Choose Smarter Spend Management Today!

Still using spreadsheets and paper trails to manage expenses? It could be costing you more than you think. As India’s digital transformation accelerates, businesses that rely on manual methods risk falling behind in efficiency and accuracy.

With the digital transformation market in India growing rapidly, adopting an Expense Management System (EMS) is no longer optional. An EMS streamlines processes, reduces errors, and boosts efficiency, giving your business a competitive edge.

In this blog, we’ll show how an EMS simplifies your operations and highlight the top tools to improve your expense management.

What Is an Expense Management System?

An Expense Management System (EMS) is a digital platform that automates and streamlines the process of recording, tracking, approving, and reimbursing expenses. By replacing manual, paper-based methods, an EMS allows businesses to manage the costs with real-time monitoring, automated approvals, and centralised dashboards.

This increases accuracy and speeds up the entire expense cycle, ensuring that companies can focus more on growth and less on administrative tasks.

Here are the key features of an EMS that can transform how your business manages expenses:

Automation of Expense Tracking: A modern EMS automates the process of capturing, categorising, and tracking expenses. With features like receipt scanning and automatic data entry, businesses can reduce manual errors, save time, and ensure accurate reporting.

Customisable Approval Workflows: A modern EMS enables businesses to set up tailored approval workflows. Managers can define who approves specific types of expenses, streamlining the process and maintaining control over financial approvals.

Expense Policy Enforcement: EMS helps enforce company expense policies automatically, flagging any non-compliant expenses and ensuring that employees adhere to pre-defined spending limits, guidelines, and approval processes.

Data Analytics and Reporting: Built-in analytics provide insights into spending trends, helping businesses identify areas for cost-saving. Dashboards and customisable reports offer managers a clear overview of the company’s financial health.

Integration with Accounting and ERP Systems: Integration with accounting or ERP (Enterprise Resource Planning) systems allows for seamless synchronisation of financial data, ensuring accurate reporting and eliminating the need for manual reconciliation between systems.

Tax Compliance and Auditing: EMS platforms are designed to keep track of tax rules and regulations, ensuring businesses remain compliant with local tax laws. They also provide features for audit trails, making it easier to conduct internal audits and ensure financial transparency.

An EMS reduces errors, saves time, and enhances financial control, empowering businesses to make informed decisions, improve oversight, and reduce compliance risks. If you're ready to move beyond spreadsheets, it’s time to explore an EMS solution.

Benefits of an Expense Management System

An EMS automates daily tasks, optimises operations, and boosts financial efficiency. Here are a few key ways it can drive improvements in your organisation.

1. Automates Routine Tasks

EMS platforms automate tasks like receipt uploads, categorisation, and report generation. Employees submit receipts via mobile, and the system handles categorisation and approval routing. This saves time and reduces manual errors, improving accuracy and efficiency.

2. Speeds Up Approvals and Reimbursements

Custom workflows automate approval chains and trigger real-time notifications, ensuring no expense is delayed. This speeds up the approval process, resulting in faster reimbursements and enhanced employee satisfaction.

3. Improved Accuracy with Automated Validation

EMS platforms automatically flag duplicate entries, missing receipts, and policy violations, ensuring that expense data is accurate and consistent. This minimises costly mistakes and improves data quality.

4. Built-In Policy Enforcement and Fraud Prevention

EMS systems automatically enforce company reimbursement policies, flagging non-compliant expenses and alerting approvers. This helps prevent fraud and ensures adherence to spending guidelines.

5. Centralised Data and Real-Time Insights

An EMS consolidates all expense data in one platform, giving business owners real-time access to spending trends by employee, team, or category. This helps improve decision-making and cost control.

6. Boosts Compliance and Audit-Readiness

EMS platforms create digital expense trails, ensuring all claims are time-stamped and backed by receipts. This simplifies audits and ensures compliance with financial regulations, saving time and reducing the risk of errors during reviews.

By automating workflows and providing real-time insights, an EMS improves efficiency, reduces errors, and ensures better compliance, leading to stronger financial control and faster reimbursements.

With these benefits in mind, let’s now explore the top tools that can help elevate your expense management.

Top 8 Expense Management Platforms

Efficient expense management is crucial for businesses that streamline financial operations and maintain control over spending. Below are eight leading platforms that offer robust solutions tailored to various business needs:

1. Kodo

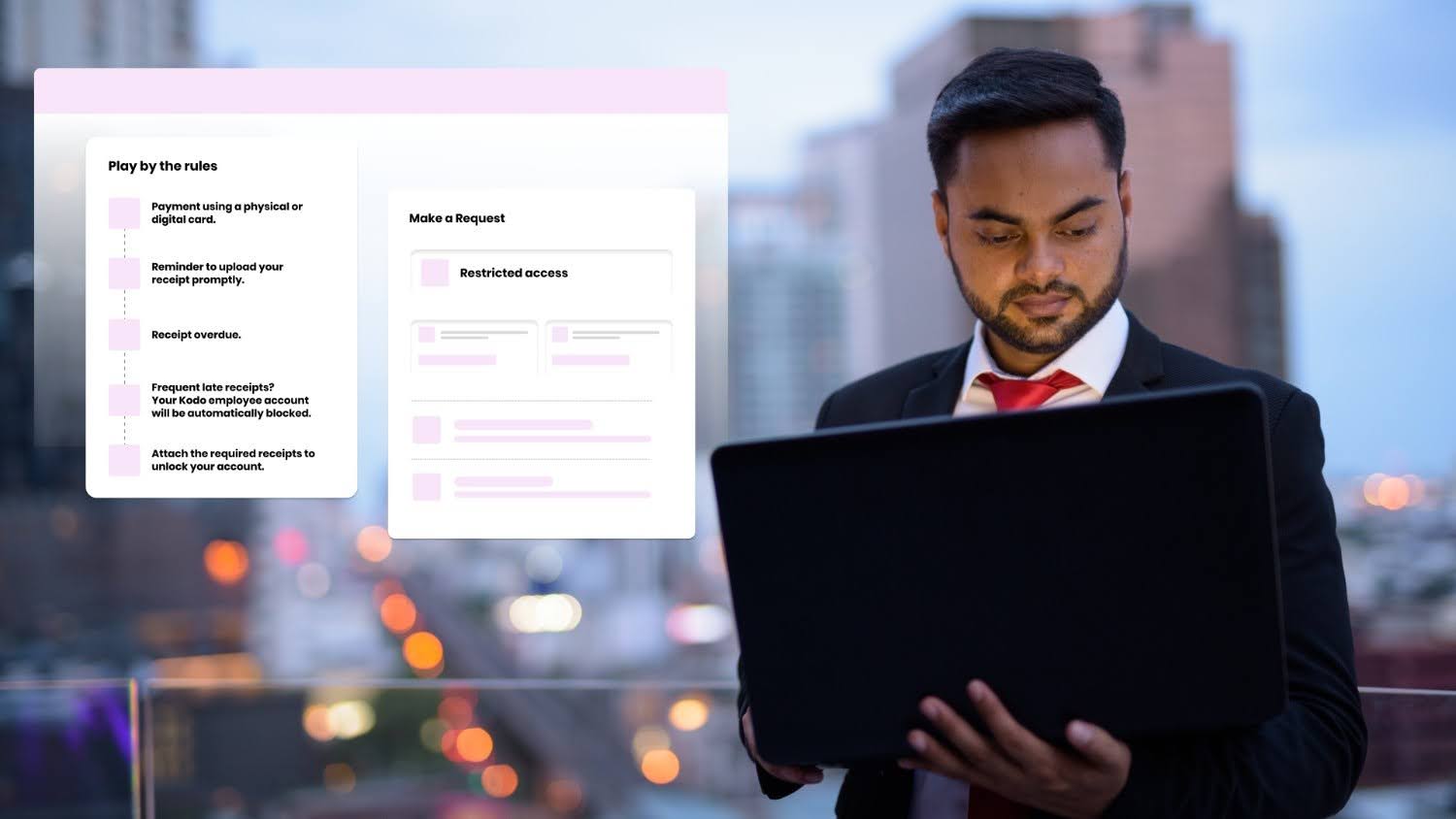

Kodo is a cutting-edge, all-in-one spend management platform tailored for businesses, designed to optimise procurement, accounts payable, and corporate card management. With its robust suite of features, Kodo streamlines expense management processes and drives efficiency, ensuring businesses can scale operations without sacrificing control or accuracy.

Key Features:

Procure-to-Pay Automation: Streamlines the entire procurement process, from purchase requests to vendor payments, ensuring efficiency and compliance.

Corporate Card Management: Provides real-time tracking and spending controls for corporate cards.

Accounts Payable Automation: Automates invoice processing and payment approvals, reducing manual errors and delays.

Vendor Payouts: Facilitates seamless vendor payments through various channels, including UPI and bank transfers.

Real-Time Analytics: Offers actionable insights into spending patterns, helping businesses optimise expenses.

GST Integration: Integrates with the Goods and Services Tax portal for accurate tax calculations and compliance.

Mobile Accessibility: Provides a mobile app for on-the-go expense management and approvals.

Pricing: For detailed pricing information, contact Kodo today.

2. Zoho Expense

Zoho Expense is a cloud-based expense management software designed to automate expense reporting and approval workflows, catering to small and medium-sized businesses.

Key Features:

Receipt Scanning: Automatically scans and extracts data from receipts using OCR technology.

Mileage Tracking: Tracks mileage and calculates reimbursements based on distance travelled.

Per Diem Management: Manages daily allowances for employees during business trips.

Expense Policies: Enforces company policies to ensure compliance and control over spending.

Pricing: Zoho Expense offers a free plan for up to 3 users. Their premium plan is ₹79/month per user when billed annually.

3. Expensify

Expensify is a widely used expense management platform known for its user-friendly interface and automation capabilities, suitable for businesses of all sizes.

Key Features:

SmartScan Technology: Scans receipts with 98.6% accuracy, automatically extracting data for expense reports.

Corporate Card Integration: Integrates with corporate cards for seamless expense tracking and reconciliation.

Multi-Level Approval Workflows: Customizable approval processes to ensure compliance and control.

Real-Time Reporting: Provides real-time insights into spending patterns and trends.

Pricing: Expensify plans start at approximately ₹450/month per member.

4. SAP Concur

SAP Concur is an enterprise-grade expense and travel management platform that offers comprehensive solutions for large organisations.

Key Features:

Automated Expense Reporting: Simplifies and accelerates the expense reporting process.

Travel Booking: Allows employees to book travel and manage itineraries within the platform.

Invoice Management: Streamlines the accounts payable process with automated invoice handling.

Policy Enforcement: Enforces company policies to ensure compliance and control over spending.

Pricing: Request pricing for a custom quote.

5. Emburse Certify (formerly Certify Expense)

Emburse Certify is a highly configurable travel, invoice, and expense management software tailored for mid-size organisations.

Key Features:

Automated Expense Reporting: Automatically creates and submits expense reports, reducing manual effort.

Customisable Approval Workflows: Allows businesses to define approval processes that align with their policies.

Real-Time Expense Tracking: Provides real-time visibility into employee spending.

Analytics and Reporting: Provides detailed reports and analytics to monitor and analyse expenses.

Pricing: Request a quote to get the most suitable plan for your organisation.

6. Divvy (BILL Spend & Expense)

Divvy is an innovative expense management tool designed for small and medium-sized businesses, offering real-time expense tracking and automated spend controls.

Key Features:

Virtual Cards: Provides customisable virtual cards for employees to manage expenses securely.

Automated Expense Categorisation: Automatically categorises expenses to reduce manual tracking and ensure accurate reports.

Real-Time Alerts: Sends real-time alerts for spending limits and policy violations.

Integrations with Accounting Software: Seamlessly integrates with platforms like QuickBooks and Xero for smooth financial reconciliation.

Pricing: Divvy’s spend and expense platform offers a free plan.

7. Rydoo

Rydoo is a global expense management platform that simplifies expense reporting and approval workflows, especially for businesses with international teams.

Key Features:

Multicurrency Support: Supports multi-currency expense reporting and integrates seamlessly with accounting systems.

Mobile Receipt Capture: Allows employees to capture receipts and submit expenses directly via the app.

Automated Reimbursement: Automates the reimbursement process, ensuring faster payouts for employees.

Compliance and Audit Control: Offers built-in compliance checks to ensure expenses adhere to company policies.

Pricing: Rydoo pricing plans start at around ₹750/user per month when billed annually.

8. Spendesk

Spendesk is an all-in-one spend management tool that helps businesses control expenses with features for procurement, invoicing, and employee reimbursements.

Key Features:

Virtual and Physical Cards: Issue virtual or physical cards to employees with customisable spending limits.

Expense Request & Approval: Simplifies the process of submitting and approving expenses for faster processing.

Expense Analytics: Provides detailed analytics to track and optimise spending across departments.

Vendor Invoice Management: Automates invoice processing to streamline vendor payments.

Pricing: Spendesk offers customised pricing based on the number of transactions and specific business needs. Contact for a tailored quote.

How to Choose the Right Expense Management System

Selecting the right EMS is a critical decision that can streamline your financial operations. When evaluating options, consider the following factors:

Ease of Use: Ensure the system is intuitive for employees and managers, minimising the learning curve and adoption time.

Customisable Approval Flows: Look for a platform that lets you design approval workflows that fit your business processes and policies.

Mobile App Availability: A mobile-friendly EMS enables employees to submit expenses and track approvals on the go, enhancing convenience.

Integration Capabilities: Choose an EMS that seamlessly integrates with your accounting, HR, and other business tools, reducing manual data entry and increasing data accuracy.

Transparent Pricing: Ensure the platform offers clear, upfront pricing with no hidden fees, helping you budget effectively.

Compliance Features: Look for an EMS that helps ensure your expense management complies with relevant financial regulations and industry standards, including tax laws, audit trails, and reporting requirements.

Security: Ensure the platform has strong security features like data encryption, secure authentication, and role-based access controls to protect sensitive financial information.

Reporting & Analytics: A robust EMS should offer real-time reporting and analytics capabilities, providing insights into spending patterns, trends, and opportunities for cost savings.

Expense Policy Enforcement: The system should help enforce company expense policies by automatically flagging or rejecting non-compliant expenses.

Vendor Support: Check the level of support the EMS provider offers, including customer service availability, training resources, and user manuals.

Automated Data Capture: Look for EMS platforms that allow employees to easily capture receipts through mobile apps, with features like OCR (Optical Character Recognition) to extract key data, reducing manual entry automatically.

By evaluating these factors, you'll be well-prepared to choose the expense management system that aligns with your business needs, enhances efficiency, and supports growth.

Conclusion

An EMS is more than just a tool; it's a strategic investment in your business's productivity, accuracy, and scalability. By automating manual tasks, providing real-time visibility, and accelerating reimbursements, EMS platforms empower companies to focus on what truly matters: growth and innovation.

If you're ready to eliminate inefficiencies and modernise your expense workflows, Kodo offers a powerful solution built specifically for fast-moving Indian businesses. Don't let outdated processes hold you back; take control of your financial operations today and set the foundation for sustainable growth.

Book a demo with Kodo now and transform your expense management into a competitive advantage.