flows, and sustainable financial resilience.

Once the roles are clear, it becomes easier to see how stronger collaboration can shift outcomes across the company.

What is the Impact of Finance and Procurement Collaboration in Businesses?

When procurement and finance teams merge their efforts, from process redesign to systems integration and risk management, they cut costs, improve cash flow, speed operations, strengthen compliance, deepen supplier engagement, and improve forecasting accuracy.

Reduced Total Cost of Ownership

Reworking procurement processes with finance involves cutting redundant steps and manual work. This delivers savings through better contract terms, more innovative sourcing, and optimised inventory, lowering purchase and operational costs.

Improved Cash Flow & Working Capital

Coordinated teams optimise payment timing, using early-payment options or dynamic discount tools, so funds stay longer while allowing suppliers to get paid promptly, strengthening cash position.

Better Spend Visibility & Control

Linking P2P or B2P systems brings transparency to every stage, from budgets and POs to invoices and payments. That unified history detects off-contract spend, reveals maverick buys, and enforces budget boundaries.

Shorter Process Cycles & Efficiency

Automation of requisitions, invoicing, matching, and approvals accelerates the entire purchase-to-pay cycle. Fewer manual touchpoints reduce errors and lower administrative overhead.

Lower Risk and Greater Compliance

Joint work on supplier due diligence, risk scoring, audit trails, and digital matching minimises fraud, compliance gaps, and invoice mismatches.

Stronger Supplier Relationships

Reliable payments, transparent data sharing, and shared platforms foster trust. This can trigger better pricing, loyalty, and even supplier innovation.

Better Forecasting & Strategic Planning

Procurement insight into supplier markets, like commodity price trends or lead times, feeds more accurate financial projections. This yields better-aligned budgets and more resilient plans.

Businesses that synchronise procurement steps with financial strategy gain more than smoother operations. That combined effort forms a foundation for long-term financial resilience and growth agility.

Of course, it’s not always smooth. Even with the right intent, specific roadblocks often get in the way.

What are the Challenges in Finance and Procurement Collaboration?

These challenges, diverging objectives, poor communication, isolated systems, unclear ownership, change resistance, conflicting payment practises, supplier risk, and inconsistent metrics create friction zones in procurement–finance collaboration.

Divergent Goals and Workstyles

Finance often works toward budget discipline, adhering to monthly, quarterly, and annual reporting cycles. Procurement reacts to sudden supply needs, market shifts, and contract terms. Without common ground, priorities often clash, and urgent purchase demands are vs. scheduled financial reviews.

Communication Hurdles

Teams often speak different technical languages. Finance uses accounting terms; procurement uses sourcing jargon. This causes misinterpretations, delays in approvals, and fragmented visibility into spending activity.

Siloed Systems and Data

Procurement and finance often use separate platforms, leading to data duplication, stale or inaccurate records, and manual reconciliation. This lack of unified data limits actionable insight into budgets, approvals, and supplier commitments.

Undefined Accountability

When roles are unclear, overlapping duties and missing responsibility for key tasks inflate risk and create delays. For instance, unclear ownership of invoice errors or supplier onboarding often leads to stalled processes and compliance gaps.

Resistance to Change

Automation and process redesign can provoke anxiety. Staff may fear redundancy, distrust new platforms, or resist moving away from familiar workflows, even those with inefficiencies.

Conflicted Payment Strategies

Finance may seek longer payment terms to protect cash, while procurement may favour prompt payments to maintain supplier goodwill. This mismatch can strain supplier relationships or prevent suppliers from taking advantage of discount opportunities.

Risk from Disparate Supplier Engagement

Coordination gaps in due diligence can expose the organisation to fraud, weak supplier performance, or regulatory issues. Fragmented audit trails and inconsistent risk scoring heighten vulnerability.

Difficulty Standardising Terms

Procurement measures savings against external standards, finance against budgets and historical costs. Without shared definitions or reporting, claimed savings may not reflect in financial results, eroding trust.

Bridging finance and procurement demands more than shared goals; it requires shared language, unified systems, clear responsibility maps, and change management. By working through these common obstacles, organisations can streamline the purchase-to-pay process, strengthen supplier ties, reduce risk, and realise financial savings. The payoff is smoother operations and stronger financial stewardship.

With the right systems, some of those challenges can be reduced or even avoided. That’s where Kodo comes in.

How Can Kodo Improve Your Finance and Procurement?

Kodo brings finance and procurement teams closer by connecting purchase decisions, approvals, and payments in one place.

Vendor Payments: Kodo lets finance schedule or automate payments based on approved invoices. Payment records stay connected to the full sourcing trail, so there’s no scrambling during audits or reviews.

Cross-Platform Integration: Kodo syncs with your finance systems to keep vendor data, approvals, and payment statuses consistent. There is no need to re-enter the same information across tools.

Purchase Request: Teams can raise detailed requests with budgets, vendor options, and supporting documents in one view. Finance gets early visibility into spending plans without waiting for follow-ups.

Purchase Order: Once requests are approved, Kodo lets you create and share purchase orders in one step. Orders stay linked to the original request, so both teams work from the same source of truth.

Invoice Management: Invoices can be matched against approved POs or earlier quotes. This reduces back-and-forth, missed entries, and end-of-month surprises for both finance and procurement.

Kodo helps both teams stay on the same page with fewer delays, clearer records, and less manual effort across the entire process.

Conclusion

Misalignment between procurement and finance can lead to delays in approvals, supplier dissatisfaction, and budget overruns, highlighting the importance of procurement finance, effective communication and collaboration despite both teams’ efforts.

Better collaboration doesn’t mean adding more meetings or red tape. It comes from small changes: clearer expectations, shared tools, and quicker conversations. When both sides know what the other needs and why, it’s easier to move faster.

From small teams to enterprise-scale operations, more than 2000+ businesses use Kodo to remove the usual friction between finance and procurement. Instead of chasing approvals over email, fixing invoice mismatches, or scrambling to meet payout deadlines, teams work off the same system from day one.

Purchase requests, orders, invoices, and payments are tracked in one place, making it easier to move faster without losing control. Delays drop, errors are easier to catch, and vendor communication stays clear. For growing businesses, it saves time, protects cash flow, and stays focused on what moves the company forward. Book a demo with Kodo today.

FAQs

How can shared KPIs between finance and procurement reduce friction?

Aligning on metrics like cost savings, cash flow impact, and supplier performance helps both teams focus on the same outcomes. It avoids one team prioritising short-term price cuts while the other values long-term supplier stability.Should procurement have visibility into budget forecasts?

Yes. When procurement teams understand upcoming budget shifts, they can adjust sourcing strategies accordingly, avoiding rushed decisions or unplanned contract renewals that hurt financial performance.What role does contract lifecycle management play in improving collaboration?

Centralised contract tools let both finance and procurement track obligations, renewal dates, and payment terms. This minimises missed deadlines, late fees, or duplicate vendor payments, common issues when contracts are siloed.Can supplier payment data improve future procurement decisions?

Absolutely. Finance teams hold valuable data on payment trends, discounts used, and invoice delays. Sharing this with procurement can help evaluate supplier reliability and renegotiate better terms.How often should finance and procurement teams meet, and what should they discuss?

At a minimum, monthly check-ins are useful. These meetings should cover budget updates, contract risks, supplier performance, and upcoming spend. Frequent touchpoints prevent surprises and encourages strategic planning.