Choose Smarter Spend Management Today!

When invoices stack up and payment deadlines start blinking red, the last thing your finance team needs is confusion in the books. Managing accounts payable can quickly become overwhelming without a clear system in place.

Behind every successful payment cycle lies a crucial but often overlooked element: accurate journal entries.

These entries are more than just numbers on a ledger. They form the foundation of financial clarity and control.

In this guide, we'll walk you through everything you need to know about accounts payable journal entries. We’ll break down what to record, when to record it, and how to keep your books clean while staying in sync with vendors and payment cycles.

What are Accounts Payable Journal Entries?

Accounts Payable journal entries are the records that show the money a company owes to its suppliers or vendors for goods and services received but not yet paid for. Think of them as the financial notes that keep track of all outstanding bills before payment.

When your business gets an invoice, you don't just wait to pay it. You first log that liability in your accounting system. This is done through a journal entry that increases your accounts payable balance, signalling that you owe money. Later, when you pay the invoice, another entry reduces this balance and shows the cash leaving your accounts.

Components of AP Journal Entries

The components of an accounts payable journal entry ensure that every credit transaction is accurately recorded and can be easily referenced. Here are the typical components:

Date: The date on which the transaction occurred or the entry is being recorded. This helps track and reconcile transactions over time.

Description: A brief explanation of the transaction, often including the invoice number, supplier name, and a summary of what was purchased or the reason for the entry.

Account Titles: The specific accounts affected by the transaction. For a purchase on credit, this is usually an expense or asset account (debit) and the Accounts Payable account (credit).

Debit Amount: The amount to be debited reflects the expense or asset account increase.

Credit Amount: The amount to be credited reflects the increase in the Accounts Payable liability.

Reference/Journal Number: An optional field for a unique identifier or code to help with tracking and cross-referencing.

These components collectively ensure that the journal entry is complete, transparent, and compliant with the principles of double-entry bookkeeping.

Now that you have a basic idea of AP journal entries, let's move forward and learn more about their types.

Common Journal Entries Every AP Team Should Know

When it comes to tracking what you owe, not every entry looks the same. If you're buying on credit, returning goods, or snagging an early payment discount, the journal entry changes depending on the situation. Some common AP journal entries include:

Recording a Purchase on Credit

This is the starting point of any payable-related entry. When a company buys goods or services without immediate payment, it's essential to log this transaction to reflect both the acquired asset or expense and the outstanding liability.

What it captures:

You recognise a financial obligation when goods or services are received, even if cash hasn't moved yet.

Example:

Suppose your business purchases ₹50,000 worth of raw materials from a vendor on 30-day credit.

Journal Entry:

Account | Debit (₹) | Credit (₹) |

Raw Materials Inventory | 50,000 | |

Accounts Payable | 50,000 |

Why it matters:

This entry ensures your balance sheet reflects the accurate value of inventory and liabilities. It also sets the stage for tracking vendor dues and payment deadlines, which are crucial for maintaining supplier relationships and avoiding late fees.

Payment Made to Vendor

Once the payment is cleared, the earlier liability needs to be closed. This entry reflects cash outflow and the fulfilment of your obligation.

What it captures:

It's about reducing liabilities and showing actual cash movement, which is key for cash flow tracking.

Example:

Paying off the ₹50,000 due to the vendor.

Journal Entry:

Account | Debit (₹) | Credit (₹) |

Accounts Payable | 50,000 | |

Bank | 50,000 |

Why it matters:

This shows that the company has met its commitment. It impacts both your cash position and vendor standing. Consistently logging these ensures there are no hanging payables on the books.

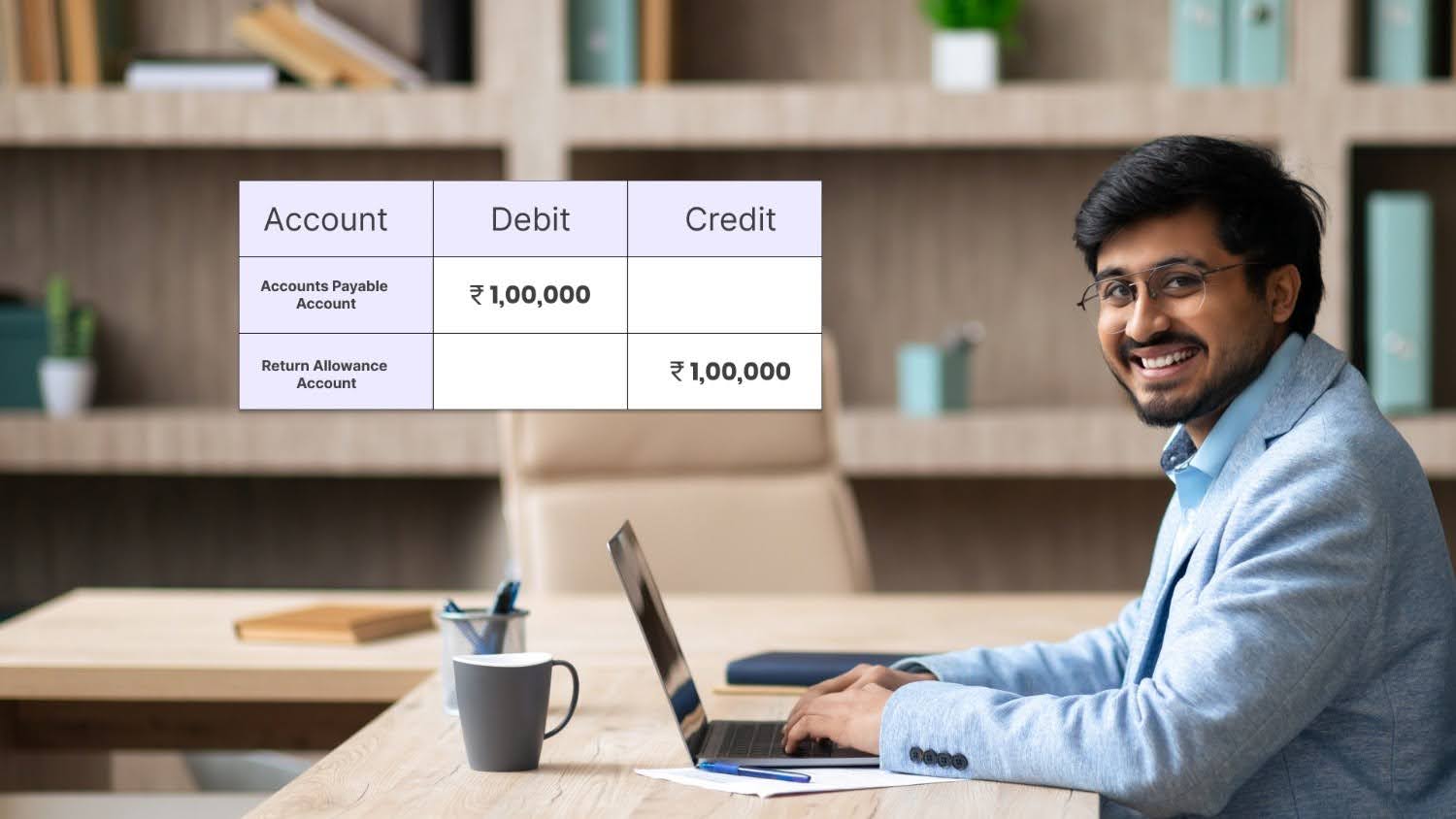

Purchase Returns or Allowances

Not every order goes perfectly. You might return defective goods or get a price reduction post-purchase. In either case, the original liability must be reduced.

What it captures:

This corrects or reduces your original payable amount and ensures expenses or assets aren't overstated.

Example:

You return ₹10,000 worth of goods from the earlier purchase.

Journal Entry:

Account | Debit (₹) | Credit (₹) |

Accounts Payable | 10,000 | |

Raw Materials Inventory | 10,000 |

Why it matters:

Helps keep your inventory valuation accurate. It also prevents overpayment and ensures your accounts reflect what was kept or used.

Early Payment Discounts

Vendors often offer incentives for early payments, like a 2% discount if paid within 10 days. This entry reflects the financial benefit gained from paying before the due date.

What it captures:

The business saves money, which must be recognised in your income (discount received).

Example:

Paying ₹49,000 within the discount window for a ₹50,000 invoice with a 2% discount.

Journal Entry:

Account | Debit (₹) | Credit (₹) |

Accounts Payable | 50,000 | |

Bank | 49,000 | |

Discount Received | 1,000 |

Why it matters:

It tracks savings on your books and gives clarity during audits. It also helps teams monitor how often early-payment discounts are utilised, a key cash management strategy.

Adjusting Entries (Accruals & Corrections)

Some expenses don't arrive with an invoice immediately, especially recurring ones like utilities or legal services. These need to be accounted for at period-end to keep financial reports accurate.

What it captures:

Your team acknowledges expenses that have occurred but haven't yet been billed. This ensures accurate monthly or quarterly financials.

Example (Accrued Expense):

You receive legal services worth ₹20,000 in March but get the invoice in April.

March-end Journal Entry:

Account | Debit (₹) | Credit (₹) |

Legal Expenses | 20,000 | |

Accounts Payable | 20,000 |

Why it matters:

Without this, your March profit would be overstated, and April would absorb an unrelated expense. These entries are key for compliance, budgeting, and forecasting.

Also Read: 5 Signs Your Business Needs an Integrated Expense Management Solution.

How to Record Accounts Payable the Right Way

Recording accounts payable accurately is crucial for maintaining financial clarity, preventing discrepancies, and ensuring seamless cash flow management in your business. Use the following steps:

Step 1: Identify the Transaction

The first step is identifying the transaction requiring an accounts payable entry. This typically happens when you receive goods or services from a supplier or vendor on credit.

Step 2: Determine the Amount

Ensure you know the exact amount that needs to be recorded. This can be found on the vendor invoice or purchase order. The amount will be the one you will credit to the accounts payable.

Step 3: Record the Debit

A debit will be made to the corresponding expense or asset account. For example, you would debit the "Inventory" account if the transaction is related to inventory. If it's for a service, you may debit the "Legal Expenses" or "Supplies Expense" account.

Step 4: Record the Credit

The credit will be made to the accounts payable account, which reflects the amount your business owes to the supplier. Accounts payable is a liability account, so the entry increases the liability.

Step 5: Verify with Documentation

Cross-check the details on the vendor invoice, including the vendor's name, amount, and date. Ensure that the total amount recorded matches the invoice before making the journal entry.

Step 6: Post the Journal Entry

Once you've verified the details, you can record the journal entry in your accounting system or general ledger. This includes the date of the transaction, the debit amount, and the credit amount.

Step 7: Monitor Payment

After posting the journal entry, monitor the payment due to the supplier. Once the payment is made, you must make another journal entry to reduce the accounts payable and record the payment.

If journal entries are eating up your time, it's time to hand them over. Kodo makes it effortless.

However, even seasoned finance teams can encounter issues. Let's look at where things often go wrong and how to fix them.

The Most Common AP Mistakes (And How to Fix Them)

Even the most experienced finance teams slip up sometimes, especially when juggling piles of invoices, tight deadlines, and last-minute changes. These minor errors can quietly accumulate, affecting your reports, cash flow, and audit trail. The good news? Most of these issues are fixable with a few simple checks in place.

Booking Payables Without Supporting Documents

Sometimes, entries are made without the actual invoice or purchase order. This often leads to duplicate liabilities, wrong vendor details, or compliance issues during audits.

Solution: Always use a 3-way match before booking a payable, match the purchase order, vendor invoice, and goods receipt. This ensures the amount, vendor, and service/product are all validated. Automating this process through an AP tool can also significantly reduce manual errors.

Want to simplify the accounts payable process even further? Kodo’s 3-way match feature ensures that your invoices are automatically matched with the purchase order and receiving details, reducing errors and saving you time.

Recording Payment Before It's Made

Some finance teams record a payment as soon as it's approved or scheduled, not when it's deposited into the bank. This misrepresents your cash position and causes reconciliation issues later.

Solution: Only post the payment journal entry once the bank has confirmed the transaction. If you're scheduling payments in advance, use a temporary clearing account to hold the amount until it's processed.

Using Incorrect or Generic GL Codes

Lumping all purchases under broad expense categories (such as "Miscellaneous" or "Admin") may expedite the process, but it leads to significant reporting inaccuracies and budgeting issues.

Solution: Assign each payable to a specific general ledger (GL) account that reflects the true nature of the expense (e.g., Software Subscription, Office Supplies, Legal Fees). Maintain a clear and up-to-date chart of accounts and train your AP team to accurately map invoices.

Missing Accruals for Unbilled Expenses at Month-End

If you wait to receive an invoice before recording an expense, you risk underreporting your liabilities and distorting your financials, especially at month or year-end.

Solution: Introduce a regular accrual process. Collect input from department heads on expected but unbilled expenses, and create reversing journal entries for those amounts. This ensures your liabilities are complete even before the invoice arrives.

Entering the Same Invoice More Than Once

Duplicate entries often occur, especially when an invoice is sent by both mail and email, or when it is forwarded by different people.

Solution: Set up your AP system to detect duplicates based on invoice number, vendor, and amount. Establish vendor naming conventions to avoid small spelling or spacing differences that confuse the system.

Overlooking Early Payment Discounts

Vendors sometimes offer 1-2% discounts for early payment, but these are missed when teams aren't tracking due dates closely or are unaware of the terms.

Solution: Clearly record payment terms in your AP system. Set up reminders or automated workflows to take advantage of early payment discounts. Also, update your journal entries to reflect the net amount paid and discount received, not just the gross invoice value.

Also read: What is Accounts Payable Automation? Key Strategies, Benefits, and Challenges

Manually tracking every invoice and journal entry can feel like walking through mud with heavy boots. That's where Kodo steps in.

Automate AP Journal Entries With Kodo

Manual journal entries are time-consuming, error-prone, and a nightmare to track, especially as invoice volumes grow. That's where automation comes in with tools like Kodo; finance teams no longer have to spend hours chasing invoices, matching line items, or fixing GL errors.

Here's how Kodo’s Invoice Management features simplify your accounts payable journal entry process.

Capture Invoices Instantly: Kodo enables instant invoice capture, eliminating manual data entry and reducing the risk of errors. This ensures that invoices are processed quickly and accurately for journal entry.

Automated Matching for Accuracy: Kodo’s automated matching feature cross-references invoices with purchase orders and receiving details, ensuring the amounts match before creating journal entries. This reduces discrepancies and ensures your financial records are accurate.

Smarter Approvals with Invoice Scrutinizer: Kodo’s Invoice Scrutinizer tool helps automatically flag discrepancies and enforce approval workflows, allowing your team to approve invoices before they are entered into the journal, ensuring compliance and minimising errors.

Effortless Reconciliation: Kodo’s platform makes reconciliation easier by automatically matching payment records with invoices and journal entries. This reduces the manual effort needed to match and reconcile accounts payable entries.

Final Thoughts

Accurate accounts payable journal entries are more than just red tape; they keep your finances honest, your vendors happy, and your audits clean. Whether it's logging a purchase, recording a discount, or adjusting for an accrual, each entry tells part of your company's financial story.

With automation tools like Kodo, you're not just making entries faster. You're making them more innovative, reliable, and efficient to manage. Kodo’s automated invoice matching, real-time reconciliation, and seamless integration with ERP systems ensure that your AP journal entries are streamlined and error-free, saving you time and effort.