Choose Smarter Spend Management Today!

The way companies manage accounts payable is changing, and not just on the surface. What was once a backend function is now a strategic focus area. Companies can now track and control every aspect of the process from invoice capture to reconciliation.

That's not to say that most businesses haven't yet fully embraced AP automation. Research shows only 10% have entirely digitised their workflows. Moreover, 70% of mid-sized firms that have embraced automation have reported higher satisfaction and fewer processing delays.

The technology is still in its early stages, and a lot is expected to happen in the upcoming months. If you are curious to know what's emerging and how it's shaping modern finance departments, keep reading.

Key Takeaways

AI now does more than read invoices. It flags errors, learns from patterns, and enforces compliance with less manual input.

Cloud-native AP tools give SMEs enterprise-grade automation without heavy budgets or IT support.

Global e-invoicing rules are speeding up adoption. Platforms now include built-in compliance for each country.

Manual AP adds to burnout. Thirty percent of finance teams blame delays and reconciliation chaos for rising stress.

Smart forecasting tools update cash flow in real time, helping CFOs manage inflation risk and avoid cash crunches.

Top 10 AP Automation Trends in 2025

AP automation has developed rapidly in the last two years. Some new trends have become popular, while others have lost relevance as businesses focus on practical solutions.

Many trends have emerged, while some have already begun to fade as businesses discover what works in practise rather than what sounds good in theory.

Trend | Key Operational Advantage |

AI-Powered Invoice Processing | Smarter extraction, fewer errors, and fraud detection without manual effort |

Cloud-Native Solutions | Scalable, always up-to-date, no IT hassle - great for growing, distributed teams |

ERP & Accounting Integration | Real-time sync, no double entry, faster closes, and stronger audits |

E-Invoicing Compliance | Built-in rules for global compliance and cross-border growth |

Automated Vendor Payments | Fast, error-free payouts with real-time tracking and improved vendor relationships |

Advanced Security Protocols | Detect fraud early, validate vendors, and secure financial data end-to-end |

Inflation-Aware Forecasting | Adjusts projections for price hikes - better cash flow planning under pressure |

Mobile-First Payments | Faster, cheaper transactions with instant confirmations for smaller vendors |

Artificial Intelligence Takes Centre Stage

Finance teams are slowly moving away from rule-based automation. The shift now is towards AI-led systems that can adapt, interpret, and make better decisions independently. Many platforms use AI technology to automatically read invoice data, compare it with purchase order numbers, and highlight any differences.

This trend is remarkable because AI handles the messy reality of business documents. Instead of struggling with poorly scanned invoices or handwritten receipts, these systems extract data with impressive accuracy.

They understand context, recognise patterns, and get smarter with each transaction they process.

Recent studies reveal that 66% of finance professionals save between 50 and 200 hours annually with AI-based automation. They redirect this time towards strategic analysis and decision-making that moves the business forward.

Cloud-Based SaaS Dominates the Market

Procurement software platforms with cloud-native capabilities are the backbone of modern AP automation. These cloud-based solutions offer something traditional software never could: complete flexibility without technical headaches.

Companies can now access their entire AP system from anywhere, scale up or down based on business needs, and integrate with existing tools without a hitch.

These platforms integrate tools such as OCR (optical character recognition), AI, machine learning, and RPA (robotic process automation) to scan invoices, match data, and automate payment scheduling. This speeds up approval cycles and makes errors easier to catch.

What's particularly appealing is how these solutions democratise advanced AP technology. Small businesses can now access the same sophisticated tools that were once exclusive to large enterprises. The subscription model means no massive upfront investments or lengthy implementation cycles.

Take Kodo, for example. Rather than juggling multiple systems, businesses can handle invoice capture, approval workflows, payment scheduling, and reconciliation through a single interface. This unified approach eliminates the data silos that plague traditional accounts payable (AP) processes.

Want to see how Kodo addresses real-life AP challenges? Schedule a free demo today.

Need for Wider Integration Capabilities

Gone are the days when AP systems operated in isolation. Successful AP automation demands hassle-free integration with existing ERP and accounting platforms.

This connection transforms how financial data flows through an organisation, eliminating the manual data entry that creates bottlenecks and errors.

Accounts payable automation systems synchronise data in real time between AP systems, ERPs, and accounting platforms like QuickBooks, Xero, and Tally.

When an invoice is approved, the information is instantly updated across all connected systems, triggering automated workflows and ensuring that financial records remain current.

The technical complexity that once made integration difficult has largely disappeared, allowing businesses to maintain their existing financial infrastructure while adding powerful automation capabilities.

E-Invoicing Compliance Drives Global Adoption

Regulatory requirements are reshaping how companies handle invoices worldwide. Countries across Europe, Latin America, and Asia have mandated electronic invoicing for business transactions.

The compliance challenge is particularly acute for companies operating internationally. Each country has unique requirements for invoice formats, submission methods, and approval processes.

What works in Germany might not meet requirements in Brazil or India. This complexity is pushing businesses towards AP solutions with built-in compliance capabilities.

Smart AP systems now come pre-configured with country-specific compliance rules. They automatically format invoices according to local requirements, submit them through approved channels, and maintain the audit trails that regulators demand.

This takes the guesswork out of international compliance whilst reducing the risk of penalties.

Automated Vendor Payments

Vendors are tired of chasing payments and constantly calling finance teams for updates. AP automation platforms, such as Kodo, are eliminating this frustration by automating the entire payment process, from invoice approval to fund transfer.

How does this work exactly? Smart reconciliation technology uses AI algorithms to compare invoice data with payment records in real-time, ensuring accurate matches and triggering alerts for discrepancies automatically.

Meanwhile, customisable approval workflows ensure internal reviews occur seamlessly, with only verified payments progressing to prevent errors and maintain financial control.

Once an invoice receives final approval, the system triggers payment instructions directly to your bank whilst simultaneously updating your accounting records. This eliminates double data entry and ensures your books stay current without extra work.

This is a step in the right direction, as it helps strengthen vendor relationships by avoiding payment delays and maintaining transparency.

Cybersecurity and Fraud Prevention Take Priority

With financial fraud in AP processes getting increasingly sophisticated, CFOs can no longer rely on legacy systems and age-old practises.

Criminals can now use AI to create convincing fake invoices, manipulate email communications, and even impersonate legitimate vendors. Traditional security measures simply can't keep up with these evolving threats.

In 2024, 83% of companies faced cyber threats through methods like phishing, deepfakes, and unauthorised system access. What's more concerning is that 94% of those companies experienced repeated attacks.

Modern AP systems are responding to these threats with multi-layered security approaches. Advanced encryption protects data at every stage, whilst machine learning algorithms analyse transaction patterns for suspicious activity.

These systems can identify anomalies that human reviewers might miss, such as subtle changes in vendor banking details or unusual invoice amounts.

The stakes are particularly high because AP fraud often involves large sums and can go undetected for months. Companies are investing in solutions that verify vendor identities, validate banking information, and maintain detailed audit trails for every transaction.

Inflation-Adjusted Cash Flow Management

Rising costs and volatile pricing make traditional cash flow forecasting unreliable. Modern AP systems now factor in inflation rates, price fluctuations, and seasonal variations when making payment predictions.

This means finance teams get realistic projections that account for the actual purchasing power of their cash reserves.

These intelligent systems leverage machine learning models trained on historical vendor pricing data, market indices, and seasonal trends to forecast future payment needs with greater accuracy.

When your office supplies vendor raises prices by 8%, the system automatically updates all future forecasts rather than assuming static costs. This prevents the cash shortfalls that catch many businesses off guard.

By anticipating higher costs months in advance, finance teams can secure credit lines, negotiate fixed-price contracts, or adjust budgets before cash becomes tight.

Mobile Payment Solutions Become More Popular

More vendors are opting to receive payments through digital wallets, UPI transfers, and mobile banking apps rather than traditional cheques or wire transfers. This preference is particularly noticeable among smaller suppliers who value speed and convenience.

India's mobile payment landscape exemplifies this transformation. Digital transactions reached nearly ₹200 lakh crore in the second half of 2024, representing a 30% year-over-year increase, driven primarily by the adoption of UPI.

Mobile-first payment solutions offer advantages beyond convenience. They provide instant confirmation, reduce banking fees, and create digital records that integrate seamlessly with accounting systems. For vendors, this means faster access to funds and simplified reconciliation processes.

Advanced Analytics Drive Smarter Financial Decisions

Finance teams are discovering that their AP data contains goldmine insights about company spending patterns, vendor performance, and cash flow trends. Manual processes bury this valuable data in spreadsheets where it can't drive strategic decisions.

Automated AP systems extract and analyse this information automatically. They identify which vendors consistently deliver late, which departments regularly exceed their budgets, and which payment terms result in the most cost savings.

Finance leaders can spot opportunities to renegotiate contracts or adjust cash management strategies based on real transaction data.

Comprehensive Spend Management Replaces Basic Expense Tracking

Traditional expense management focuses on tracking expenses that have already been incurred. The modern approach concentrates on controlling and optimising spending before it happens. This evolution encompasses procurement planning, budget allocation, and strategic vendor management.

New-age spend management platforms integrate with AP automation to create complete financial oversight.

They monitor purchase requests, track budget utilisation in real time, and flag potential overspending before invoices arrive. Finance teams can see committed spending, pending approvals, and actual expenditures in a single view.

This way, organisations can identify spending trends early, negotiate better terms with frequently used vendors, and prevent budget overruns through automated approval controls. :

While it's definitely exciting to see how these trends are reshaping the AP landscape, understanding their technical capabilities is only half the story.

If you're planning to overhaul your entire existing system, you need a deeper understanding of how each solution fares against the persistent, day-to-day challenges finance teams face.

Take a thorough look at the core problems AP automation is designed to solve.

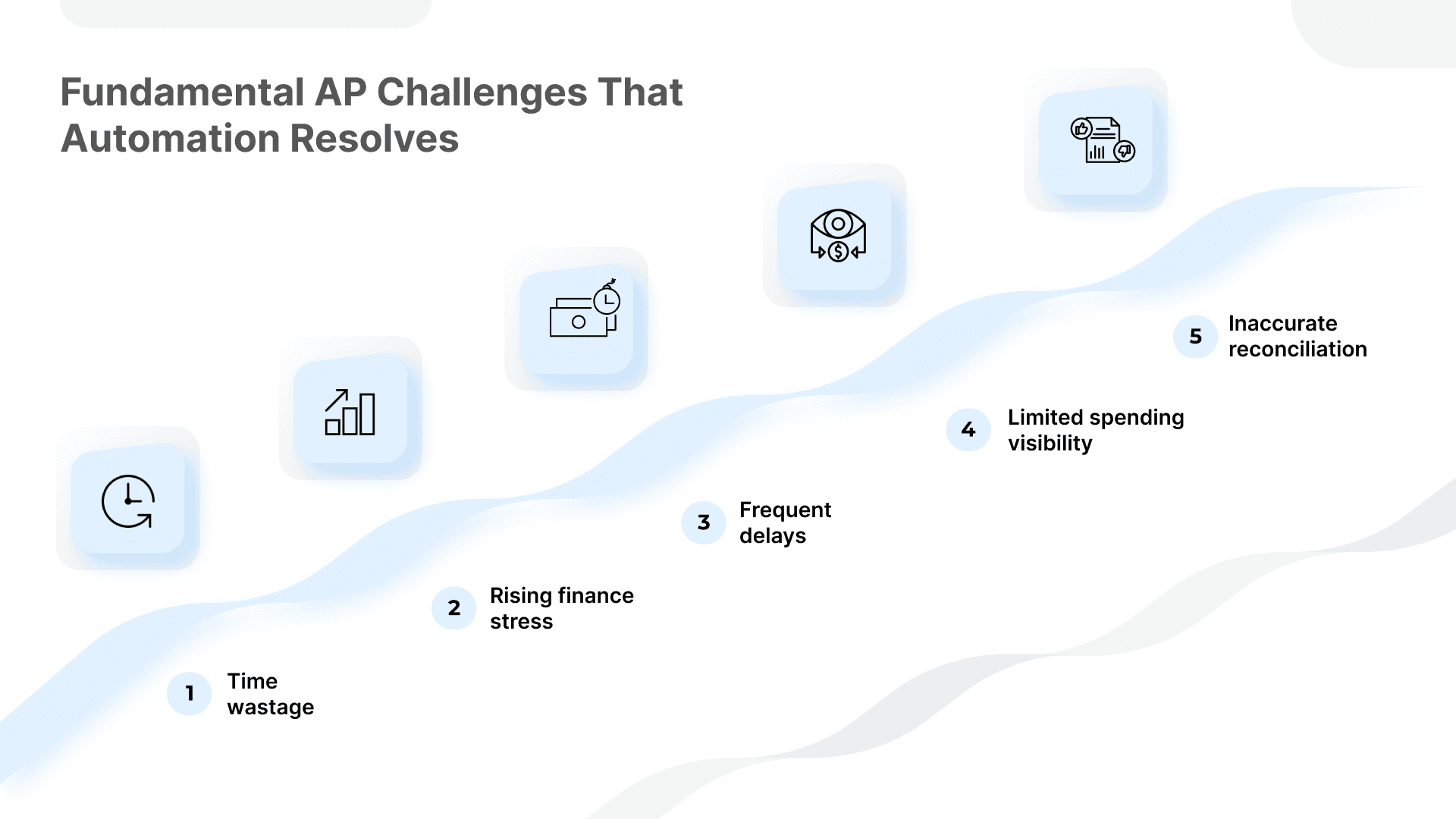

Fundamental AP Challenges That Automation Resolves

Manual accounts payable processes create significant operational challenges that affect both productivity and employee satisfaction. These issues compound over time, leading to delayed payments, strained vendor relationships, and frustrated finance teams.

Unfortunately, these slip-ups often go unnoticed until they begin to affect vendor relationships, reporting accuracy, and team morale. Let's break down the most common ones.

Excessive Time Consumption: Research from the Institute of Financial Operations and Leadership reveals that over 68% of finance professionals still manually enter invoices into accounting systems. 56% of employees spend 10 hours or more a week just on approvals and payments. That time adds up quickly.

Rising stress within finance teams: According to the same report, 30% of teams stated that the workload in accounts payable (AP) has become a serious source of stress, driven by manual checks, short timelines, and constant back-and-forth.

Too many delays and late payments: Exceptions and invoice errors often cause delays. Payments get stuck in the pipeline with no tracking or automated checks, and vendor trust suffers.

Lack of visibility into spending: When invoices are processed manually, it becomes harder to track real-time spending. Finance leaders struggle to make decisions with outdated or incomplete information.

Error-prone reconciliation and reporting: The more hands involved, the greater the room for mistakes. Manual data entry often leads to mismatches, which create difficulties during audits or month-end close.

These problems create a domino effect that touches every part of your business. The good news is that AP automation directly addresses each of these issues.

However, with numerous solutions and trends emerging, it can be challenging to determine where to focus your attention.

The right AP automation tool for your team must have the following:

Scalable architecture: Adapts as your invoice volume grows.

Real-time integration: Syncs seamlessly with existing ERP and accounting tools.

Built-in compliance logic: Handles country-specific invoicing requirements effortlessly.

Smart approval workflows: Routes tasks without causing bottlenecks

Take your time to vet through each solution, because small inefficiencies in AP add up fast, and automation done right fixes them at the root.

Take Your AP to the Next Level with Kodo?

Kodo helps businesses automate their entire accounts payable workflows, from invoice receipt to final payment. Our comprehensive platform eliminates manual processes, providing you with complete control over spending and cash flow.

With over 2,000 companies trusting our solution, we've proven that AP automation can work for businesses of every size and industry.

Automated Invoice Processing: Capture and process invoices instantly through AI-powered data extraction that works with any document format or quality.

Streamlined Approval Workflows: Set up custom approval paths that automatically route invoices to the right people, ensuring that nothing gets stuck in someone's inbox.

Intelligent Payment Scheduling: Schedule payments to optimise cash flow whilst capturing early payment discounts and maintaining strong vendor relationships.

Simplified Vendor Payments: Execute payments through multiple channels, including bank transfers, digital wallets, and mobile platforms, whilst keeping vendors informed throughout the process.

Complete Reconciliation: Automatically match payments with invoices and keep your accounting records perfectly synchronised across all platforms.

Real-Time Spend Visibility: Monitor spending patterns, track budgets, and identify cost-saving opportunities through comprehensive dashboard analytics.

Native Integration Capabilities: Effortlessly connect with your existing ERP systems, accounting software, and financial tools without disrupting current workflows or requiring technical expertise.

Ready to transform your AP process from a daily headache into a strategic advantage? Book a demo today and see how our platform can save your team hours every week whilst improving your bottom line.

Conclusion

Accounts payable has taken on a new role, one that directly affects how businesses manage growth, cash flow, and vendor reliability. What once ran quietly in the background is now being brought to the front, with more teams rethinking how they handle every transaction.

Kodo is built to support that rethink. It connects each part of the AP process into a single, easy-to-manage flow, reducing delays, cutting stress, and improving visibility.

Want to see it in action?

Schedule a strategy call with our sales team to explore how Kodo can support your finance goals.

FAQs

What is the top AP automation software in 2025?

Several platforms stand out in 2025, including:

Kodo

Stampli

SAP Concur.

The best choice depends on your company size, integration requirements, and workflow complexity.

What is the future of accounts payable automation?

The future of accounts payable lies in AI-driven automation, real-time payment tracking, seamless ERP integrations, and touchless invoice processing.

As more finance teams shift to digital-first workflows, AP systems are evolving to reduce manual intervention and improve cash flow visibility.

Can accounts payable processes be fully automated?

Yes, most accounts payable tasks, such as invoice capture, approvals, matching, and payments, can now be fully automated using modern AP software. However, exceptions or complex approvals may still require some human oversight, depending on your internal controls and compliance needs.

What is the best KPI for accounts payable performance?

One of the most important KPIs is Days Payable Outstanding (DPO), which measures the average time a company takes to pay its vendors. Other valuable KPIs include invoice processing time, cost per invoice, and percentage of early payment discounts captured.